D

deleted682700

Recently the Indian government banned all old currency of 500 rupee ( approx7.5 us$). And 1000 rupee (approx 15$ usd). Obviously it is a very good move to unearth all the black money that lubricates the parallel economy. The choice for the underground money is to declare their money, by dec 30 , pay fine and taxes or loose 50%. Old notes get exchanged for new notes and u loose 50% to keep it unaccounted.

This sudden move has devastated the real estate in several cities and has deflated realestate values by 50%. Any one with dollars can go to india and buy property. Name your price and you are most likely to get it, particularly high end luxury markets.

Will the 100$ bill be abolished and only smaller notes be valid in the US? Will such a move ever happen.

Kenneth Rogoff, has made the case to abolish cash. When the banks charge negative interest rates, the general public withdraw their savings and keep it at home. This causes bank runs and TPTB want to abolish all cash transaction.

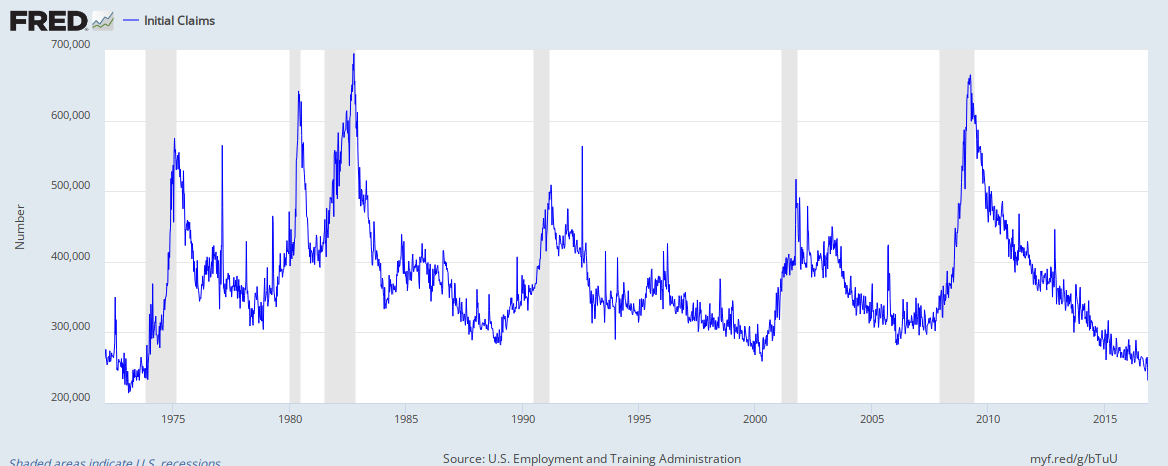

May be next step is Gesselian economy to force people to spend money today to increase the velocity of money exchange. Something is not right, particularly the huge disconnect between wall street and main street. Why does the layoffs continue if everything is so good

This sudden move has devastated the real estate in several cities and has deflated realestate values by 50%. Any one with dollars can go to india and buy property. Name your price and you are most likely to get it, particularly high end luxury markets.

Will the 100$ bill be abolished and only smaller notes be valid in the US? Will such a move ever happen.

Kenneth Rogoff, has made the case to abolish cash. When the banks charge negative interest rates, the general public withdraw their savings and keep it at home. This causes bank runs and TPTB want to abolish all cash transaction.

May be next step is Gesselian economy to force people to spend money today to increase the velocity of money exchange. Something is not right, particularly the huge disconnect between wall street and main street. Why does the layoffs continue if everything is so good