- Joined

- Jul 28, 2011

- Messages

- 179

- Reaction score

- 223

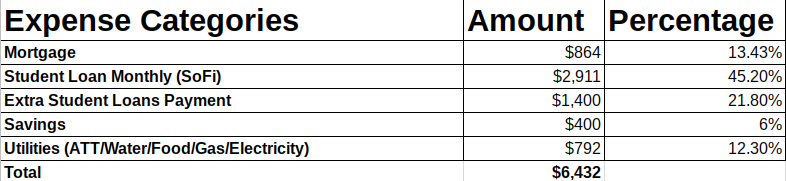

Hello fellow Pharmacist, I am posting this to show what life is like with heavy student loans debt and what it takes to conquer it. I have a goal of paying off $153k in 3 years. As you can see from my budget, paying off your student loans quickly is very doable as long as you stay focus, work hard and adhere to a very strict budget. I hope this provides some motivation to all of you.