- Joined

- May 6, 2021

- Messages

- 73

- Reaction score

- 148

Hi all,

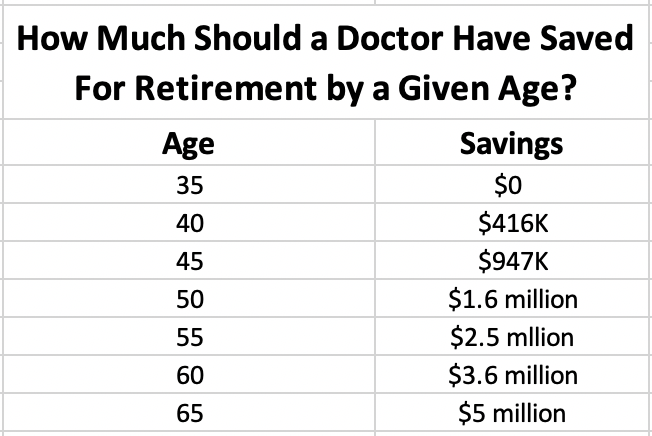

My family and I stumbled into an amazing situation - Long story short we sold our house in order to downsize (it was waaay to big a place and our new house is perfect in all the ways we like) and are pocketing $600k of equity earned after all the closing costs in 3 short years on top of our $300k we put in for a down payment. The new house we bought with a 0% down physician loan for 900k @ 4.75% 10 year ARM. I'm 35, work full time as a partner in my anesthesia group which is MD only, 4 years out from residency. My wife is part time primary care doc. I have 100k left in student loans @ 4.25% on a 5-year fixed at this point and 529s for each of our 2 toddlers with about $25k in both. We aim to max them out at 60k each. We have a combined $450k in retirement investments, mostly roth IRA and 401k money.

What should we do with all this cash, totaling about $900k?

The first thing I'd like to prioritize is working less, but HOW... quit partnership and do locums? Add more vacation time but remain a partner? My group does not allow part-time positions for partners, just extra vacation time. I love the group - complex broad spectrum of anesthesia cases with moderate call and good pay, but the culture and hospital pressure is to work hard, not a lifestyle practice.

We don't have lavish tastes: I drive a Honda Fit, my wife a Subaru Forester (both paid off). We're pretty satisfied with them. No other debts. I like construction projects, we are also interested in travel with the kids. I have kind of always had an interest in doing an Ironman someday but never found the time...

We are considering me doing locums abroad but we are nervous about cutting ties with our current partnerships / jobs for just a 1 year stint.

I've thought about real estate investing with the cash. With more free time it's appealing to me to spend my extra free time learning about this stuff. I'm interested in investing and am excited for the opportunity to dabble in a variety of different ways to invest.

My family and I stumbled into an amazing situation - Long story short we sold our house in order to downsize (it was waaay to big a place and our new house is perfect in all the ways we like) and are pocketing $600k of equity earned after all the closing costs in 3 short years on top of our $300k we put in for a down payment. The new house we bought with a 0% down physician loan for 900k @ 4.75% 10 year ARM. I'm 35, work full time as a partner in my anesthesia group which is MD only, 4 years out from residency. My wife is part time primary care doc. I have 100k left in student loans @ 4.25% on a 5-year fixed at this point and 529s for each of our 2 toddlers with about $25k in both. We aim to max them out at 60k each. We have a combined $450k in retirement investments, mostly roth IRA and 401k money.

What should we do with all this cash, totaling about $900k?

The first thing I'd like to prioritize is working less, but HOW... quit partnership and do locums? Add more vacation time but remain a partner? My group does not allow part-time positions for partners, just extra vacation time. I love the group - complex broad spectrum of anesthesia cases with moderate call and good pay, but the culture and hospital pressure is to work hard, not a lifestyle practice.

We don't have lavish tastes: I drive a Honda Fit, my wife a Subaru Forester (both paid off). We're pretty satisfied with them. No other debts. I like construction projects, we are also interested in travel with the kids. I have kind of always had an interest in doing an Ironman someday but never found the time...

We are considering me doing locums abroad but we are nervous about cutting ties with our current partnerships / jobs for just a 1 year stint.

I've thought about real estate investing with the cash. With more free time it's appealing to me to spend my extra free time learning about this stuff. I'm interested in investing and am excited for the opportunity to dabble in a variety of different ways to invest.