- Joined

- Sep 18, 2017

- Messages

- 201

- Reaction score

- 305

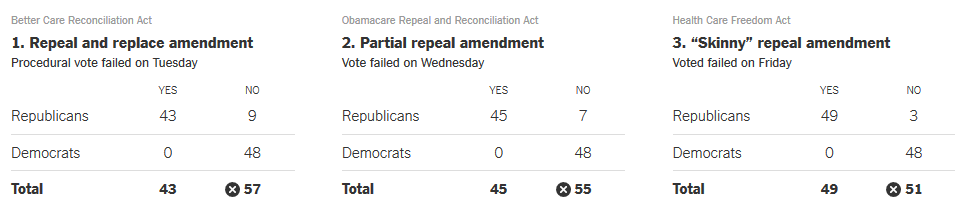

"Skinny" repeal was rightly called so because it only sought to repeal some provisions (and even then it failed.) This is what I meant by using the word "altogether," because as you know the "altogether" repeal of the act failed by more than one vote.Repealing the federal income tax is politically impossible. Undoing social security benefits is politically impossible. Skinny repeal of ACA was one vote shy of being extremely possible. To the point of reality, really. Your bar for "impossible" must be pretty low.

Absolutely, and my argument was never 100% public option or bust. I think that the incentive of the public option being favorable is good and entails a larger public share, but I don't say I want the public share to be as big as possible in that it removes private options by legislation, only in that, as is the case elsewhere, the public favors it overwhelmingly over adding an additional private choice.So your argument is 100% public option or bust? Reducing the share of the private sector reduces its bargaining power in a graded fashion just like any other market. Just because you take 33% of the market power away and split it up among a lot of smaller companies doesn't mean that that 67% market power under a single public option goes poof. As I say below, as long as you're arguing for a public option that competes with private options in the market and let the pieces fall where they may, I would accept any allocation that results from that - whether it's 99% public or 50%. The question is, would you?

I know you put this later in your post, but I'm clumping the answer alongside the one below this one so I don't repeat myself too much.And why can those countries pay less? Because we're the cash cow here for pharma. We effectively subsidize the rest of the world's drugs. Take that away and who eats the cost? You seem to be under the impression that you can just take some money away and no one will have to bear the cost. Who bears the cost? The pharma companies. What do they do to bear the costs? Invest less. It's not rocket science here. Just basic accounting. Other countries can pay less now because we pay more. And when that goes, not only is pharma revenue and investment going to drop, they're also going to have to charge other countries higher prices. I wonder what will happen to the costs in other countries then.

Smaller companies taking risks are a finite resource as well, which is why, as opposed to a halt in R&D countries with much smaller populations, those countries continue to invest, and, to quote a 2010 study :It's not a deduction, it's from experience working in and with pharma. Throughout my PhD in chemistry, I worked with pharma companies and saw a lot of what goes on behind the scenes in their marketing and R&D schemes. A big pharma company isn't going to cut marketing just because you stop paying them as much for their drugs. They're going to cut R&D and shift risk to smaller companies by buying up drugs that the smaller companies develop first. Small companies may not have the marketing divisions or market power to bring their drug all the way to market and so they sell out to the bigger companies. This is happening today at a faster and faster rate. It's how the world works. So no, R&D isn't necessary to have exclusive rights to some product. Not if they can acquire it from a smaller company, which is what they're doing now to a large extent.

"Pharmaceutical innovation is an international enterprise. Although the United States is an important contributor to pharmaceutical innovation, we found that more than 20 countries contributed to the development of the 288 NMEs with patents at the time of approval. More than 171 companies were involved in the development of these NMEs, and the vast majority of companies were multinationals with facilities located in more than 2 countries. We also found that the United Kingdom, Switzerland, Belgium, and a few other countries innovated proportionally more than their contribution to the global GDP or prescription drug spending, whereas Japan, Spain, Australia, and Italy innovated less.

In contrast with the United States, all other countries investigated had instituted at least 1 form of drug pricing regulation.Critics of drug price regulation argue that free market pricing strategies and higher prices in the United States are instrumental to innovation.20,21 One might therefore expect the United States to be the most innovative given that it is the only country with a predominantly unregulated pharmaceutical market. However, US pharmaceutical innovation appeared to be roughly proportional to its national wealth and prescription drug spending. Our data suggest that the United States is important but not disproportionate in its contribution to pharmaceutical innovation. Interestingly, some countries with direct price control, profit control, or reference drug pricing appeared to innovate proportionally more than their contribution to the global GDP or prescription drug spending."

I hate to have an article make my argument for me because it's a bit lazy, but it conveys that the United States isn't "bearing the burden" for everyone else's price-controlling practices to be viable, as you seem to suggest. I think you'd be pressed to argue that pharmaceutical industries abroad subsist by cannibalizing smaller companies and have done so for the last few decades.

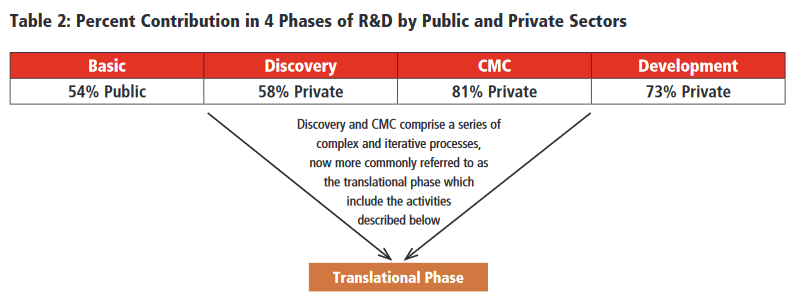

This was neither my contention nor yours, if 60% of NIH funding goes into useful therapeutic use, given about $67 billion in private "biopharmaceutical" research spending that clocks at about a fifth of all R&D spending, which is not a small fraction or a small cost. I never suggested it was the majority.Most of the costly parts of R&D are born out by pharma companies, not by NIH-funded research. Even if I grant you that 60% of NIH funding goes on to produce a useful therapeutic for human use, that's far outshadowed by the billions that pharma companies sink into developing even just one drug (Innovation in the pharmaceutical industry: New estimates of R&D costs - ScienceDirect). That amount of NIH funding is equivalent to developing 7 or 8 drugs a year (and that data is old, not taking into account the even higher costs needed to develop biologics and precision medicine nowadays). And that's a generous estimate for the NIH since a lot of NIH funding ends up in projects that further human knowledge but do not end up being used to benefit humans clinically.

As we've discussed before, there seems to be discrepancy in how we use "single-payer," which I thought was clearer since we are talking about the United Kingdom and Spain, neither of which bars private competition. Though I'd be too arrogant to put a single number of what I find is reasonable, the United Kingdom clocks at a healthy 10.5% of citizens having private insurance as of 2015—I don't think under 20% is a serious bargaining ability loss, but any number I give relies on data that we simply do not have (for every increasing % market participation of private sector, how much does the incentive of pharmaceutical and technology companies to negotiate with the government for public inclusion change?) I can however, reasonably guess that there is a negative correlation in there.Save us both the time by being clear with what you're supporting. First you argue for "single-payer" systems and now you believe that some private competition is okay? How much? You think that 33% market share is too high. Give me a number at which that share would be acceptable to you.

I'm arguing for a system where, as in the United Kingdom, the single-payer system isn't something you opt out of but something you can add private insurance to. I'm glad we're finally clear on that. These posts are getting too long.I understand your point. But realize that you are not arguing for a single payer system or even very much of a two-tiered system. What you're arguing for is a public option with a set benefit schedule that competes with private options equally in the market. And let the pieces fall where they may. If 99% of people elect to take up the public option and only that, then that means that 99% of people believe that the public option is sufficient to meet their goals. If this is the case, then I have no quarrel with that. As long as the private option exists and people have the right to freely choose to purchase private coverage (even if everyone contributes to the public option).

If everyone contributes to the public option, I don't think there would be a need to set "premiums," as systems like the NHS receive their funding directly from general taxation, i.e. they're not going on the market and setting price levels rather than everyone pays for it and whoever so chooses can go ahead and add private insurance (sometimes, provided optionally through an employer or a professional union)My only concern in that case would be what premiums the public option would set - I would agree only if they were actuarially fair or very close to it.