- Joined

- Mar 19, 2005

- Messages

- 7,704

- Reaction score

- 7,467

- Points

- 5,701

- Location

- Las Vegas

- Attending Physician

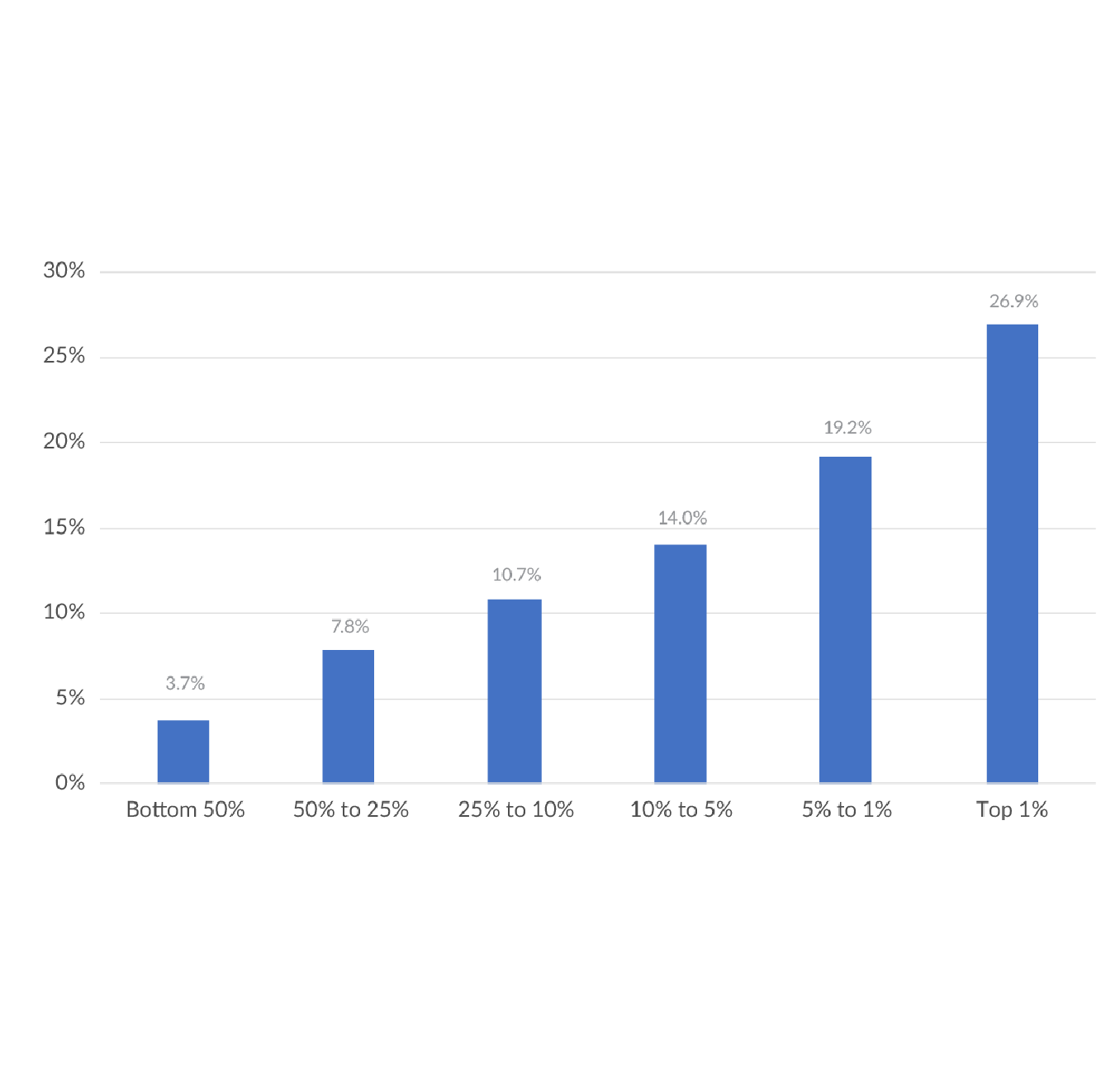

I don't see how anyone can think of EM docs as anything but UMC, and yes we pay plenty of taxes. The truly wealthy are business owners with massive tax deductions. Investment income is taxed at a much lower rate, of course. Remember what Buffet said- he pays a lower rate of income tax than his secretary; he certainly doesn't see the need to not work.

We are in a service industry- we service the rich and the poor. We don't own our own businesses (for the most part, and they are easily sold because we don't add much value) and we are generally interchangeable. This is not the road to true, multigenerational wealth.

Technically we aren't middle class. Most of us community docs who are making > 300K would be in the top 10% of wage earners. A few of us in a good year with overtime and bonuses can even make the 1% for a period of time.