D

deleted923283

In an era of insane dental school debt, I see many students planning to “live like a student” when they start working in order to save money and aggressively pay off their student debt. It’s sounds nice in theory. But I’m here to pop your bubble and explain why it probably won’t happen.

BOTTOM-LINE: Saying you’ll „live like a student“ to stash away massive amounts of cash to pay down your debt is unrealistic for most people. In the real world, it’s not so easy.

CONCLUSION: Go to the cheapest school.

- Any desirable safe place to live costs an insane amount of money. If you are going to rent, it builds no equity over time. Think you’re smart by getting a mortgage? The way interest rates are going, you’ll be probably be paying more than twice the cost of the real estate by the time it’s paid off in 30 years. Finding roommates is easy when you’re 22. No one safe, sober, and not crazy wants to be your roommate in their late 20s.

- You will need a dependable car when you start working. And you will probably need to work at more than 1 office starting as an associate. Your rusty hand-me-down is not going to cut it through the snow. Leasing is an atrocious financial decision, and dependable cars start at like $12,000 nowadays.

- All the free stuff you had during University now costs money. Gym membership. Books. WiFi. Social hangouts. Sports. You have to pay for all of that now.

- You will want to start dating. Dating someone financial responsible - nice! Dating someone who is cheap - not nice! No one wants to date someone who is cheap all the time. Dating usually means eating out, or seeing a movie, or getting a drink - all $$$. Especially if you put doctor in your Hinge profile. And ladies, the market out there nowadays is trash - there’s a good chance you’re going to be dating men who make less than you. And if you’re thinking of marrying a doctor, multiple your debt x2 and pray they don’t want to be a medicine doctor.

- Your friends are going to be getting married. Friends from home, college, and dental school. You’ll need to fly all over the country, buy outfits, buy gifts, buy hotels. It’s part of being a good friend. And your girlfriend is going to start bugging you to get married soon. Average wedding cost an average of 33k last year, but your girlfriend doesn’t think you’re average. Oh, and she wants a baby too!

- Your parents are going to get old. Depending on your culture, you may be on the hook to support them, especially since you’re a „doctor“ now. But even if not, you’ll want to spend more time with them, go on trips with them, etc. They’re getting older, and it’s not so easy for them to come to you. Then you’ll realize YOU are getting older, and those cool trips you want won’t be possible when you’re 45 with kids.

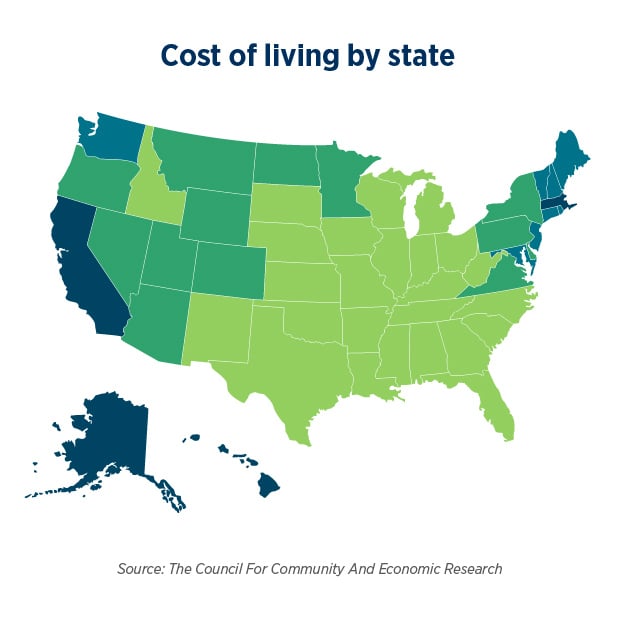

- Taxes. Federal income tax ~29%, states like NY have ~6% state income tax, city income taxes (WTF!?), FICA taxes, insane property taxes, sales taxes, death tax, health insurance (average was 24k for a family in 2023). Dude I’ll be honest, I’m paying taxes for things I don’t even know what they mean. Any financial person will also tell you that you should be maxing your IRA every year (7k), and you should probably be contributing to your 401k and HSA. There’s not much money left at the end of the day.

- Dentist income hasn’t budged for what… like 2 decades or something? Meanwhile, there’s inflation, the fed’s favorite tool for keeping you poor.

BOTTOM-LINE: Saying you’ll „live like a student“ to stash away massive amounts of cash to pay down your debt is unrealistic for most people. In the real world, it’s not so easy.

CONCLUSION: Go to the cheapest school.

Last edited by a moderator: