- Joined

- Feb 26, 2003

- Messages

- 8,860

- Reaction score

- 3,420

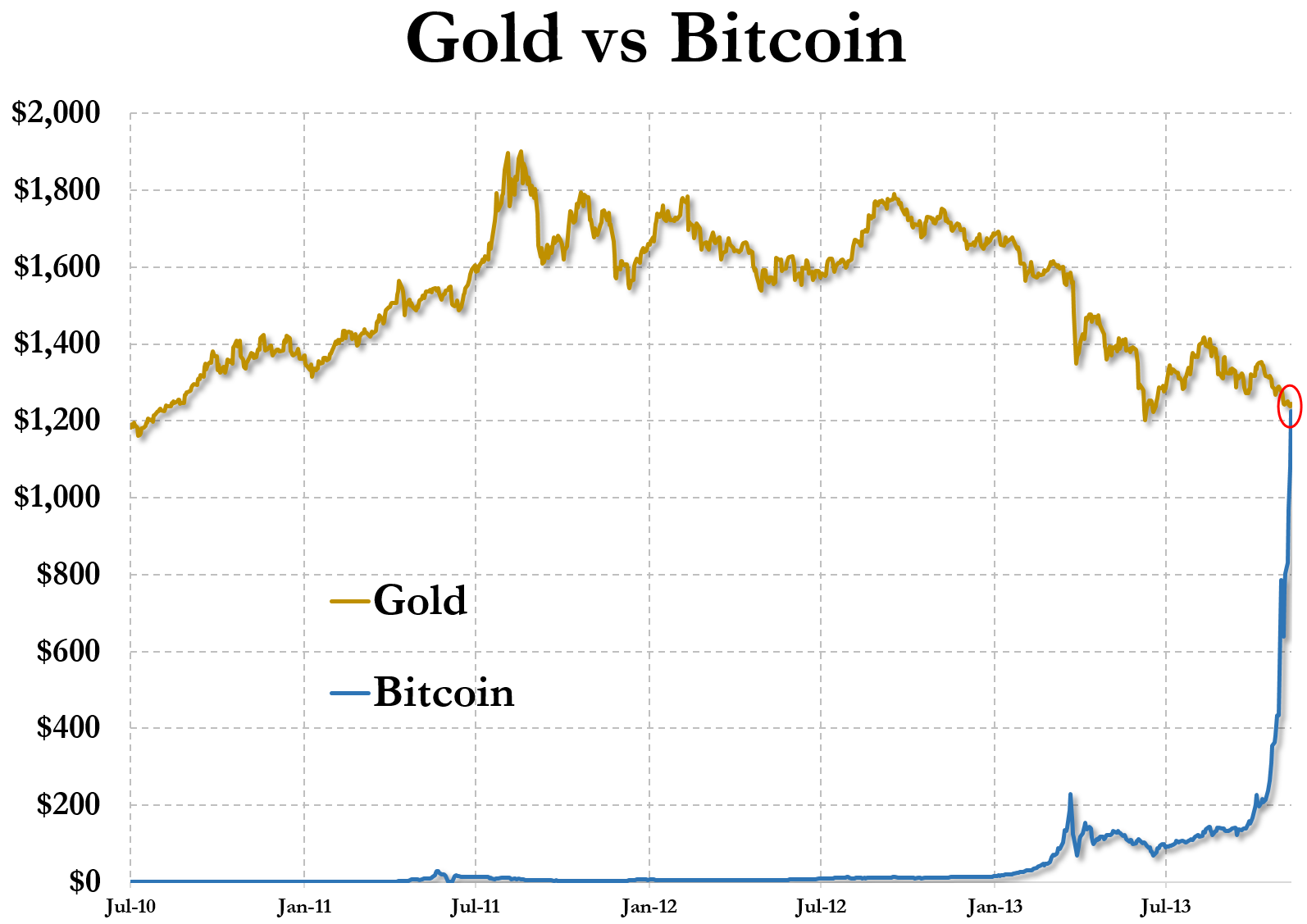

In order for you to be successful at speculation, you need to be right two times: (1) when you to buy and (2) when you to sell.

What if the market dropped 10%, are you going to buy? What if it dropped another 10%? Are you going to sell? Remember in order for you to "buy", someone must "sell" so if the other guy sells, then he's betting that the price will drop. Who's going to be right? What knowledge do you have that he doesn't have?

What if the market dropped 10%, are you going to buy? What if it dropped another 10%? Are you going to sell? Remember in order for you to "buy", someone must "sell" so if the other guy sells, then he's betting that the price will drop. Who's going to be right? What knowledge do you have that he doesn't have?