- Joined

- Mar 23, 2010

- Messages

- 7,042

- Reaction score

- 6,693

- Points

- 5,371

- Attending Physician

I’m gonna to pickup usap ipo. I’m telling you. Buy buy buy usap

sometimes u gotta to re balance your portfolio and cut ties with non performing sectors.

I had att and verizon for a long time for their dividend yields but I was better off just buying another blue chip stock without the dividend yields and gotten better gains.

I dumped all my emerging markets around 2017. Sure it was high flying from 2004-2007 when I had it. But it’s been horrible the past 10 years.If you choose to tilt away from the total market portfolio, you must be prepared to accept multi decade periods of under performance. That is the risk you bear for seeking outperformance, i.e., superior risk adjusted returns. Other than the fact that emerging markets haven't delivered for 10+ years, do you believe that your rationale for choosing to tilt that way was flawed? If so, abandon your tilt. If not stay the course or even commit the venal sin of increasing your tilt since they are so much cheaper now.

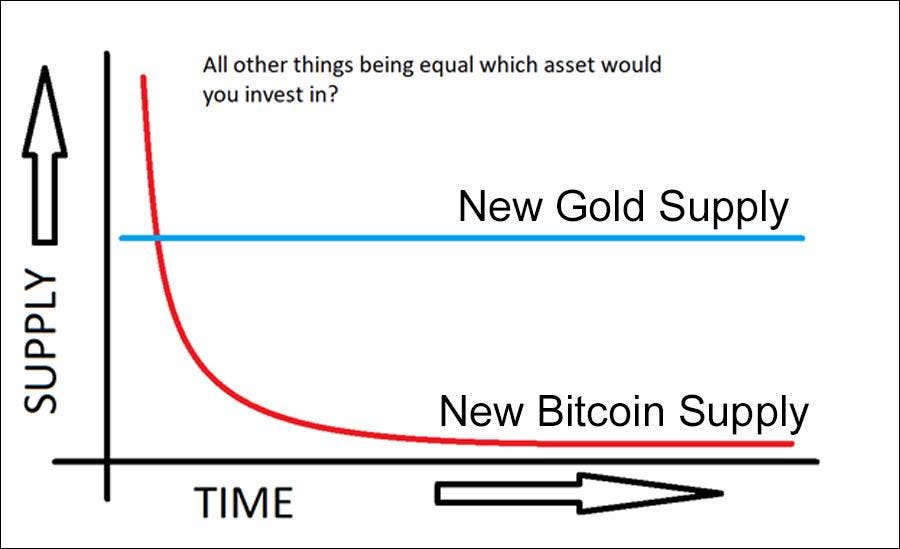

View attachment 309142

sometimes u gotta to re balance your portfolio and cut ties with non performing sectors.

I had att and verizon for a long time for their dividend yields but I was better off just buying another blue chip stock without the dividend yields and gotten better gains.