http://www.economicsvoodoo.com/the-kabuki-of-markets-as-history-unfolds/

The Kabuki of ‘Markets' as History UnfoldsPosted by Economics Voodoo, June 8, 2013 at 19:15

Today marks the second day of the United States's expedited meeting with China "as they work out ways for the U.S.-led world order to make room for a China that is fast accruing global influence and military power" (Associated Press. May 21, 2013).

April-May, 2013: Orchestrated plunge in gold, silver. Stock "market" levitated. What the system does not have much of is gold, silver. Growing reports of shortage and major banks refusing to deliver physical gold belonging to clients; extended delivery delays; drainage of gold from London; ABN Ambro defaulted, refused to deliver gold but predicts a gold price collapse.

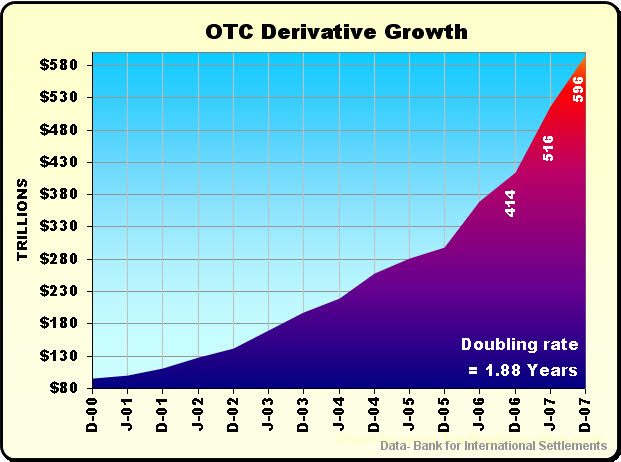

Consider a hyperinflation not in the traditional ways of the Weimars and Zimbabwes that printed currency with ink and paper, but in derivatives (a portion in above chart). Over $1,000 Trillion unprinted pretend ‘derivatives' dollars that do not exist, mostly interest rate derivatives that hold together the interest rate structure. Inflation subdued? That depends on where asset prices would be (stock market – 401k-IRAs – bank balance sheets…

without suspending FASB's accounting rule and printing money ‘QE' 0-1-2-3∞ + ZIRP and multi-trillion dollar swaps.

Behind this kabuki theatre is history in the making. It is the U.S. dollar's diminishing role as the international settlement currency for world trade (about $18 trillion merchandise trade in 2012) along with its implications. Since at least 2012, bilateral trade agreements among other nations have begun settling in non-U.S. dollars. Over the next few years, China's economy will become the largest in the world, and with India (the people) and Russia lead the world in gold accumulation.

May 7, 2013: China announces aim of convertibility of the yuan in 2013. [Yuan]

May 7-8, 2013: G-20 Meets in Turkey: "Reinventing Bretton Woods" [Reinventing the gold standard…]

Developing and emerging economies led by China, now hold two-thirds of foreign exchange reserves among world central banks.

May 10-11, 2013: Unscheduled Meeting of G-7 (Britain, Canada, France, Germany, Italy, Japan and the United States) over the weekend in London. Federal Reserve Bank Chairman Bernanke absent. " ‘It's very rare for a G-7 to focus on financial regulation,' one of the officials said, speaking on condition of anonymity". Perhaps then, on the G-20's meeting in Turkey which portends the re-entry of gold to anchor the new system. In the previous article, "Yes it is true: ‘Gold is dead.'" reports raise questions about how much gold, if any, is left at Fort Knox, which at its height vaulted about half of the gold holdings in the United States, half belonging to other countries.

May 21, 2013: : China's President Xi to Meet with U.S. President earlier than expected, June rather than September

(AP). "The June 7-8 meeting at a retreat southeast of Los Angeles, announced Monday by the White House, underlines the importance of the relationship between the countries as they work out ways for the U.S.-led world order to make room for a China that is fast accruing global influence and military power.

President Xi has said China wants its rise to be peaceful…"