psychdoc00

New Member

- Joined

- Sep 9, 2023

- Messages

- 6

- Reaction score

- 3

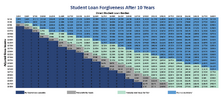

Hi everyone! Was hoping someone could please help me and offer some sound advice. I have around ~500k in student loan debt (all direct federal loans eligible for PSLF forgiveness). I’m in my last year of fellowship (six total years of residency and fellowship), plus one year where I worked at an eligible employer. So that will be about 7 years total come next July. I was on REPAYE which just got switched to SAVE.

As I look for general and/or child psychiatry jobs, I’m not sure what my best option is. If I work for a PSLF qualifying employer for the next 3 years, ideally all of the 500k loans should be forgiven. But I’m tempted to accept a job that pays more (but is private).

Any advice on how to proceed? With 500k in student loans I’m worried my interest will forever continue to grow, but I think the SAVE plan helps me out now while I’m on a fellow salary (and next year since they use the prior year’s tax info) and the interest is waived?

Thank you for any help everyone!

I know the PSLF program has recently been revised with last year’s limited waiver and the current IDR one-time adjustment, so I know positive changes have happened to this program, so I’m hoping to continue to qualify but, unsure if accepting a higher paying job at a private company is better.

As I look for general and/or child psychiatry jobs, I’m not sure what my best option is. If I work for a PSLF qualifying employer for the next 3 years, ideally all of the 500k loans should be forgiven. But I’m tempted to accept a job that pays more (but is private).

Any advice on how to proceed? With 500k in student loans I’m worried my interest will forever continue to grow, but I think the SAVE plan helps me out now while I’m on a fellow salary (and next year since they use the prior year’s tax info) and the interest is waived?

Thank you for any help everyone!

I know the PSLF program has recently been revised with last year’s limited waiver and the current IDR one-time adjustment, so I know positive changes have happened to this program, so I’m hoping to continue to qualify but, unsure if accepting a higher paying job at a private company is better.