Second approach makes much more sense to me.

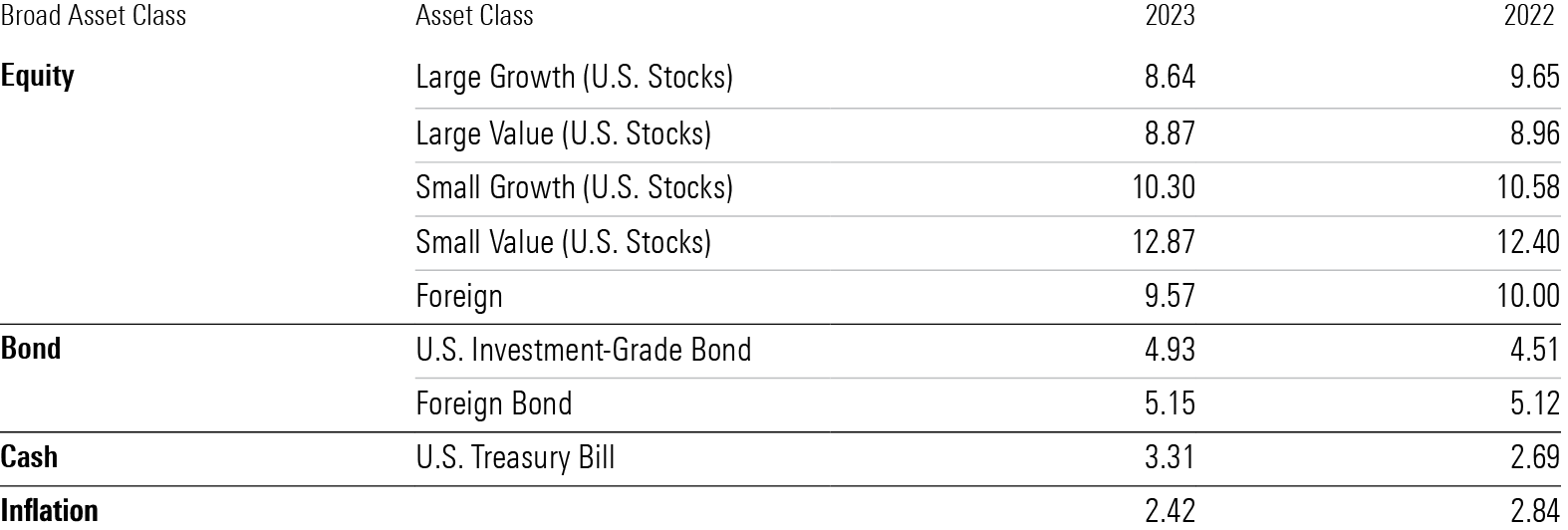

The first approach is the "dry powder" approach, where you save cash to invest during dips. The problem is the cash drags your portfolio returns down, probably more then buying the dip helps

Will a strategy of keeping "dry powder" or cash available to invest in a downturn increase your returns? Crunching the data to see if it can actually work.

www.whitecoatinvestor.com

The second approach is more in line with rebalancing your portfolio. If you're 80/20, and equities are down 10% and bonds are stable, now your're 72/20 and you want to sell bonds and buy equities to rebalance. You're not sitting on "dry powder" 80/20 was your planned portfolio.