- Joined

- Jul 16, 2003

- Messages

- 6,030

- Reaction score

- 3,810

Just in case none of you know what it is.

If you work for an AMC, you can do this to get up to 56k.

Can only do a conversion once a year.

www.nerdwallet.com

www.nerdwallet.com

If you work for an AMC, you can do this to get up to 56k.

Can only do a conversion once a year.

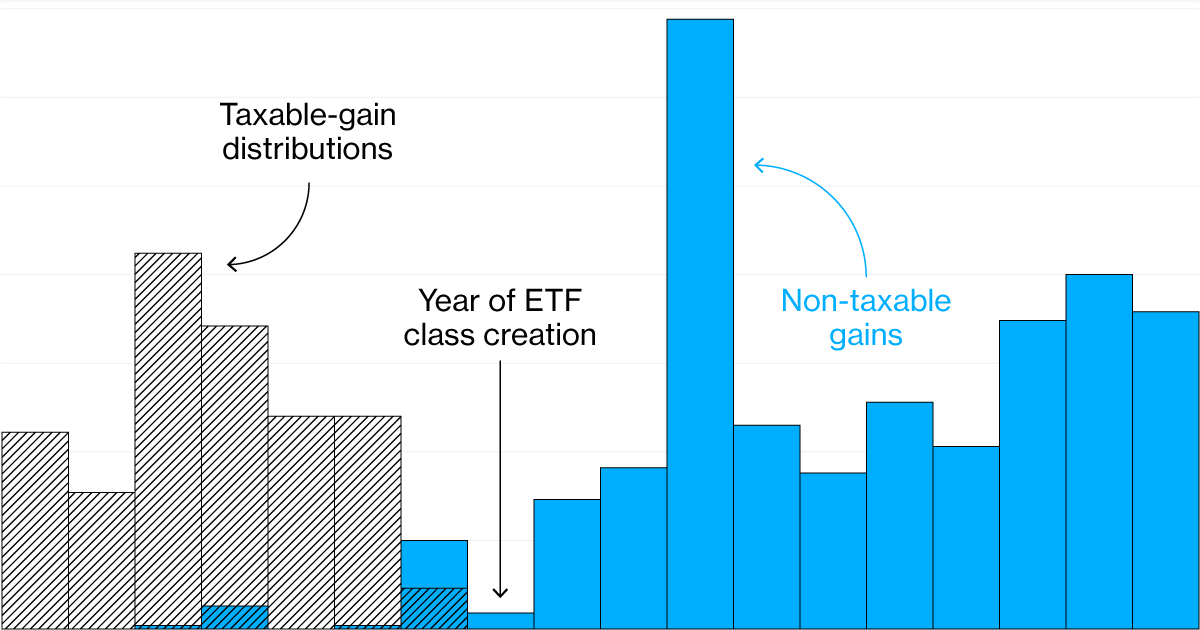

Mega Backdoor Roths: How They Work - NerdWallet

If you're a high-earner who can't contribute to a Roth IRA, a mega backdoor Roth — particularly if your 401(k) plan allows it — might be a solution.