Its hard to see CVS having TSLA potential. But potential is a scary thing until it's all hindsight. Investing 2 years of banking on TSLA's potential with no (or downhill) movement took a lot of patience when other stocks seem to be performing better, like you said. At that time, obviously no one knew TSLA was going to be a 2 bagger, a 10 bagger or end up a failure.I don't think any of the losers I sold have Tesla potential.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (stocks, bonds, real estate, retirement, just not gold)

- Thread starter BMBiology

- Start date

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

I'm very curious what you're going to be like during a legit crash if it ever happensI'm convinced there's no point in holding onto losing stocks. Why keep dead money when thousands of stocks gain 5-100%+ daily?

I held a bag of CVS for 5 years. Finally sold at a loss and put into NIO, never looked back.

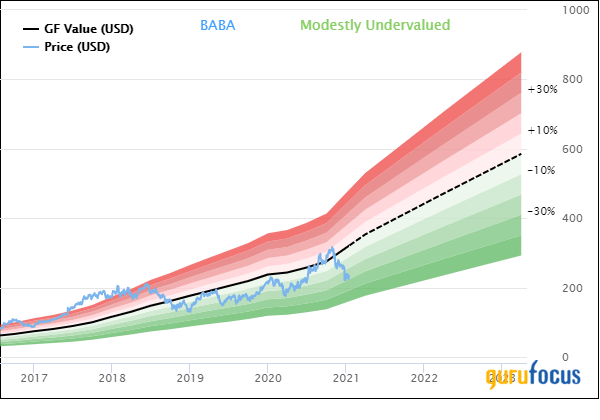

Sold BABA at a loss in the fall and put into PLTR.

Last week sold some bags of AESE, GIX, CETX, ATAC. Put into GEVO, ENG, ZOM and made way more.

Yesterday dumped EBON before it tanked more and put it into MARA. Already made up what I lost from EBON and expect to profit more in the long run.

My account went from 43k last week to 54k by making these moves, no money added. I posted all of my moves and account balance in the stock entry/exit thread if you want to see them. If I kept my losing stocks, the account would probably be around 43k or less.

Even with short term tax gains, I'm still way better off than if I held onto the bags.

Change my mind.

- Joined

- Nov 22, 2009

- Messages

- 7,948

- Reaction score

- 8,104

I'm very curious what you're going to be like during a legit crash if it ever happens

Probably panic sell while I'm still green like I did with NIO.

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

But will you buy something else?Probably panic sell while I'm still green like I did with NIO.

What if then that falls?

- Joined

- Nov 22, 2009

- Messages

- 7,948

- Reaction score

- 8,104

But will you buy something else?

What if then that falls?

Probably keep cash until signs of a recovery. Stay the course with retirement account.

- Joined

- Feb 27, 2016

- Messages

- 228

- Reaction score

- 113

This is the reason I take my winnings often and put them into the PSLDX.I'm very curious what you're going to be like during a legit crash if it ever happens

I suppose the answer is the same as it was last March: Stocks on discount buy more.

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

See that's not what you should be doingProbably keep cash until signs of a recovery. Stay the course with retirement account.

This isThis is the reason I take my winnings often and put them into the PSLDX.

I suppose the answer is the same as it was last March: Stocks on discount buy more.

But the problem is you're buying these way out of range valued stocks. Yes they are going to do great during bull runs but if you don't have the stomach to buy when it's down 25% you will miss out

When you buy your stocks are you buying because you agree with where they are going or because it looks like there's a big run coming?

If you like the stock, 25% should be a discount.

StockPharmD2020

Full Member

- Joined

- Nov 29, 2020

- Messages

- 454

- Reaction score

- 179

There is a difference between trading and investing. I don't think you understand he's trading not long term investing.See that's not what you should be doing

This is

But the problem is you're buying these way out of range valued stocks. Yes they are going to do great during bull runs but if you don't have the stomach to buy when it's down 25% you will miss out

When you buy your stocks are you buying because you agree with where they are going or because it looks like there's a big run coming?

If you like the stock, 25% should be a discount.

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

There is a difference between trading and investing. I don't think you understand he's trading not long term investing.

You haven't read my posts then.

He's trading a small account. Its easy to trade money you don't mind losing.

We all have our limit for how much we're willing to gamble. When you are checking your account out of fear instead of looking for your next stock you've reached your limit.

My limit was 200k, I picked my stocks and didn't worry at all. Could I have gone to 500k? Sure but there would have been times where we had healthy dips and my account would have been getting slaughtered and I'd be staring at it every minute of the day worrying

Last edited:

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

I think sometimes people read my posts and they think I'm telling them they're wrong.

That's not why I post, I'm just trying to keep people in check.

That's not why I post, I'm just trying to keep people in check.

- Joined

- Nov 22, 2009

- Messages

- 7,948

- Reaction score

- 8,104

See that's not what you should be doing

This is

But the problem is you're buying these way out of range valued stocks. Yes they are going to do great during bull runs but if you don't have the stomach to buy when it's down 25% you will miss out

When you buy your stocks are you buying because you agree with where they are going or because it looks like there's a big run coming?

If you like the stock, 25% should be a discount.

I bought ETH with you when it was down 25%.

The dilemma about selling during a crash is that the bottom is already priced in- the emotion of fear for a few months into the future is already reflected in the crashing price. Eventually, the point will come where the last seller will sell and it starts coming back and the valley has been missed. On occasion, people will time the best selling and bottom price well enough to even out capital gains tax but as a consistent strategy...I haven't seen sustained success. If someone has that skill (or luck)...they should probably consider a career change from pharmacy.

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

Probably the only time you'll see me in crypto at these prices. It was just too juicy to pass up.I bought ETH with you when it was down 25%.

owlegrad

Uncontrollable Sarcasm Machine

Staff member

Administrator

Volunteer Staff

Lifetime Donor

15+ Year Member

- Joined

- Mar 19, 2009

- Messages

- 25,314

- Reaction score

- 11,929

do you pay capital gains taxes on losses?Even with short term tax gains, I'm still way better off than if I held onto the bags.

Change my mind.

- Joined

- Jul 19, 2020

- Messages

- 230

- Reaction score

- 319

do you pay capital gains taxes on losses?

Your losses negates your profit for tax purpose. Going to be a pain in the ass putting in 200+ transactions for less than six figures profit. Not worth the squeeze imo

StockPharmD2020

Full Member

- Joined

- Nov 29, 2020

- Messages

- 454

- Reaction score

- 179

I took an account from 20k to 10k to 50k to 25k (March) back to 50k. Should be a lot more had I played March right. QYou haven't read my posts then.

He's trading a small account. Its easy to trade money you don't mind losing.

We all have our limit for how much we're willing to gamble. When you are checking your account out of fear instead of looking for your next stock you've reached your limit.

My limit was 200k, I picked my stocks and didn't worry at all. Could I have gone to 500k? Sure but there would have been times where we had healthy dips and my account would have been getting slaughtered and I'd be staring at it every minute of the day worrying

StockPharmD2020

Full Member

- Joined

- Nov 29, 2020

- Messages

- 454

- Reaction score

- 179

I'd also not throw more than a thousand in the types of plays he's making. I'd rather buy a decent stock and hold it than day trade.You haven't read my posts then.

He's trading a small account. Its easy to trade money you don't mind losing.

We all have our limit for how much we're willing to gamble. When you are checking your account out of fear instead of looking for your next stock you've reached your limit.

My limit was 200k, I picked my stocks and didn't worry at all. Could I have gone to 500k? Sure but there would have been times where we had healthy dips and my account would have been getting slaughtered and I'd be staring at it every minute of the day worrying

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

Low 5 figures, probably notYour losses negates your profit for tax purpose. Going to be a pain in the ass putting in 200+ transactions for less than six figures profit. Not worth the squeeze imo

I'd be willing to put in that much effort for $50k though

- Joined

- Nov 22, 2009

- Messages

- 7,948

- Reaction score

- 8,104

do you pay capital gains taxes on losses?

No I meant the profit from my green stocks is greater than the losses I took plus the taxes I'll have to pay.

Your losses negates your profit for tax purpose. Going to be a pain in the ass putting in 200+ transactions for less than six figures profit. Not worth the squeeze imo

I think TurboTax does this for you. I think I had less than 50 transactions last year.

- Joined

- Apr 10, 2018

- Messages

- 586

- Reaction score

- 187

You had to do it yesterday. It went down 6% yesterday and is already up 4% today. Just hold VAW until the stimulus stuff gets passed and student loans get cancelled.I will buy it if you want me to but we do already have cloudflare.

Ok I'll let you know when/if it hits so you can give me a different stock

- Joined

- Jul 19, 2020

- Messages

- 230

- Reaction score

- 319

Turbotax is not reliable when it comes to trading transactions. Trust me about this bc I had to manually type in my transaction back in my day trading days.No I meant the profit from my green stocks is greater than the losses I took plus the taxes I'll have to pay.

I think TurboTax does this for you. I think I had less than 50 transactions last year.

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

Its going to be hard for me to sell in the middle of the day when I'm at work.You had to do it yesterday. It went down 6% yesterday and is already up 4% today. Just hold VAW until the stimulus stuff gets passed and student loans get cancelled.

So I already sold vaw but I didn't buy dbx since I wanted your thoughts

Dropbox play right now is a buyout so I'll buy if you want and we can just hold until it hopefully happens

If it doesn't, I don't see much upside outside that.

Its up to you. Today would have bought in the morning and be up like 1% so not much has been lost out.

- Joined

- Jul 19, 2020

- Messages

- 230

- Reaction score

- 319

Moving all my 403 and 401 to government treasuries. Incoming dip is coming at some point soon.

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

How long are you staying out if we keep going up?Moving all my 403 and 401 to government treasuries. Incoming dip is coming at some point soon.

- Joined

- Nov 22, 2009

- Messages

- 7,948

- Reaction score

- 8,104

Moving all my 403 and 401 to government treasuries. Incoming dip is coming at some point soon.

Will this affect ETH? Was thinking of reloading today.

- Joined

- May 10, 2013

- Messages

- 197

- Reaction score

- 60

what's happened?Moving all my 403 and 401 to government treasuries. Incoming dip is coming at some point soon.

- Joined

- Jul 19, 2020

- Messages

- 230

- Reaction score

- 319

How long are you staying out if we keep going up?

I'm forced to be in these indices due to the nature of these vehicles. Maybe we have another 3-5% gen market up from here. Maybe not. Dip is coming imo with extreme taxes and regulation from Joe Biden. There may even be a 30d lockdown, that the general market hasn't priced in yet.

I'm looking to use my cash to buy individual stocks on this upcoming dip though. In a year, I just need to make 2-3 right moves in order to make my annual min 30% return. This is one of those things that I do normally.

JBLU is breaking out now.

Will this affect ETH? Was thinking of reloading today.

Nothing. Buy and buy more of BTC and ETH. Money printers are going warp speed regardless of the bs and propagandas. Until they show me their teeth, I'm not scared bc I know that these central bankers are nothing but bought frauds.

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

Basically what you are saying is: taxes>stimulusI'm forced to be in these indices due to the nature of these vehicles. Maybe we have another 3-5% gen market up from here. Maybe not. Dip is coming imo with extreme taxes and regulation from Joe Biden. There may even be a 30d lockdown, that the general market hasn't priced in yet.

I'm looking to use my cash to buy individual stocks on this upcoming dip though. In a year, I just need to make 2-3 right moves in order to make my annual min 30% return. This is one of those things that I do normally.

JBLU is breaking out now.

Nothing. Buy and buy more of BTC and ETH. Money printers are going warp speed regardless of the bs and propagandas. Until they show me their teeth, I'm not scared bc I know that these central bankers are nothing but bought frauds.

Not saying you're wrong, the narrative could very well turn to taxes but why not wait until that comes up?

Its not like it's going to be a sharp drop unless we do shut the country down completely

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

before the pandemic hit, i posted on this forum that the market has hit its high for the next 10 years.

if you scroll back, i had been warning of a massive tanking of the stock market on this forum starting in Oct 2019, just a few months before Covid reared its ugly head...

after seeing this massive run-up in stocks, i am reiterating my call that stocks have hit their ceiling for the next 10 years. the key is to pay full attention to the DOW index. i don't care that tech has made all-time highs. the DOW holds all the clues. it won't break all-time highs for the next 10 years. what's more, this is all gonna end with a bang 5-10 years from now. DOW 10k here we come!

there is a mathematical secret to this that i have unlocked

You have people like this guy who thinks he can look at charts and figure out where we're going.

No one knows. We're up 15% since before the pandemic and that makes no sense.

Heck I've been at 50% stocks for awhile now just because I want to retire soon. I've missed out on a lot too.

Just look at this guyhanging man close last friday. time to take profits

I don't think he was ever righti was buying into the end of month in november, i sold yesterday and on monday (some portion), and bought back more bearish positions today, and will continue to add to my positions tomorrow and for the rest of the month if markets continue to recover

- Joined

- Nov 22, 2009

- Messages

- 7,948

- Reaction score

- 8,104

You have people like this guy who thinks he can look at charts and figure out where we're going.

No one knows. We're up 15% since before the pandemic and that makes no sense.

Heck I've been at 50% stocks for awhile now just because I want to retire soon. I've missed out on a lot too.

Just look at this guy

I don't think he was ever right

Who this guy?

- Joined

- Jul 19, 2020

- Messages

- 230

- Reaction score

- 319

You have people like this guy who thinks he can look at charts and figure out where we're going.

No one knows. We're up 15% since before the pandemic and that makes no sense.

Heck I've been at 50% stocks for awhile now just because I want to retire soon. I've missed out on a lot too.

Just look at this guy

I don't think he was ever right

Yeah he’s wrong. It’s STONKs in the long run since things are priced in nominal USD and the fiat supply is going nowhere but up in the long run. Central bankers are pissed at how quick the mass is catching up to their game due to the free dissemination of info via the Internet.

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

You don't remember the chart guy who thought he always knew which way stocks were going?Who this guy?

He's probably broke at this point

owlegrad

Uncontrollable Sarcasm Machine

Staff member

Administrator

Volunteer Staff

Lifetime Donor

15+ Year Member

- Joined

- Mar 19, 2009

- Messages

- 25,314

- Reaction score

- 11,929

I was literally just thinking about chart guy.You don't remember the chart guy who thought he always knew which way stocks were going?

He's probably broke at this point

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

Just so it doesn't get buried @redfish955 you are currently in cash.

- Joined

- May 10, 2013

- Messages

- 197

- Reaction score

- 60

I sold SGMO as a loss. You can set a limit sell @ 16.30$

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

Good chance it will trigger soon.I sold SGMO as a loss. You can set a limit sell @ 16.30$

What would you like me to buy?

- Joined

- May 10, 2013

- Messages

- 197

- Reaction score

- 60

all in VLDR if you can get less than you paid previously. Average down

- Joined

- Apr 2, 2008

- Messages

- 4,191

- Reaction score

- 2,522

Alibaba Unveils New Electric Vehicle Partnership

China seeking competitors to Tesla

Tesla is gonna have a real challenge to compete with all 50 other EV companies in China, one of its biggest market. More companies looking to steal its pie.

Looking good for us consumers.

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

At this point everyone is making EV

Let’s let beam ride for now, I’m not sure if you set a sell order for 120 but cancel it if so.Good chance it will trigger soon.

What would you like me to buy?

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

Let’s let beam ride for now, I’m not sure if you set a sell order for 120 but cancel it if so.

Fine by me

- Joined

- Sep 15, 2008

- Messages

- 695

- Reaction score

- 498

Market has been insane. ENG decided to go on a 300% plus run since I posted here so I sold half at 7.50 and seeing if it can still reach 10.

BCRX, my pick for the the portfolio just had an excellent presentation at jpm. Take a look at the slide deck. Factor D, 9930, has the makings of a blockbuster drug. They are adding indicatons to study including different nepropathies. Orledayo won't report sales until may earnings so don't buy this thinking you will get rich overnight. this will be a slow burner. but I think it could be at least a 2x to 3x stock this year and 10x plus over the next 2 to 4 years. https://ir.biocryst.com/static-files/41ee0771-0acc-479e-a39e-2842101c6aa9

VXRT, oral covid vaccine is a company I added with cost basis of 5.70. It has already started running up because the phase 1 data is due by end of month. probably not too late yet. speculative buy of course. they are also working on an oral flu vaccine and the previous data on that leads me to believe phase 1 covid will have good results.

BCRX, my pick for the the portfolio just had an excellent presentation at jpm. Take a look at the slide deck. Factor D, 9930, has the makings of a blockbuster drug. They are adding indicatons to study including different nepropathies. Orledayo won't report sales until may earnings so don't buy this thinking you will get rich overnight. this will be a slow burner. but I think it could be at least a 2x to 3x stock this year and 10x plus over the next 2 to 4 years. https://ir.biocryst.com/static-files/41ee0771-0acc-479e-a39e-2842101c6aa9

VXRT, oral covid vaccine is a company I added with cost basis of 5.70. It has already started running up because the phase 1 data is due by end of month. probably not too late yet. speculative buy of course. they are also working on an oral flu vaccine and the previous data on that leads me to believe phase 1 covid will have good results.

- Joined

- Nov 22, 2009

- Messages

- 7,948

- Reaction score

- 8,104

Alibaba Unveils New Electric Vehicle Partnership

China seeking competitors to Teslafinance.yahoo.com

Tesla is gonna have a real challenge to compete with all 50 other EV companies in China, one of its biggest market. More companies looking to steal its pie.

Looking good for us consumers.

They had no trouble competing last year. Tesla dominated sales in China. Chinese are all about brand names.

- Joined

- Nov 22, 2009

- Messages

- 7,948

- Reaction score

- 8,104

Market has been insane. ENG decided to go on a 300% plus run since I posted here so I sold half at 7.50 and seeing if it can still reach 10.

BCRX, my pick for the the portfolio just had an excellent presentation at jpm. Take a look at the slide deck. Factor D, 9930, has the makings of a blockbuster drug. They are adding indicatons to study including different nepropathies. Orledayo won't report sales until may earnings so don't buy this thinking you will get rich overnight. this will be a slow burner. but I think it could be at least a 2x to 3x stock this year and 10x plus over the next 2 to 4 years. https://ir.biocryst.com/static-files/41ee0771-0acc-479e-a39e-2842101c6aa9

VXRT, oral covid vaccine is a company I added with cost basis of 5.70. It has already started running up because the phase 1 data is due by end of month. probably not too late yet. speculative buy of course. they are also working on an oral flu vaccine and the previous data on that leads me to believe phase 1 covid will have good results.

You're only keeping ENG until 10? I'm still buying in the 7s.

- Joined

- Sep 15, 2008

- Messages

- 695

- Reaction score

- 498

no I sold half. my principal is out so I am risk free now. want to let that part run wherever it may go now.You're only keeping ENG until 10? I'm still buying in the 7s.

- Joined

- Nov 22, 2009

- Messages

- 7,948

- Reaction score

- 8,104

no I sold half. my principal is out so I am risk free now. want to let that part run wherever it may go now.

Nice. Lots of people think this will be the stock of 2021.

- Joined

- Sep 17, 2014

- Messages

- 5,440

- Reaction score

- 2,923

StockPharmD2020

Full Member

- Joined

- Nov 29, 2020

- Messages

- 454

- Reaction score

- 179

What is eng?Nice. Lots of people think this will be the stock of 2021.

- Joined

- May 10, 2013

- Messages

- 197

- Reaction score

- 60

- Joined

- Nov 22, 2009

- Messages

- 7,948

- Reaction score

- 8,104

What is eng?

It's down 8%, good day to enter.

Similar threads

- Replies

- 17

- Views

- 2K