- Joined

- Jul 12, 2012

- Messages

- 1,631

- Reaction score

- 1,465

Very interesting, you're doing a great job!

Last edited:

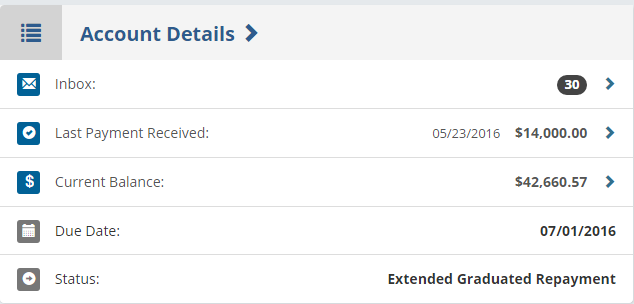

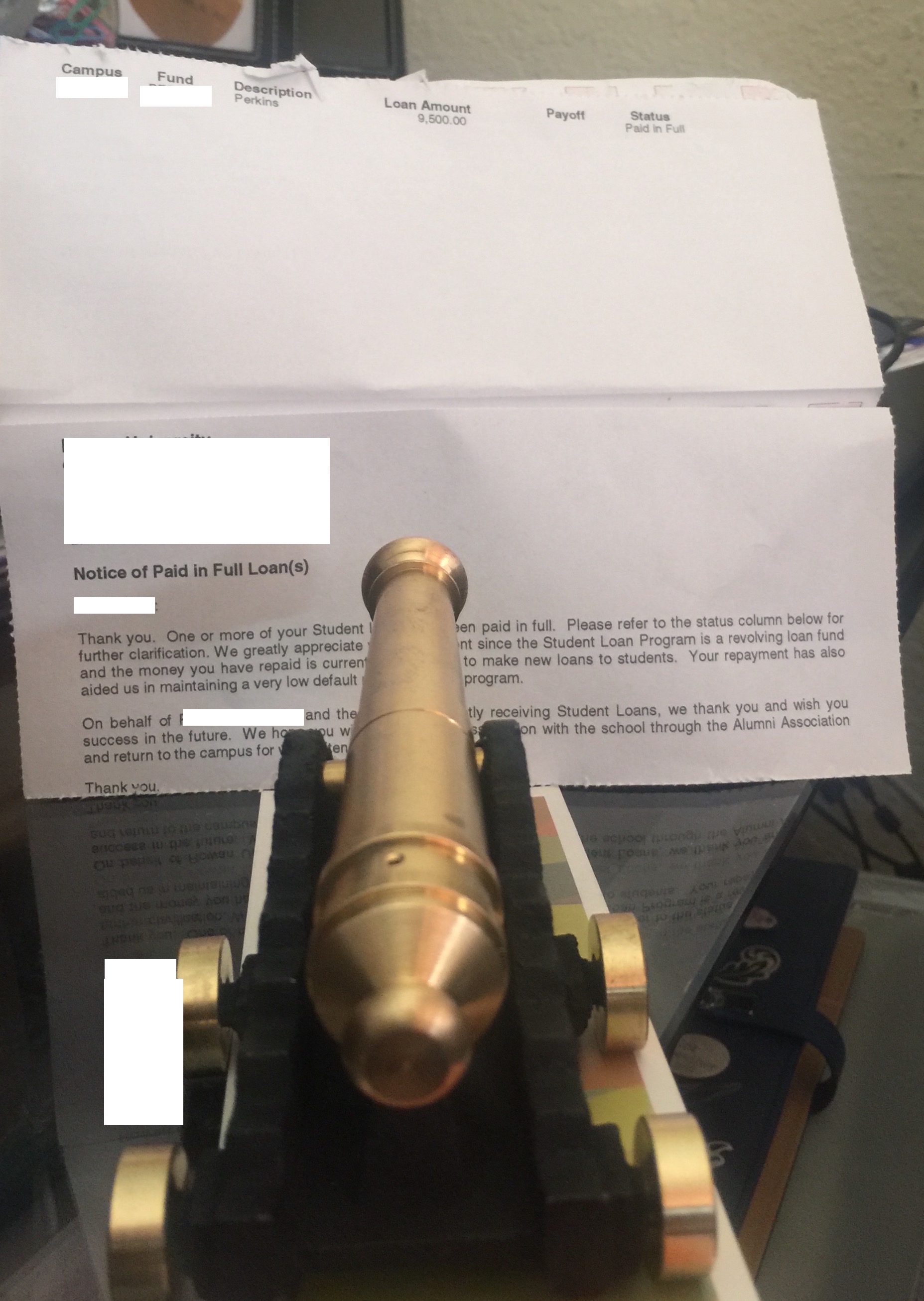

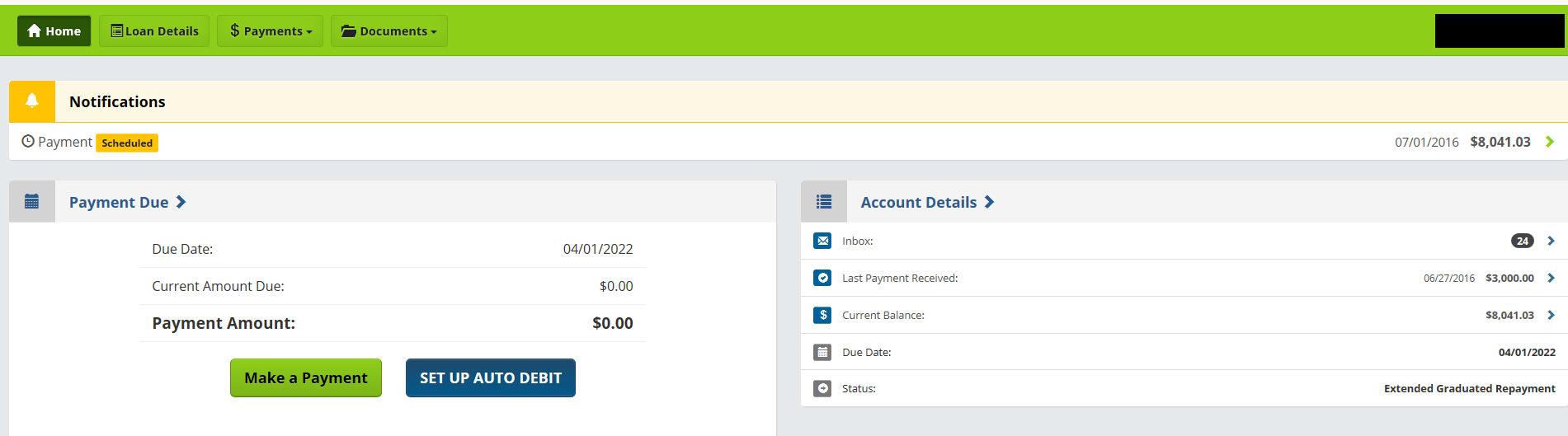

Made another 3k payment yesterday. I went to St. Augustine for Memorial Day and bought a souvenir from the Castillo de San Marcos. I got a paid loan statement from my school today and put the cannon to good use, lol.

Thanks, I may do a post on there or I was asked to do a front page article for sdnI'm inspired by your drive and tenacity to aggressively pay off your student loans, @sweetlenovo88. I think it would benefit other doctors to read about your strategy as a case study. I'm particularly interested in how you arranged your weekly telepsych schedule and your weekend out of state gigs - you work very hard! I strongly urge you to consider being a case study on the @The White Coat Investor blog.

Thanks, I may do a post on there or I was asked to do a front page article for sdn

I love this thread! Gives hope that those motivated enough can accomplish this.I can see the finish line...

I'd start with a few websites.this is amazing. you seem extremely financially aware and it's making me want to take some time this summer to start thinking about my future debt and how I'm going to handle it. congrats on your tenacity and thanks for the motivation!

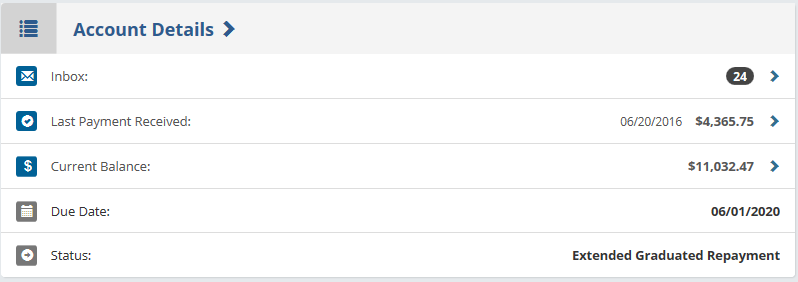

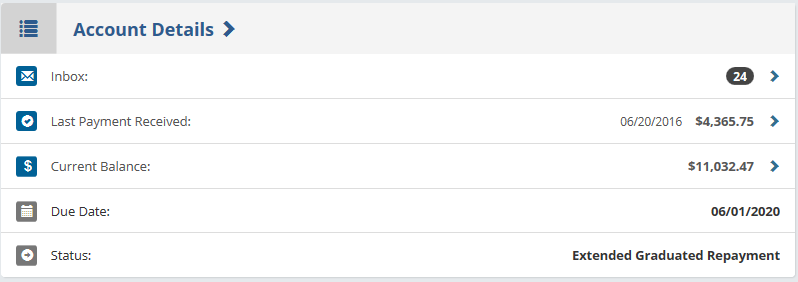

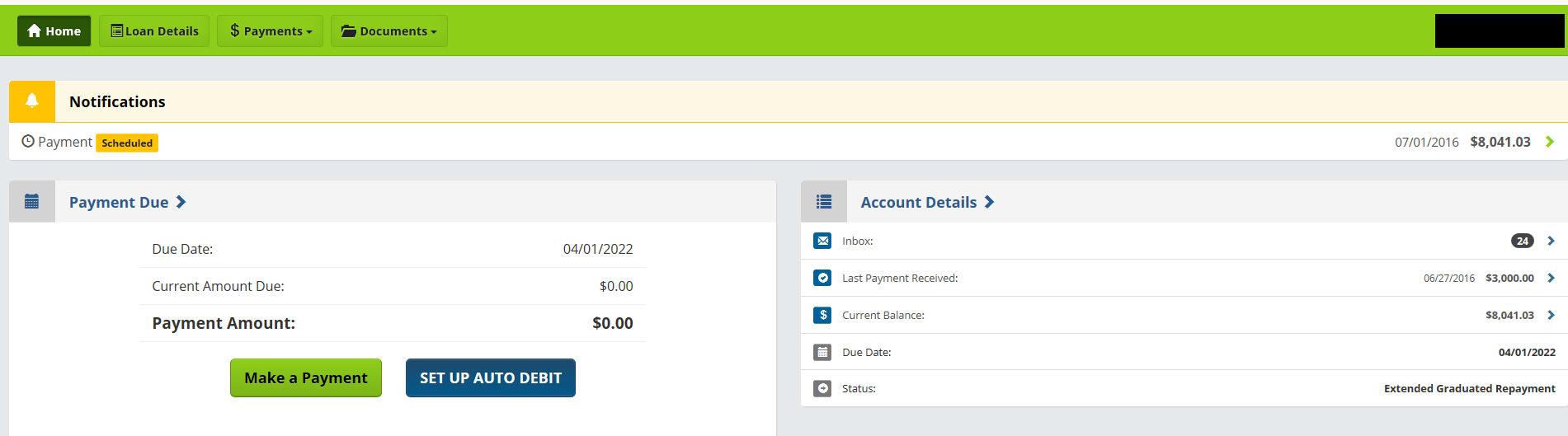

I'm deeeeeeebbbbbbbbbbbbbbbbbbbbtttttttttttttttttttttttttttttttttt ffffffffffffffffffffffffffffffffffffffffffrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrreeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeee!!!!!!!!!!!!!!!!!!!!!!!!!

I'm deeeeeeebbbbbbbbbbbbbbbbbbbbtttttttttttttttttttttttttttttttttt ffffffffffffffffffffffffffffffffffffffffffrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrreeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeee!!!!!!!!!!!!!!!!!!!!!!!!!

Would you mind giving an example of the budget you lived off of while paying off this huge amount of debt? It'd be great to see the gross income, living expenses, taxes, and all the other stuff that went along with the debt payoff just to help people see really "what it takes."I'm deeeeeeebbbbbbbbbbbbbbbbbbbbtttttttttttttttttttttttttttttttttt ffffffffffffffffffffffffffffffffffffffffffrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrreeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeee!!!!!!!!!!!!!!!!!!!!!!!!!

Thank you, I will try to put one together when I have the time. I can say while paying off loans, I continued eating out and took a vacation to Europe for two (4k because of airlines miles), bought a diamond ring, and bought a bmw from an auction for 12k (which only cost me 7k) and I put 58.5k into retirement. Everything was bought in cash. All off these things were done frugally and quite cheaply except the diamond which I bought using all of my cash reserves before starting to pay the loans off. My only irresponsible purchase you could say was the diamond since it was quite pricey. If anyone needs advice buying diamonds, pm me, lol

Very inspiring. I am working to aggressively pay off my debt but did not have near as much as you did. Now I can say that I have no excuses haha. Congratulations on being debt free.

Thank you!Super congrats!!!!! I saw this thread only today, but I found myself holding my breath whilst following your conquest lol lol lol

You made an inspiring, amazing, and truly balsy accomplishment!!!!

Job very well done!

+1 @GrignardsReagent

@sweetlenovo88 we all hope you're still working just as hard as you want to and enjoying your soon upcoming first year debt free anniversary xD

Again, Congrats!

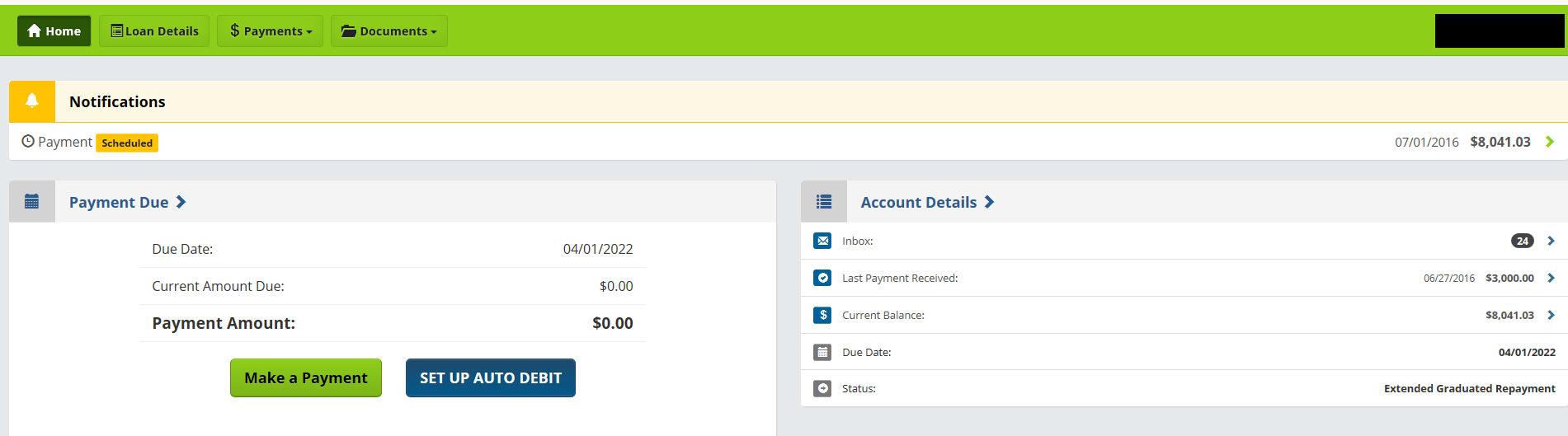

Thank you. I am glad my journey has been able to inspire others. Since becoming debt free in July of 2016, I have continued to maximize retirement and increased my net worth which now sits above 200k not counting possessions. I live on 10-15% of my gross pay. Expenses since then included an older LS460 from a government auction for my long distance drive to my weekend job. Also, a 10 day vacation to Paris over the holidays with the fiance. Flights+five star hotel+activities=5k. I also splurged on an expensive espresso machine, the breville oracle for my home office. All paid in cash of course. Standard of living: I moved to a 2bd and my portion of the rent went from $900 to $1500 which is cheap for this city. No other increase in spending but I do continue to spend regularly on eating out and weekend entertainment. I have also lost 30lb and am 50% to my pre-med school shape. My main goals are saving capital toward a business, continuing to maximize retirement and finding a work/life balance.

Thank you. I am glad my journey has been able to inspire others. Since becoming debt free in July of 2016, I have continued to maximize retirement and increased my net worth which now sits above 200k not counting possessions. I live on 10-15% of my gross pay. Expenses since then included an older LS460 from a government auction for my long distance drive to my weekend job. Also, a 10 day vacation to Paris over the holidays with the fiance. Flights+five star hotel+activities=5k. I also splurged on an expensive espresso machine, the breville oracle for my home office. All paid in cash of course. Standard of living: I moved to a 2bd and my portion of the rent went from $900 to $1500 which is cheap for this city. No other increase in spending but I do continue to spend regularly on eating out and weekend entertainment. I have also lost 30lb and am 50% to my pre-med school shape. My main goals are saving capital toward a business, continuing to maximize retirement and finding a work/life balance.

ds the end I was making

Yes this is very inspiring, even as a pre-med. We hope to see another post from you in a few months!For anyone curious for an update, I have remained debt free and have built up a retirement portfolio. I realized my love is business and entrepreneurship and being debt free has given me the ability to pursue those goals. I started a telemedicine clinic a year ago with that is doing well and we are about to hire some providers and expand to another state. Our clinic is debt free and I have a big reserve in the business account. I had to take a significant cut in income to pursue this goal but it was not a problem given I have no obligations and continue to below my means and not spend very much but have some very nice toys I got from car auctions that qualify as business deductions that I could sell for my than I what paid for them with deductions at any time. When traveling for work, I fly Spirit airlines and pack my stuff in a backpack to avoid their $80 round trip carryon fee, then check in to a four star hotel I pay $50 a night for, may buy McDonald’s for breakfast the next day, spend 1k for a dinner for my staff and a 7 doctors that have been referring to us, fly back on Spirit and then go food shopping at Walmart with the wifey. Valentines jewelry come from Costco because it’s a great deal.

A bit contradictory, but I am willing to spend to grow our clinic and on the rare occasion on myself to grab a steal of a deal. I am working on being more comfortable with risk. An investor does not want it and is about slow growth, an entrepreneur has dreams and wants to grow quick and is willing to take losses to get there (I took an 80% pay cut to try my idea). Still sticking to the debt free principle guys, it is liberating!

For anyone curious for an update, I have remained debt free and have built up a retirement portfolio. I realized my love is business and entrepreneurship and being debt free has given me the ability to pursue those goals. I started a telemedicine clinic a year ago with that is doing well and we are about to hire some providers and expand to another state. Our clinic is debt free and I have a big reserve in the business account. I had to take a significant cut in income to pursue this goal but it was not a problem given I have no obligations and continue to below my means and not spend very much but have some very nice toys I got from car auctions that qualify as business deductions that I could sell for my than I what paid for them with deductions at any time. When traveling for work, I fly Spirit airlines and pack my stuff in a backpack to avoid their $80 round trip carryon fee, then check in to a four star hotel I pay $50 a night for, may buy McDonald’s for breakfast the next day, spend 1k for a dinner for my staff and a 7 doctors that have been referring to us, fly back on Spirit and then go food shopping at Walmart with the wifey. Valentines jewelry come from Costco because it’s a great deal.

A bit contradictory, but I am willing to spend to grow our clinic and on the rare occasion on myself to grab a steal of a deal. I am working on being more comfortable with risk. An investor does not want it and is about slow growth, an entrepreneur has dreams and wants to grow quick and is willing to take losses to get there (I took an 80% pay cut to try my idea). Still sticking to the debt free principle guys, it is liberating!

I used to think like this but realized the big picture for me is to win the game and reach FI and I prefer to do it on the quicker side. Some prefer the love of business and creating and growing it. I prefer year round mai tai's in exotic locations.

I used to think like this but realized the big picture for me is to win the game and reach FI and I prefer to do it on the quicker side. Some prefer the love of business and creating and growing it. I prefer year round mai tai's in exotic locations.

I used to think this way too and was busting my ass making a lot of money then my roommate from medical school got dx with colon cancer at 34 years old and my wife was dx with skin cancer and thought...**** life can be short. Maybe tone it back a bit, still make good money, but enjoy life a little while still working hard.

Now I just take a few vacations a year to cool places or buy some splurging items occasionally but to each their own. It also helps that I now have employees who every time they make money, I make money. So even when I'm on vacation, I'm still making some level of money.

Personal finance is personal.

I have an idea that is now a reality and on its way to growing to be multimillion dollar company. My goal is to see it blossom and join the Silicon Valley entrepreneurial world. I plan to be stepping away from all clinical medicine in about a year.