- Joined

- Jun 12, 2016

- Messages

- 593

- Reaction score

- 562

Hello everyone,

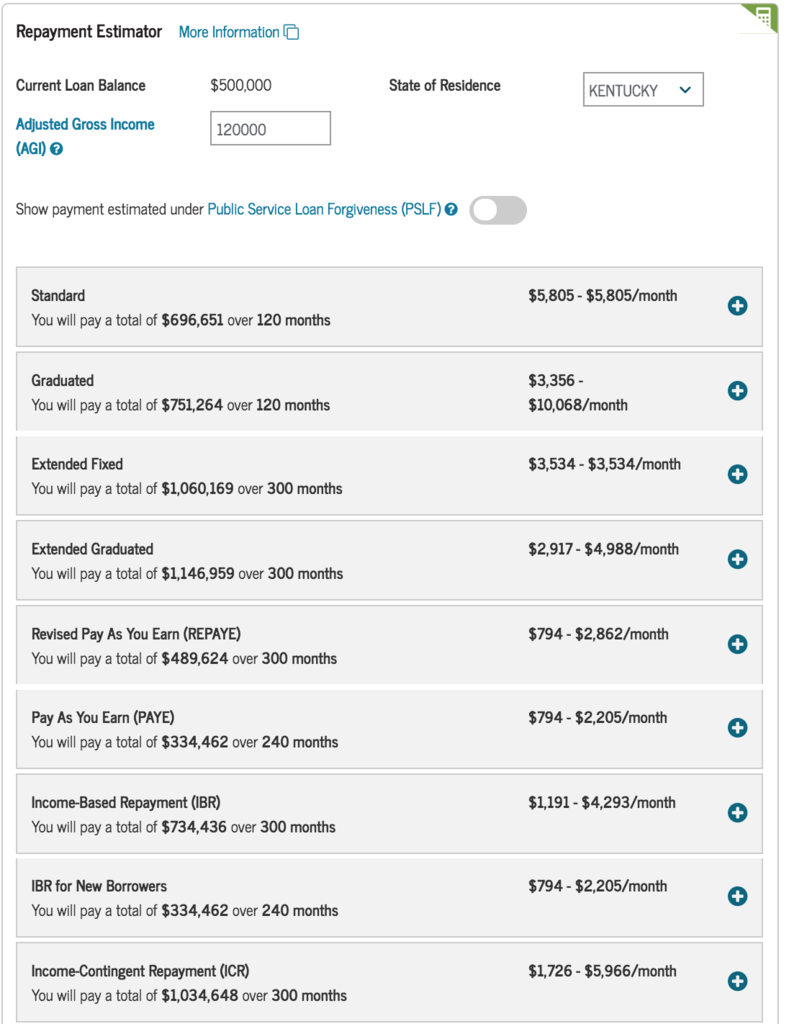

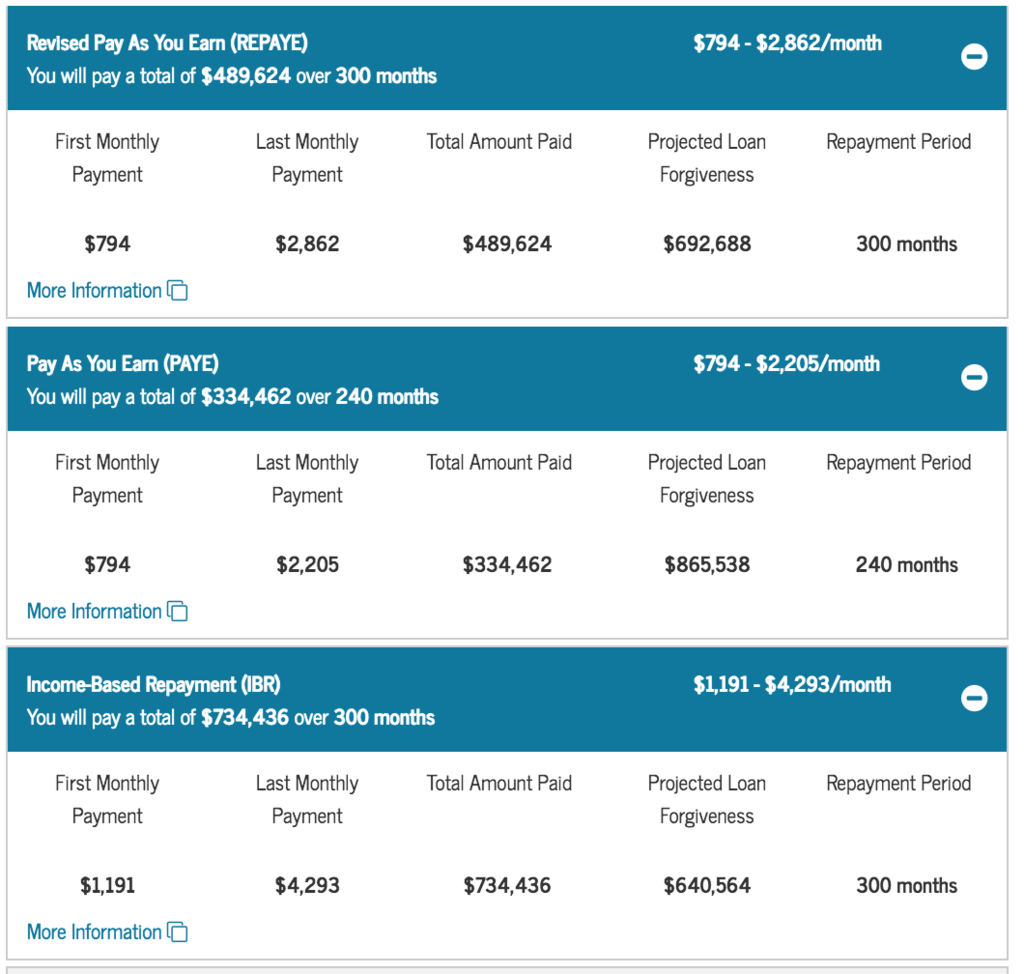

My SO and I will have about 500,000 in loans between the two of us once it is all said and done (all federal, interest rate between 4-7% on all). I put these numbers into the loan repayment calculator and the numbers are super confusing. For example, how in the world will doing PAYE allow us to pay back less than REPAYE? Both of them seem to imply that we will be paying back less than the 500,000 we will owe. What?

Thanks in advance, finances are not my strong point.

Combined income after taxes should be ~ 180K

My SO and I will have about 500,000 in loans between the two of us once it is all said and done (all federal, interest rate between 4-7% on all). I put these numbers into the loan repayment calculator and the numbers are super confusing. For example, how in the world will doing PAYE allow us to pay back less than REPAYE? Both of them seem to imply that we will be paying back less than the 500,000 we will owe. What?

Thanks in advance, finances are not my strong point.

Combined income after taxes should be ~ 180K