I wish I had invested more during this whole thing. Of course, I still have time to invest more. Eventually the DOW will hit 29,000 and the trillions of dollars (stimulus money) created for the economy will eventually make it to the stock market. I just wish I had had more money to put in during this whole thing...

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter Porfirio

- Start date

- Joined

- Dec 19, 2010

- Messages

- 10,254

- Reaction score

- 13,582

I've been putting in my normal amount every month, but not as much as I would have liked to, either. Regardless, it always feels better when trend is up, as opposed to down. If you had anything in the market starting about 6 weeks ago, then you've got to be happy about the trend. I held tight and didn't sell anything, so I'm liking the trend. When I'm closer to retirement I may act differently, but for now, I ride out the ups and downs entirely.I wish I had invested more during this whole thing. Of course, I still have time to invest more. Eventually the DOW will hit 29,000 and the trillions of dollars (stimulus money) created for the economy will eventually make it to the stock market. I just wish I had had more money to put in during this whole thing...

- Joined

- Jul 12, 2004

- Messages

- 5,278

- Reaction score

- 4,969

I fully funded my retirement for 2020 and put some of that money to work, but not all.

What happened this week is unusual. I do expect a 1000 point correction (in the DOW), or more in the coming weeks.

The market is priced to perfection, the stocks are the most expensive they have been relative to earnings in the history of the stock market from what I read.

The market was kind of like this prior to COVID. Rapid rise....everyone is happy...debt spending. It can't go on like this forever and unchecked.

I'm going to wait more before I buy....I have about another 30K in cash. I was fortunate that I put in about 30-40K while the market was between 20K - 24K. I also bought JETS, a 100% airline ETF at a low. It's a small position but gives me a little bit of happiness.

Just imagine what the market is going to do if we have a COVID part deux outbreak in a major city with several thousands of deaths or we get information that the vaccines are not particularly effective. It will drop!

What happened this week is unusual. I do expect a 1000 point correction (in the DOW), or more in the coming weeks.

The market is priced to perfection, the stocks are the most expensive they have been relative to earnings in the history of the stock market from what I read.

The market was kind of like this prior to COVID. Rapid rise....everyone is happy...debt spending. It can't go on like this forever and unchecked.

I'm going to wait more before I buy....I have about another 30K in cash. I was fortunate that I put in about 30-40K while the market was between 20K - 24K. I also bought JETS, a 100% airline ETF at a low. It's a small position but gives me a little bit of happiness.

Just imagine what the market is going to do if we have a COVID part deux outbreak in a major city with several thousands of deaths or we get information that the vaccines are not particularly effective. It will drop!

- Joined

- Jul 27, 2011

- Messages

- 2,243

- Reaction score

- 2,914

I purchased roughly 46k of stocks between March and May. I could have bought another 10-15k, was just lazy to set up my wife's back door Roth and doing some more employer contributions to my solo 401k.

I wish i had put in more, but it doesn't matter honestly. My investing will not change and I'll continue to invest massive amounts into my portfolio. My investing in based on dollar cost averaging. So the price of the market doesn't change anything. I have 3 different accounts that make weekly investments. I no longer think about my investments much.

July 1st is almost here, that will mark my first year as attending. Went from 200k in debt to debt free with a 185k net worth as of today. Will probably reach 240+k net worth by August 15th which marks 1 year of attending paychecks. So overall, not a bad year so far.

I wish i had put in more, but it doesn't matter honestly. My investing will not change and I'll continue to invest massive amounts into my portfolio. My investing in based on dollar cost averaging. So the price of the market doesn't change anything. I have 3 different accounts that make weekly investments. I no longer think about my investments much.

July 1st is almost here, that will mark my first year as attending. Went from 200k in debt to debt free with a 185k net worth as of today. Will probably reach 240+k net worth by August 15th which marks 1 year of attending paychecks. So overall, not a bad year so far.

Last edited:

- Joined

- Jun 30, 2019

- Messages

- 164

- Reaction score

- 287

July 1st is almost here, that will mark my first year as attending. Went from 200k in debt to debt free with a 185k net worth as of today. Will probably reach 240+k net worth by August 15th which marks 1 year of attending paychecks. So overall, not a bad year so far.

Don't be so modest. A 385k swing is probably one of the all-time best turn arounds for a 1st year attending. You must have taken the mantra "live below your means" to heart.

D

deleted547339

Time in the market.

- Joined

- Jul 27, 2011

- Messages

- 2,243

- Reaction score

- 2,914

Don't be so modest. A 385k swing is probably one of the all-time best turn arounds for a 1st year attending. You must have taken the mantra "live below your means" to heart.

Debt was 200k at peak which is end of pgy2 before moonlighting. But the net worth was never that low - maybe neg 160k at end of pgy2. Pgy3 saw decent swing in networth too. So the swing in networth is more like 350k and probably 50-70k of that was as pgy3 from moonlighting and also wife's residency income. So not as dramatic a swing as attending, but a decent swing.

Last edited:

- Joined

- Jul 27, 2011

- Messages

- 2,243

- Reaction score

- 2,914

Don't be so modest. A 385k swing is probably one of the all-time best turn arounds for a 1st year attending. You must have taken the mantra "live below your means" to heart.

It's honestly not hard to live below means with a doctor income.

Last edited:

- Joined

- Jan 2, 2013

- Messages

- 389

- Reaction score

- 319

I do understand the bullish sentiment, but I am actually more in agreement with @thegenius right now. I just pulled out all $100k of my 401(k) stock money when the market rebounded a couple weeks ago (still 100% equities in Roth and other retirement funds).

Primarily this is so it's protected as a possible 401(k) loan to buy a house free and clear in the next couple months. But I also fear we are currently picking up pennies in front of a steamroller and we just experienced a false bottom as we did in 1929; there were many more bottoms going forward in the early 1930s and the market never actually recovered for a decade or more. As I want to retire in 5-10 years, it's just too risky for me with all the bad stuff that's going on. I'll take TIPS and a mortgageless house at this point because I can't live in stocks.

Of course, I hope I'm wrong and the Fed can just keep pumping money into the market forever. I'd personally rather miss that than take the downside if there is another round of sheltering and layoffs and the stock bubble pops.

Good book I'm currently reading: Mandelbrot's The (mis)Behavior of Markets. Index funds are based on mathematical assumptions about the stock market that are just wrong. Doesn't mean they're worthless or I'm a stock picker instead, just that they're all correlated and thereis more risk involved than many appreciate over the long term. Kinda scary stuff. AFAICT it basically comes down to whether you agree with WCI that it's worth having faith in the American economy going forward or not. Personally I hope for the best but prepare for the worst.

Primarily this is so it's protected as a possible 401(k) loan to buy a house free and clear in the next couple months. But I also fear we are currently picking up pennies in front of a steamroller and we just experienced a false bottom as we did in 1929; there were many more bottoms going forward in the early 1930s and the market never actually recovered for a decade or more. As I want to retire in 5-10 years, it's just too risky for me with all the bad stuff that's going on. I'll take TIPS and a mortgageless house at this point because I can't live in stocks.

Of course, I hope I'm wrong and the Fed can just keep pumping money into the market forever. I'd personally rather miss that than take the downside if there is another round of sheltering and layoffs and the stock bubble pops.

Good book I'm currently reading: Mandelbrot's The (mis)Behavior of Markets. Index funds are based on mathematical assumptions about the stock market that are just wrong. Doesn't mean they're worthless or I'm a stock picker instead, just that they're all correlated and thereis more risk involved than many appreciate over the long term. Kinda scary stuff. AFAICT it basically comes down to whether you agree with WCI that it's worth having faith in the American economy going forward or not. Personally I hope for the best but prepare for the worst.

Last edited:

Not really a humble brag, just a brag, i went from -340k in student loan debt when I finished residency in 2017 to now debt free with net positive investment worth of over 700K today in 2020.

I shorted the market in my taxable account during the drop in March and then flipped around/went long stocks near the bottom. Unfortunately will likely pay a crapton in taxes on the profits.

In tax deferred accounts I swapped my 457b mutual fund sp500 for tech mutual fund when the pandemic started in late February which has paid off handsomely, while my HSA/IRA/Brokeragelink 401k went heavy leveraged long ETFs at the bottom.

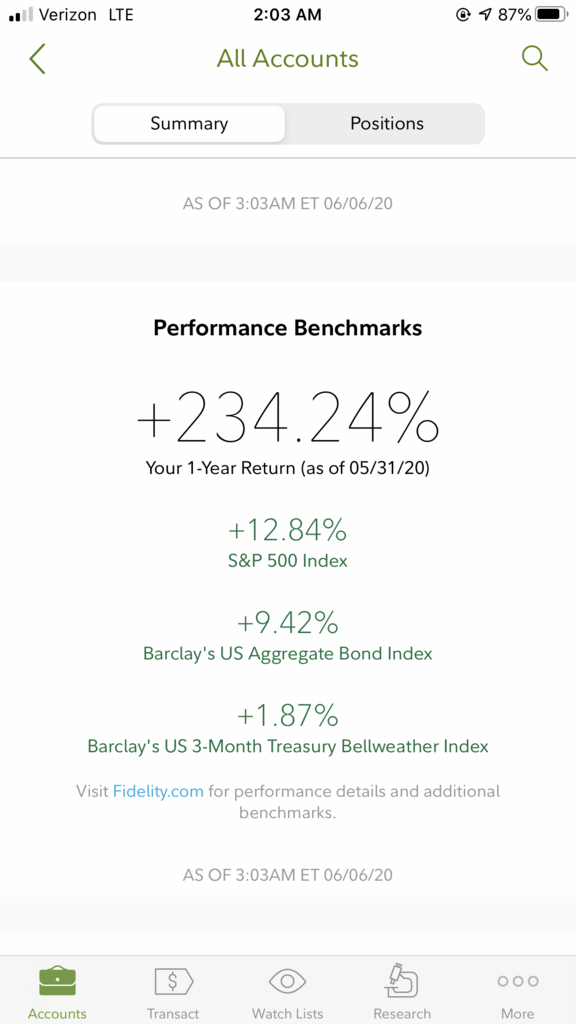

Here is my overall 1 yr return on my tax deferred accounts alone:

I shorted the market in my taxable account during the drop in March and then flipped around/went long stocks near the bottom. Unfortunately will likely pay a crapton in taxes on the profits.

In tax deferred accounts I swapped my 457b mutual fund sp500 for tech mutual fund when the pandemic started in late February which has paid off handsomely, while my HSA/IRA/Brokeragelink 401k went heavy leveraged long ETFs at the bottom.

Here is my overall 1 yr return on my tax deferred accounts alone:

Last edited:

- Joined

- Jul 27, 2011

- Messages

- 2,243

- Reaction score

- 2,914

Not really a humble brag, just a brag, i went from -340k in student loan debt when I finished residency in 2017 to now debt free with net positive investment worth of over 700K today in 2020.

I shorted the market in my taxable account during the drop in March and then flipped around/went long stocks near the bottom. Unfortunately will likely pay a crapton in taxes on the profits.

In tax deferred accounts I swapped my 457b mutual fund sp500 for tech mutual fund when the pandemic started in late February which has paid off handsomely, while my HSA/IRA/Brokeragelink 401k went heavy leveraged long ETFs at the bottom.

Here is my overall 1 yr return on my tax deferred accounts alone:

View attachment 309080

That is amazing. Congratulations. That definitely takes skill and some luck to pull off.

- Joined

- Jul 27, 2011

- Messages

- 2,243

- Reaction score

- 2,914

That’s just impressive. I wish I had gone with my gut to short the market. I was just too damn busy with this Covid crap to do it.

I had read too many books and embraced the boglehead way of investing wayyy to much to do anything exciting.

The most exciting thing i did was i got into oil and gas when oil was very low. It's doing really well now. I told myself i would remove the position once oil went back to 40-50 range per barrel.

Otherwise boring VTI, VXUS, BND is as impressive as my portfolio gets

- Joined

- Jul 12, 2004

- Messages

- 5,278

- Reaction score

- 4,969

I had read too many books and embraced the boglehead way of investing wayyy to much to do anything exciting.

The most exciting thing i did was i got into oil and gas when oil was very low. It's doing really well now. I told myself i would remove the position once oil went back to 40-50 range per barrel.

Otherwise boring VTI, VXUS, BND is as impressive as my portfolio gets

I have VTI too! And VBR, VEU, VWO, VCIT

all boring stuff. and in the long run will do better than pickers of the stock market. It's been shown repeatedly time after time after time.

It's the right way to invest. The longer you do that, the more likely you are to beat those who pick stocks for a living. Like 80% better. And you've spent your time doing other important things.

D

deleted547339

Ugh. Guys, please just go read Bogle’s books.

Not really a humble brag, just a brag, i went from -340k in student loan debt when I finished residency in 2017 to now debt free with net positive investment worth of over 700K today in 2020.

I shorted the market in my taxable account during the drop in March and then flipped around/went long stocks near the bottom. Unfortunately will likely pay a crapton in taxes on the profits.

In tax deferred accounts I swapped my 457b mutual fund sp500 for tech mutual fund when the pandemic started in late February which has paid off handsomely, while my HSA/IRA/Brokeragelink 401k went heavy leveraged long ETFs at the bottom.

Here is my overall 1 yr return on my tax deferred accounts alone:

View attachment 309080

You know, I was playing blackjack this one time and really feeling it. And I was standing on 15 and hitting on 18 and the dealer was busting and I was up like 1000%.

Keep playing.

You know, I was playing blackjack this one time and really feeling it. And I was standing on 15 and hitting on 18 and the dealer was busting and I was up like 1000%.

Keep playing.

For the vast majority of market timers and option ‘traders’ who strike it big once, they are typically just lucky gamblers. I do believe in my case, while luck is necessary to have capital at the moment market conditions become favorable to you, most of my gains are from ‘skill’. This is the culmination of years of knowledge I gained from daily watching the markets during residency and paper trading when I was broke back then.

I was already beating the bull market up to Feb 2020 from biotech stock picking since our MD degree actually gives an advantage in that area. When the markets started falling Feb 2020 it was pretty easy to go short with chunks of your portfolio in index puts- worst case if you were totally wrong you lose small percent of your portfolio. When the Fed announced full backstops on March 23, it was easy to decide that shorting was no longer worth the risk- don’t fight the Fed. Then when the markets crossed huge technical milestones past 50% retracement in early April while the rates of initial jobless claims had peaked, it was clear that the bull market was back on and the bottom was already in just by analyzing this kind of behavior from prior bear markets of >30% drop- so I went full longs by that point.

i’m not overleveraged and have plenty of hedges. Most of my gains in my taxable account now are from short puts on /ES that are very OTM - takes advantage of the relatively high VIX. My tax deferred accts I

keep 1/3 fully long in leveraged etf like UPRO, TNA, TQQQ etc and will dayttade the other 2/3 on up days like yesterday when the risk reward is obviously favorable. Also paying attnetion to sector rotation gives a great edge- I followed the trend of financials/industrials/small cap etc catching up relative to tech over the last weeks. European (thanks to more ECB pumping) and overly sold Brazilian market etfs also been great plays on the catch-up trade too

- Joined

- Dec 13, 2006

- Messages

- 1,773

- Reaction score

- 1,114

Dang I’m just trying to be rid of these loans this year.

For the vast majority of market timers and option ‘traders’ who strike it big once, they are typically just lucky gamblers. I do believe in my case, while luck is necessary to have capital at the moment market conditions become favorable to you, most of my gains are from ‘skill’. This is the culmination of years of knowledge I gained from daily watching the markets during residency and paper trading when I was broke back then.

I was already beating the bull market up to Feb 2020 from biotech stock picking since our MD degree actually gives an advantage in that area. When the markets started falling Feb 2020 it was pretty easy to go short with chunks of your portfolio in index puts- worst case if you were totally wrong you lose small percent of your portfolio. When the Fed announced full backstops on March 23, it was easy to decide that shorting was no longer worth the risk- don’t fight the Fed. Then when the markets crossed huge technical milestones past 50% retracement in early April while the rates of initial jobless claims had peaked, it was clear that the bull market was back on and the bottom was already in just by analyzing this kind of behavior from prior bear markets of >30% drop- so I went full longs by that point.

i’m not overleveraged and have plenty of hedges. Most of my gains in my taxable account now are from short puts on /ES that are very OTM - takes advantage of the relatively high VIX. My tax deferred accts I

keep 1/3 fully long in leveraged etf like UPRO, TNA, TQQQ etc and will dayttade the other 2/3 on up days like yesterday when the risk reward is obviously favorable. Also paying attnetion to sector rotation gives a great edge- I followed the trend of financials/industrials/small cap etc catching up relative to tech over the last weeks. European (thanks to more ECB pumping) and overly sold Brazilian market etfs also been great plays on the catch-up trade too

Like I said....

- Joined

- Sep 17, 2014

- Messages

- 773

- Reaction score

- 1,456

Don’t worry about missing out, another crash is coming soon. Stocks have continued to rise despite most companies losing money and record unemployment. This is an overcorrection.

Same. My portfolio is up 21% but got in late. Glad I bought airline, cruise, and energy. Healthcare stocks have been disappointing. Wish bought tech ETF.

Hope Trump wins, gotta watch polls closely, get ready for November

Hope Trump wins, gotta watch polls closely, get ready for November

D

deleted547339

For the vast majority of market timers and option ‘traders’ who strike it big once, they are typically just lucky gamblers. I do believe in my case, while luck is necessary to have capital at the moment market conditions become favorable to you, most of my gains are from ‘skill’. This is the culmination of years of knowledge I gained from daily watching the markets during residency and paper trading when I was broke back then.

I was already beating the bull market up to Feb 2020 from biotech stock picking since our MD degree actually gives an advantage in that area. When the markets started falling Feb 2020 it was pretty easy to go short with chunks of your portfolio in index puts- worst case if you were totally wrong you lose small percent of your portfolio. When the Fed announced full backstops on March 23, it was easy to decide that shorting was no longer worth the risk- don’t fight the Fed. Then when the markets crossed huge technical milestones past 50% retracement in early April while the rates of initial jobless claims had peaked, it was clear that the bull market was back on and the bottom was already in just by analyzing this kind of behavior from prior bear markets of >30% drop- so I went full longs by that point.

i’m not overleveraged and have plenty of hedges. Most of my gains in my taxable account now are from short puts on /ES that are very OTM - takes advantage of the relatively high VIX. My tax deferred accts I

keep 1/3 fully long in leveraged etf like UPRO, TNA, TQQQ etc and will dayttade the other 2/3 on up days like yesterday when the risk reward is obviously favorable. Also paying attnetion to sector rotation gives a great edge- I followed the trend of financials/industrials/small cap etc catching up relative to tech over the last weeks. European (thanks to more ECB pumping) and overly sold Brazilian market etfs also been great plays on the catch-up trade too

Dude.

- Joined

- Sep 9, 2015

- Messages

- 656

- Reaction score

- 616

And this is why I’ll be stuck in my 3 fund portfolio... have no idea what any of that means lol!!!For the vast majority of market timers and option ‘traders’ who strike it big once, they are typically just lucky gamblers. I do believe in my case, while luck is necessary to have capital at the moment market conditions become favorable to you, most of my gains are from ‘skill’. This is the culmination of years of knowledge I gained from daily watching the markets during residency and paper trading when I was broke back then.

I was already beating the bull market up to Feb 2020 from biotech stock picking since our MD degree actually gives an advantage in that area. When the markets started falling Feb 2020 it was pretty easy to go short with chunks of your portfolio in index puts- worst case if you were totally wrong you lose small percent of your portfolio. When the Fed announced full backstops on March 23, it was easy to decide that shorting was no longer worth the risk- don’t fight the Fed. Then when the markets crossed huge technical milestones past 50% retracement in early April while the rates of initial jobless claims had peaked, it was clear that the bull market was back on and the bottom was already in just by analyzing this kind of behavior from prior bear markets of >30% drop- so I went full longs by that point.

i’m not overleveraged and have plenty of hedges. Most of my gains in my taxable account now are from short puts on /ES that are very OTM - takes advantage of the relatively high VIX. My tax deferred accts I

keep 1/3 fully long in leveraged etf like UPRO, TNA, TQQQ etc and will dayttade the other 2/3 on up days like yesterday when the risk reward is obviously favorable. Also paying attnetion to sector rotation gives a great edge- I followed the trend of financials/industrials/small cap etc catching up relative to tech over the last weeks. European (thanks to more ECB pumping) and overly sold Brazilian market etfs also been great plays on the catch-up trade too

And this is why I’ll be stuck in my 3 fund portfolio... have no idea what any of that means lol!!!

It means that the second the market starts oscillating sideways he's going to get hosed on his triple leveraged, daily resetting funds (like TQQQ, which is 3x NASDAQ). Best of luck if it actually goes down. That's why TQQQ is still down 20% from it's high. SPXL (3x daily SP500) is still down 38% from its high.

It means that the second the market starts oscillating sideways he's going to get hosed on his triple leveraged, daily resetting funds (like TQQQ, which is 3x NASDAQ). Best of luck if it actually goes down. That's why TQQQ is still down 20% from it's high. SPXL (3x daily SP500) is still down 38% from its high.

This could be true if 100% of your portfolio was 'buy and hold' on triple leveraged ETF. That's why I only keep 33% in them to replicate index returns in the short term and only intraday trade the rest with leveraged ETFs. If a new 'crash' or big correction were to come I would dump the 33% long anyway; and still will come out far ahead of simple buy and hold VTSAX because I already have >240% gains to drawdown from.

In any case, if one had both the stupidity and the guts to hold TQQQ since inception, they would actually be up massively - from 1.74 starting price to 89.89 as of Friday. That's a 5166% return despite having been through giant corrections and March 2020 crash along the way.

D

deleted547339

This could be true if 100% of your portfolio was 'buy and hold' on triple leveraged ETF. That's why I only keep 33% in them to replicate index returns in the short term and only intraday trade the rest with leveraged ETFs. If a new 'crash' or big correction were to come I would dump the 33% long anyway; and still will come out far ahead of simple buy and hold VTSAX because I already have >240% gains to drawdown from.

In any case, if one had both the stupidity and the guts to hold TQQQ since inception, they would actually be up massively - from 1.74 starting price to 89.89 as of Friday. That's a 5166% return despite having been through giant corrections and March 2020 crash along the way.

If this is so easy and replicable, why isn’t everyone doing it?

D

deleted859535

If this is so easy and replicable, why isn’t everyone doing it?

My thought also.

If this is so easy and replicable, why isn’t everyone doing it?

Because it's stupid and it takes guts - most people can't stomach the volatility.

I would personally never do it as it only takes one black swan week to wipe out your entire account. If the markets somehow plummeted 33% in a week, as improbable as it may be, and you decided to hold 100% of your portfolio through it you would be decimated (33 x 3 = 99% loss).

As a short term trading vehicle for those who know what they're doing, TQQQ is great for their tax deferred accounts (since margin/options/futures isn't typically allowed )

One only has to look to the XIV volpocalypse that many traders/investors thought was a surefire thing until it suddenly wasn't. I watched that with great intensity back in 2018.

XIV trader: ‘I’ve lost $4 million, 3 years of work and other people’s money’

The VelocityShares Daily Inverse VIX Short Term ETN was created to give traders an opportunity to bet against a rise in volatility — the calmer the markets,...

- Joined

- Jan 5, 2007

- Messages

- 3,168

- Reaction score

- 12,356

Don’t worry. You’ll get your chance.

It wouldn't need to plummet 33% in a week, but 33% in a day as the triple leveraged funds reset daily. Of course that also means that if the baseline index dropped 8% in a day and then gained 2% each day over the next 4 days, you would still be down drastically.Because it's stupid and it takes guts - most people can't stomach the volatility.

I would personally never do it as it only takes one black swan week to wipe out your entire account. If the markets somehow plummeted 33% in a week, as improbable as it may be, and you decided to hold 100% of your portfolio through it you would be decimated (33 x 3 = 99% loss).

As a short term trading vehicle for those who know what they're doing, TQQQ is great for their tax deferred accounts (since margin/options/futures isn't typically allowed )

One only has to look to the XIV volpocalypse that many traders/investors thought was a surefire thing until it suddenly wasn't. I watched that with great intensity back in 2018.

XIV trader: ‘I’ve lost $4 million, 3 years of work and other people’s money’

The VelocityShares Daily Inverse VIX Short Term ETN was created to give traders an opportunity to bet against a rise in volatility — the calmer the markets,...www.marketwatch.com

Why Are Leveraged ETFs Like TQQQ Not for the Average Investor?

Discover why leveraged ETFs, such as the UltraPro QQQ (TQQQ), are designed to lose money over the long term, and discover who should consider buying them.

- Joined

- Jul 12, 2004

- Messages

- 5,278

- Reaction score

- 4,969

I don't understand any of this, and am happy making market returns every year. Because over a span of 15-20 years, I will do better than ~80% of other investors and will have a nice stable nest egg.

This other stuff is out of my league, and if people can make a lot (and congrats on making ~240% over 1 year!) this is anything but safe. It is very risky. If not I agree with those who would argue that fund investors would set up mutual funds to do this, charge 20% to investors, and give them 220% returns. Obviously that ain't happening.

I imagine the TQQQ thing is probably a very useful tool for highly volatile markets, as we've had over the past 4 months.

This other stuff is out of my league, and if people can make a lot (and congrats on making ~240% over 1 year!) this is anything but safe. It is very risky. If not I agree with those who would argue that fund investors would set up mutual funds to do this, charge 20% to investors, and give them 220% returns. Obviously that ain't happening.

I imagine the TQQQ thing is probably a very useful tool for highly volatile markets, as we've had over the past 4 months.

It wouldn't need to plummet 33% in a week, but 33% in a day as the triple leveraged funds reset daily. Of course that also means that if the baseline index dropped 8% in a day and then gained 2% each day over the next 4 days, you would still be down drastically.

Why Are Leveraged ETFs Like TQQQ Not for the Average Investor?

Discover why leveraged ETFs, such as the UltraPro QQQ (TQQQ), are designed to lose money over the long term, and discover who should consider buying them.www.thebalance.com

has to be over a week due to circuit breakers

I don't understand any of this, and am happy making market returns every year. Because over a span of 15-20 years, I will do better than ~80% of other investors and will have a nice stable nest egg.

This other stuff is out of my league, and if people can make a lot (and congrats on making ~240% over 1 year!) this is anything but safe. It is very risky. If not I agree with those who would argue that fund investors would set up mutual funds to do this, charge 20% to investors, and give them 220% returns. Obviously that ain't happening.

I imagine the TQQQ thing is probably a very useful tool for highly volatile markets, as we've had over the past 4 months.

You are correct most investors should not attempt anything but buy and hold. Only a minority have the necessary risk tolerance/emotional control to learn and be successful at beating the market consistently

D

deleted547339

You are correct most investors should not attempt anything but buy and hold. Only a minority have the necessary luck be successful at beating the market consistently

FTFY

D

deleted573262

It wouldn't need to plummet 33% in a week, but 33% in a day as the triple leveraged funds reset daily. Of course that also means that if the baseline index dropped 8% in a day and then gained 2% each day over the next 4 days, you would still be down drastically.

Why Are Leveraged ETFs Like TQQQ Not for the Average Investor?

Discover why leveraged ETFs, such as the UltraPro QQQ (TQQQ), are designed to lose money over the long term, and discover who should consider buying them.www.thebalance.com

There is no way for the stock market to drop more than 20 % in a single day. We saw level 1 circuit breakers (7 % decline) in march during coronavirus panic which triggered a 15 minute trading halt. If the stock market were to drop 20 % in one day, trade would be discontinued for the remainder of the day.

Leveraged ETFs were originaly constructed as intra-day trading (ie, betting) mechanisms for investment banks. Volatility decay and high expense ratios make these funds difficult to hold long term. Volatility decay readily seen in TQQQ 1 year returns, high ~118, today ~89 whereas QQQ 1 yr, high 239, today 239.

All the best.

FTFY

So the best poker players are simply just lucky?

- Joined

- Nov 24, 2002

- Messages

- 23,751

- Reaction score

- 12,082

Well, at its most basic, it's still what cards are dealt. No one is getting rich just folding his hole cards time and again. Just like poker, a lot of it is being in the right place, at the right time, which means that, the better one can recognize those right times, the better one does. However, the randomness is in there. To go back to poker, "you don't play the cards, you play the man", but, when the cards get flipped, if you are mismatched off suit, there's nothing, and, if you went to the end, it's what hand you have.So the best poker players are simply just lucky?

The point is, Phil Hellmuth and Daniel Negreaneau could math out what their hole cards could do much, much better then the average Joe, but, it's still random from that deal, and, evaluating those cards is like evaluating those stocks and funds. You gotta be in the right place at the right time. Who is it, the pain doc here on SDN, with the tag line, "All in at the wrong time"? That's where you don't want to be. I don't doubt that there were such massive gains (congrats!), but, the question is, is it replicable? Some people just **** on other people that post that they made a killing day trading, but, the question, again, is, is it replicable? If someone can do that, hell, throw the medicine RIGHT in the bin, and get rich, and, get out!!

("Bin" is British for "garbage can")

(I'm not British)

- Joined

- Mar 26, 2018

- Messages

- 1,365

- Reaction score

- 2,321

So the best poker players are simply just lucky?

Poker is relatively straightforward game with 52 cards. And yes, the best poker players usually win. They don’t always win. Sometimes, they lose big time. You know who does? The house.

If you are so good that you are consistently beating the market by hundreds of percent, then go off and be a fund manager for billions of other people’s money. I wish you luck in all your future endeavors.

- Joined

- Jul 27, 2011

- Messages

- 2,243

- Reaction score

- 2,914

You are correct most investors should not attempt anything but buy and hold. Only a minority have the necessary risk tolerance/emotional control to learn and be successful at beating the market consistently

Actually even the people who do this for a living cannot beat the market consistently. Hedge fund managers cannot beat the markets consistently. And I'm sure they have far more information available to them. There's always an element of luck involved.

So the best poker players are simply just lucky?

Nope, but they grind out a small edge while enduring massive short term swings. Same with professional blackjack players (if there is such a thing anymore).

How about you just post screenshots of your performance every month or so and prove your long term skill to us? Keep that rate of return up and your 700k should be over 8m in three short years.

- Joined

- Jul 12, 2004

- Messages

- 5,278

- Reaction score

- 4,969

So the best poker players are simply just lucky?

Well playing poker is different than investing in the stock market.

But if we were to just roll with the intent of your analogy...there are only very very very very very very very few poker players who can make hundreds of thousands, or millions, a year playing poker as a full time job.

It's a very rough life for 99% of professional poker players.

I don't think the poker players are doing the equivalent of investing in TQQQ and making 100% in a very short period of time. They grind out daily 6-10 hour poker sessions playing odds and making 2-4K/month, averaging out big gains on some days with big losses on other days.

Dude, @wamcp, I am in awe of your gains and I'm a jealous and I wish I was as good as you. I have nothing but praise for your accomplishments. Honestly if I had your skill I don't think I would work much longer and instead just invest and make money off that.

D

deleted547339

So the best poker players are simply just lucky?

No, but comparing poker to the stock market is like comparing chess to war, except the chess prices randomly explode when the wind blows the wrong way, the president tweets or the Korean boy-dictator kills another one of his family members. Also, your future depends on it.

You do you, but you’re flying in the face of a vast amount of data and displaying sophomoric traits.

- Joined

- Sep 19, 2004

- Messages

- 2,950

- Reaction score

- 3,277

Actually even the people who do this for a living cannot beat the market consistently. Hedge fund managers cannot beat the markets consistently. And I'm sure they have far more information available to them.

So much this. People don't think Warren Buffet has access to every damned bit of information about the companies he invests in, that most of us aren't privy to?

- Joined

- Jul 27, 2011

- Messages

- 2,243

- Reaction score

- 2,914

So much this. People don't think Warren Buffet has access to every damned bit of information about the companies he invests in, that most of us aren't privy to?

And yet while Brk beat the markets amazingly over time, but not really over the last 5 years. Just goes to show that even the best of investors sometimes cannot beat the market year after year.

- Joined

- May 8, 2007

- Messages

- 1,192

- Reaction score

- 147

Absolutely agree to this.So much this. People don't think Warren Buffet has access to every damned bit of information about the companies he invests in, that most of us aren't privy to?

Keep 10 percent of your portfolio cash; see a 20% dip spend 5%. See another 20%; spend the last 5%. When it goes up and you make money cash out to keep the 10 percent cash again. Rinse and repeat while invested for the long game. Cash is nice to have for these situations. .

- Joined

- May 8, 2007

- Messages

- 1,192

- Reaction score

- 147

You r/wallstreetbets don't you? I know you do! We all YOLO bro. Just remember, WSBGod was not real. He was the devil sent to lead us astray.So the best poker players are simply just lucky?

- Joined

- Dec 19, 2010

- Messages

- 10,254

- Reaction score

- 13,582

This can and will change, but I noticed yesterday the S&P 500 was no longer down year-to-date. It's even-steven, 0% gain or loss. That's not bad, considering 6 weeks ago we were in a near 40% drop and people were predicting Great Depression 2.0

- Joined

- Dec 13, 2006

- Messages

- 1,773

- Reaction score

- 1,114

You might as well just keep on investing in mutual funds regardless as long as you have the money. Trying to time the market is pointless time in the market is way better than timing the market.

I mean geez.

Fed going to have Zero%

interest rates forever

Fed is buying up all the junk corporate bonds

Fed is backing mortgages

Savings rates are going to be Zero% forever

Government is bailing out all the corporations

Government gave free money to everyone (except high income)

Inflation is going to be low

This can do nothing but juice the stock market. What else can absorb all this new money?

Fed going to have Zero%

interest rates forever

Fed is buying up all the junk corporate bonds

Fed is backing mortgages

Savings rates are going to be Zero% forever

Government is bailing out all the corporations

Government gave free money to everyone (except high income)

Inflation is going to be low

This can do nothing but juice the stock market. What else can absorb all this new money?