- Joined

- Aug 17, 2012

- Messages

- 1,894

- Reaction score

- 2,183

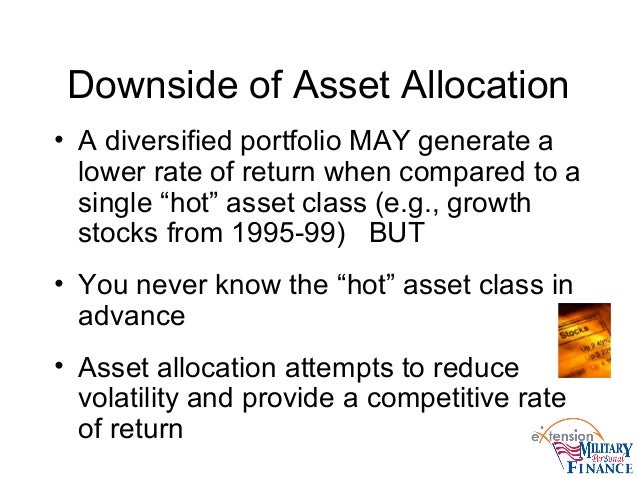

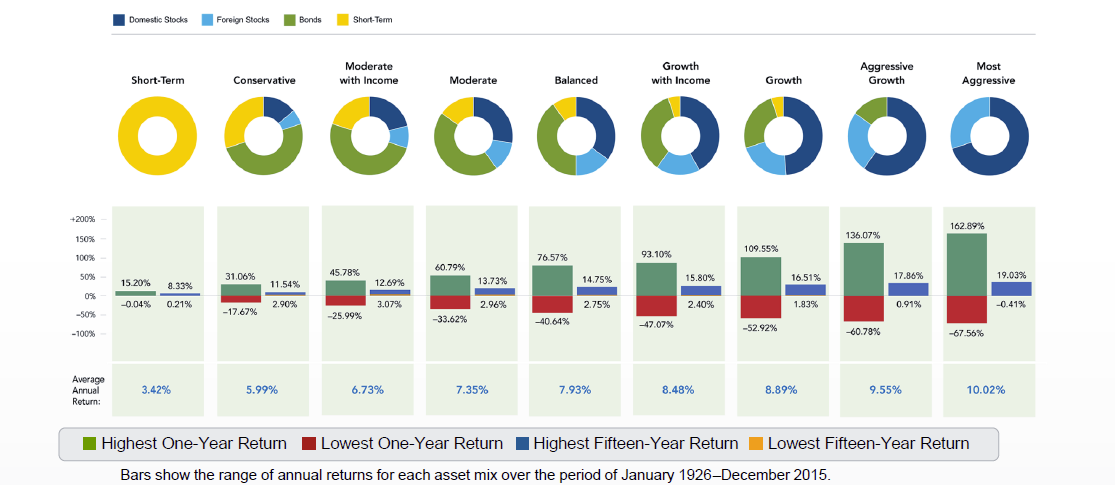

not trying to start a big debate about market timing, but who’s pulling back on equities? Record highs, various financial time bombs afloat.....

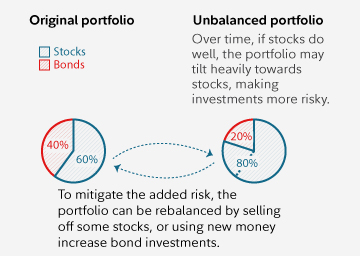

I’m 43, recently pulled back from 95 to 75% equities. Probably where I should have been anyway and what better time to do it.

One barrier is that I prefer to keep “bonds in taxable” (another debate I don’t want to trigger). But if I sell equities in taxable I trigger capital gains. Ahhh...doctor problems.

I’m 43, recently pulled back from 95 to 75% equities. Probably where I should have been anyway and what better time to do it.

One barrier is that I prefer to keep “bonds in taxable” (another debate I don’t want to trigger). But if I sell equities in taxable I trigger capital gains. Ahhh...doctor problems.