I am not against share repurchases and I think they are a very useful tool when used wisely, but they absolutely are synthetic manufacturing. Say you have two scenarios: 1) a company has a profit of $100 and 10 shareholders, EPS is $10/share. Over the course of a year, the company repurchases 5 shares but yet still only produces a $100 profit. EPS this year is now $20/share. Scenario 2) the same company with a $100 profit a year ago absolutely kills it this year and spits out a $200 profit, but does not repurchase any shares. EPS this year is also now $20/share.

EPS doubled YoY in both scenarios, ergo both are equivalent results, right? Hell no. I use the term synthetic because scenario 2 is the actual holy grail of EPS growth: the

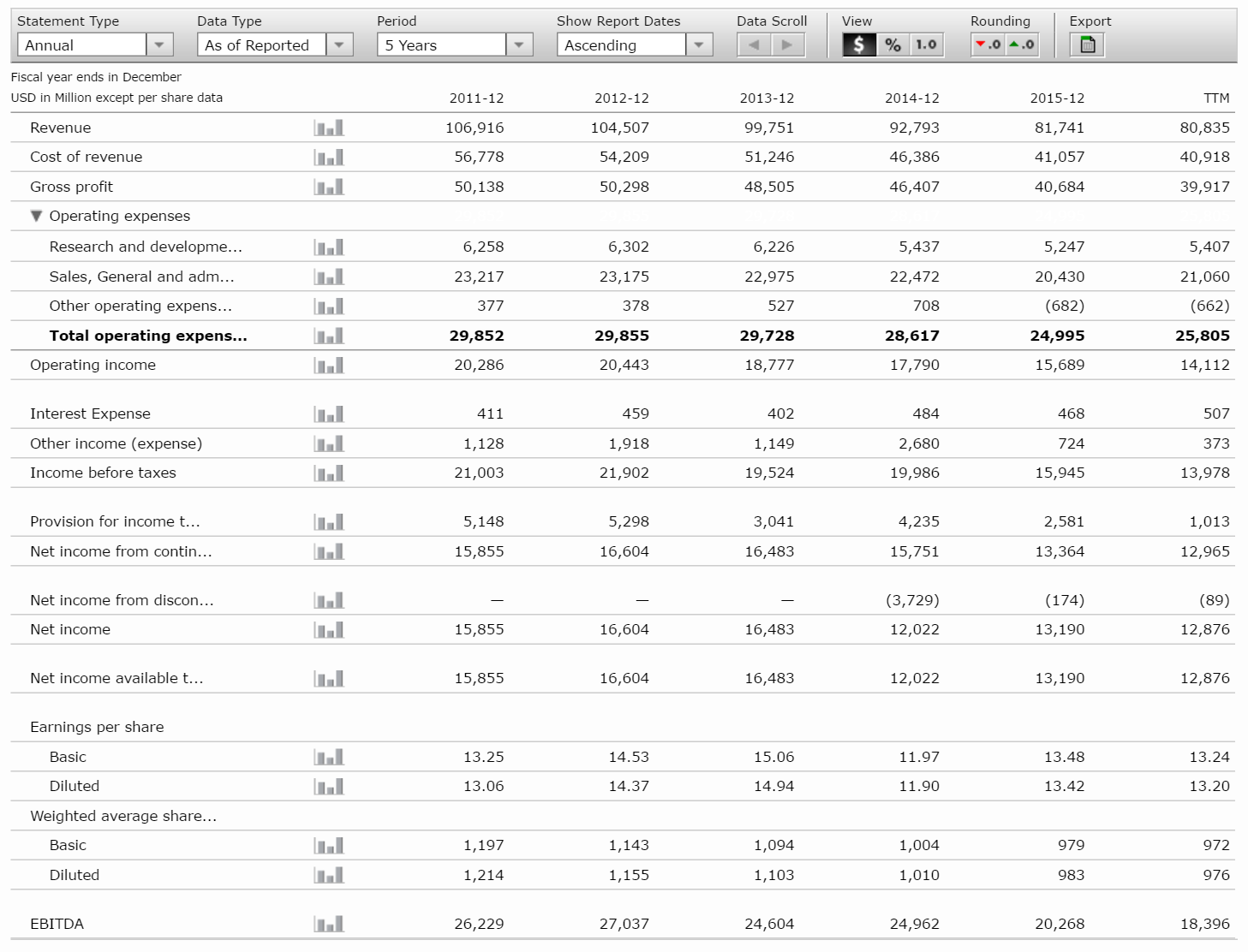

organic kind. Actually making more money YoY instead of distributing the same amount of money to a smaller pool is what equity markets value and reward in the form of out of proportion forward multiple expansion. The kicker line in your post is "(all things being equal like debt and what not)". IBM

heavily leveraged themselves to keep repurchasing shares (at ridiculous valuations) and maintain a fat divvy. The debt never stays the same for bloated, stagnant companies with declining revenue who feel the need to polish their bottom line number. Buybacks become truly evil when they are employed solely because the managers don't have a clue how to deploy capital wisely in other ways to grow the business. Shareholders eventually wised up to the lipstick on a pig and realized that declining revenue is eventually insurmountable. The stock has been punished accordingly.