- Joined

- Apr 22, 2006

- Messages

- 2,868

- Reaction score

- 2,835

- Points

- 6,431

- Attending Physician

Advertisement - Members don't see this ad

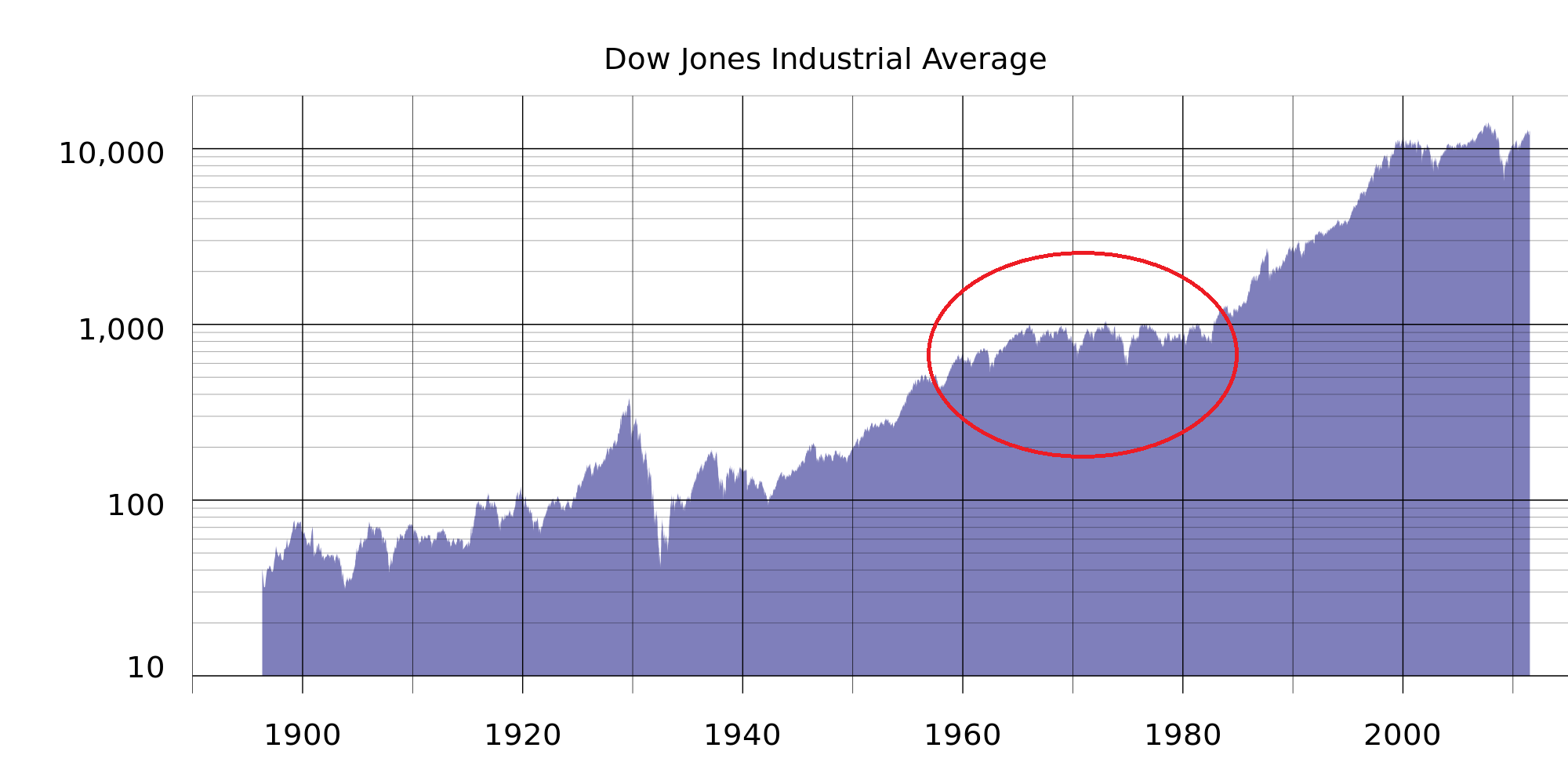

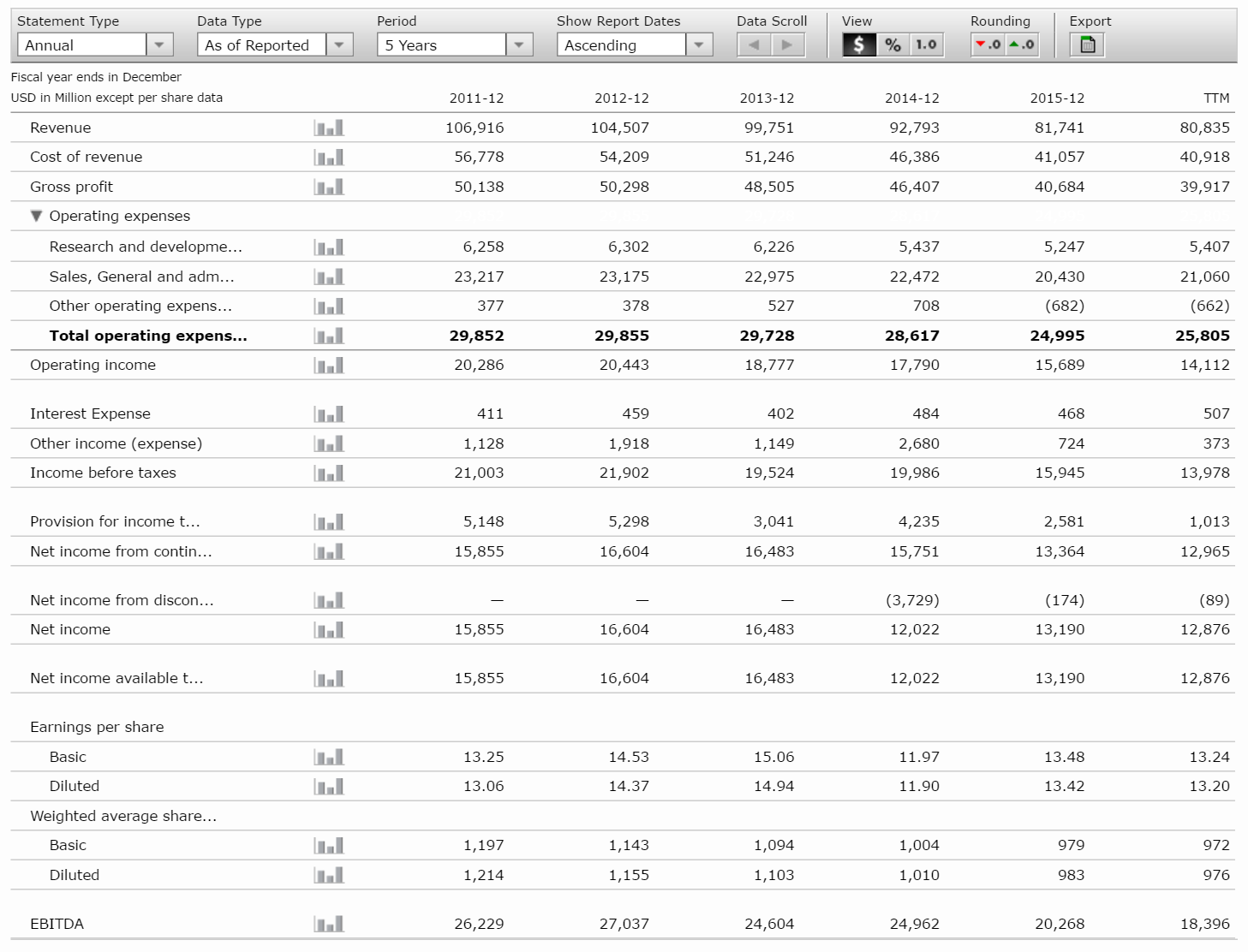

The problem isn't the fact that corporate debt is so high, it's the fact that corporate debt is high and capital expenditures are down. I don't think anyone has a problem with credit when it is used to invest in capital goods or infrastructure, given that such investments will likely increase future productivity. The point made by a lot of investors in the current market is that corporate debt is being used for financial engineering in order to raise asset prices. The reason for this isn't entire clear, but it's probably a combination of lower interest rates and the perception of negative economic outlook.This is still missing the point. There are companies with significant debt that fail. There are companies with significant debt that have become tremendous successes. There are no companies either private or public that have become tremendous successes without debt. Debt is a financial instrument that is indispensable when trying to start a business, and trying to make a blanket statement that implies that all debt is intrinsically "bad" is just plain silly.

I'm not implying they are what they are solely because of their debt. I am saying that an extremely desirable product/service and debt are the sine qua nons of a successful megacap company. Again I'll ask- tell me a successful megacap (either growth or value) that did not have significant debt in their "hypergrowth" phase?

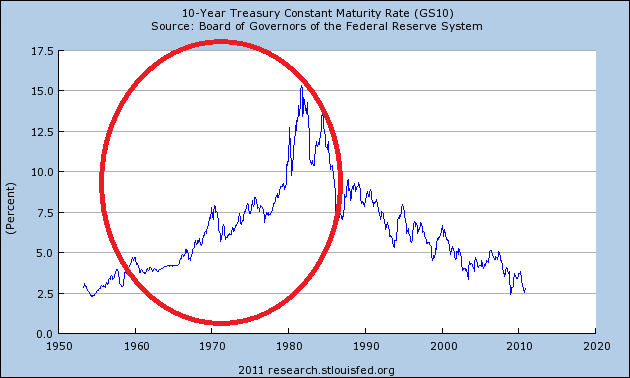

The government should run surpluses when there is the threat of inflation, especially in a situation with near capacity or full employment. However, if credit growth in the private sector (with the exception of corporate entities) is anemic, then there needs to be government deficits to shore up aggregate demand. The main problem with the economy of the US right now is low aggregate demand, and low velocity of money. The Fed (as well as all other central banks) are having trouble creating their target inflation rate. Monetary policy is at its logic end, and there are limited options for central banks. The only way forward is strong handed fiscal policy which is essentially deficit spending. From a macro standpoint, this is the main reason I can't allocate most of my capital into equities right now. The fundamentals aren't there in the medium to long term without fiscal policy. I don't see deficit spending as a viable political option, but if it was, then I would be back in equities.I agree that debt for debt's sake is ridiculous. I also agree that a government should run budget surpluses whenever possible. I suspect, though, that "whenever possible" certainly varies based on user interpretation.