Do we really want to get into a discussion about whether the majority of our current representative bodies is actually accountable to reason? Everywhere I look, it's becoming more draconian. Thank goodness they were one vote away from sending us back into the stone age where high-risk pools would have become even more real. These are the people you trust to determine what to pay for and what not to pay for? You're digging your own grave.

I'm digging no such grave, we can argue this through heuristics of how bad government is or point to the fact that removing ACA altogether was as politically impossible as it is politically impossible for parties in the U.K., Spain, etc. to do these theoretical draconian policies.

Options =/= strong competition. I think we all understand that. If the private "option" is junk or very limited in terms of options, then that's not true competition. A strong private sector exists if, say, I want coverage for drug A just in case I ever came down with disease A but since it's $1 million a year, the public option won't cover it. If I can find a private insurer that will offer me such a plan at actuarially-fair price (with a reasonable load), then that's a strong private sector. If there's not a strong private sector, then I won't be able to get that option. Perhaps there's enough crowd out of the private sector by the public option that there aren't enough people to do adequate risk pooling.

But for the sake of discussion, let's put an arbitrary number on it. Let's say for discussion's sake that the private market has no less than a 33% share of the insurance market (that is, everybody contributes to the public option but those who want to can find and buy extra coverage for what they want - this represents 33% of the total pool).

As I explained earlier, reducing the share of the public sector reduces its bargaining power. As for the choice point, I will address it at the end with your last paragraph for the purpose of brevity.

I agree that marketing and administration costs can be cut. But you're assuming that if revenue declines for a pharma company, they cut marketing and administration first before digging into R&D. That's usually not the case. R&D goes first - that's why so many big companies now have M&A departments instead of R&D. It's easier for them to shift risk onto smaller companies - and those companies don't have the marketing budget to cut.

Refer to

my earlier graph on research. Much smaller countries than our own with public insurance schemes and much reasonable prices contribute their proportional share of R&D. Though this is more solid evidence than any deduction on the behavior of pharma you or I can come up with, I would guess that it is because the incentive for R&D (larger dividends in the future) doesn't disappear when you stop making absurd profit margins for your products. And because R&D is still necessary to have exclusive rights to sell your pharmaceutical products, given that patents eventually do expire.

Slightly off topic, but sorry to break it to you - the NIH doesn't need $30 billion/year to carry out its mission. It funds a lot of junk research that isn't ever actually used to improve human health and there are many many better things to do with that money (subsidizing insurance for the poor, for example). They need to either get their funding cut or somehow become much more efficient with how they make funding allocations.

Though I would welcome it, I have no data to speak of NIH's research funding breakthrough/junk ratio relative to private. My point was that a significant portion of the R&D funding goes through the taxpayer indeed.

Now argue why a single-payer system or one in which the private sector occupies a much smaller share than 33% of the market is better.

See point #2 for why I don't think having a smaller share of the market allocated to public sector is "better." I also never argued about additional private options being bad, it looks like you're trying to pin me to that position for ease of arguing. Save your energy.

The problem isn't that a huge market can't force the seller to reconsider. That point was well established when the idea of a monopsony was invented. The problem is that the forced lowering of that price causes what economists like to call a deadweight loss and seller must eat that. As I have argued above, the first things to go aren't marketing and advertising but R&D. R&D will become less lucrative for big and small companies alike - and you're going to have less innovation.

See my point above, with the linked graph. Trying to shorten these responses.

If the cuts could somehow affect only marketing and advertising, you might be able to get away with it but this market doesn't respond in that way. Even if your drug works super well, nobody is going to know about it if you're not talking about it at the latest meeting of specialists in your field or giving samples to providers to let them try it out.

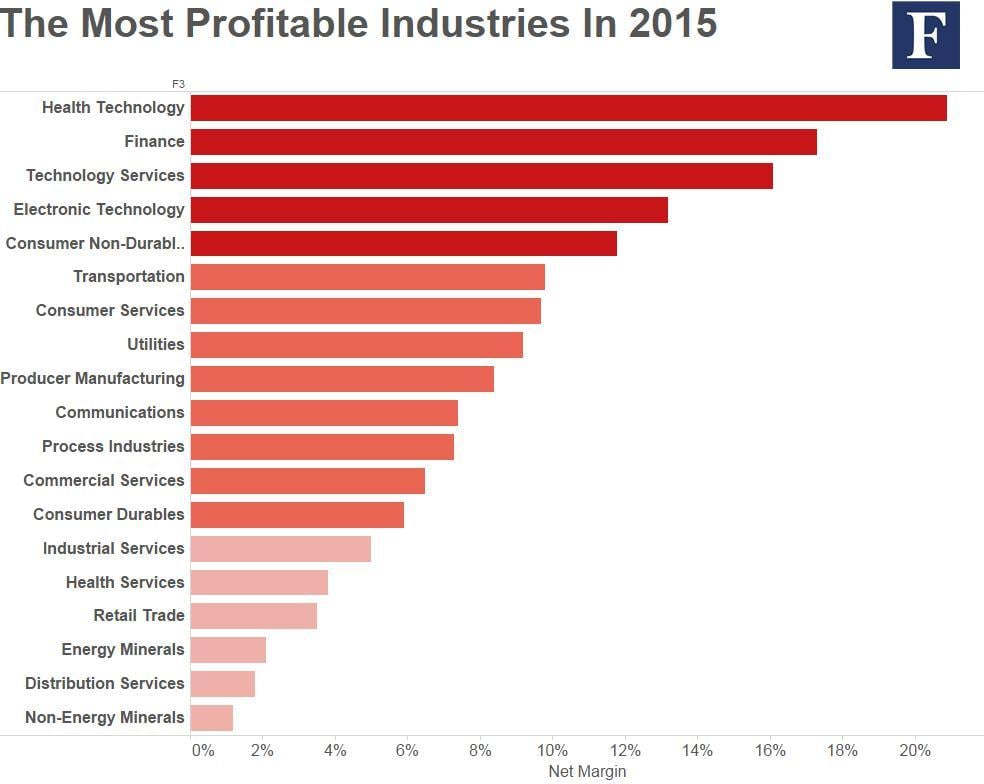

Except, again, this is not the case at all in countries with overwhelmingly public insurance health schemes. They're paying a fraction of what we do for the same medications, and don't for that reason have their doctors advertised less towards. Their incentive to keep making returns doesn't go away because their profit margins are suddenly proportional with those of almost every other industry

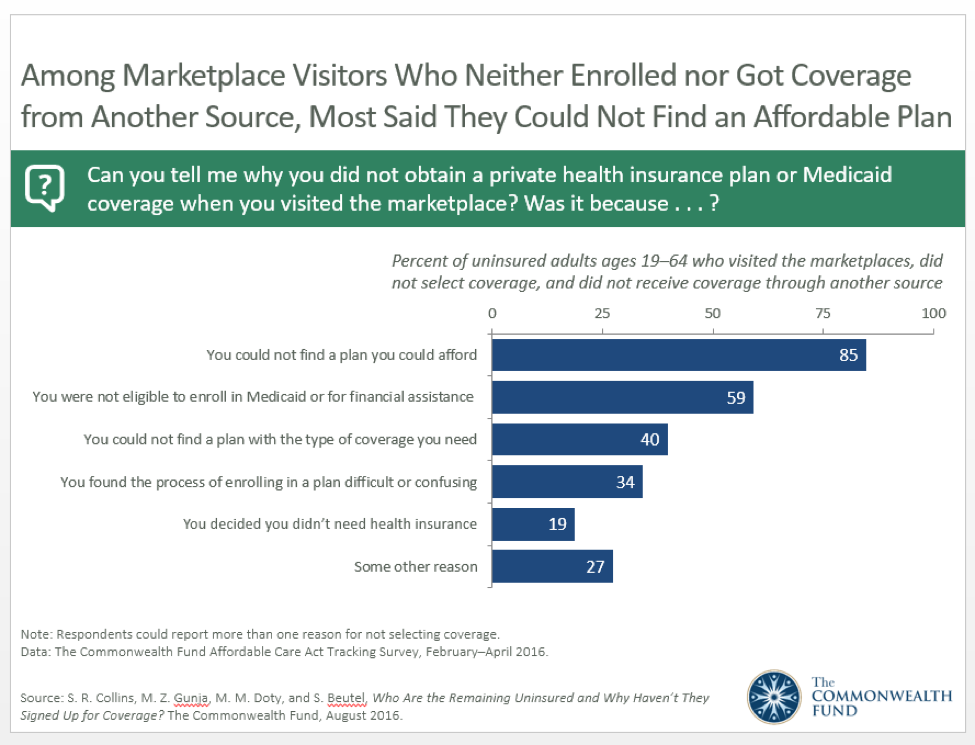

Having a tiny market share means that risk pooling is not as effective (law of large numbers and regression to the mean and all) and so insurers must take on more uncertainty, which is then reflected in premiums. It's not a matter of an expensive risk pool - expensive risk pools are expensive now not because people want more things to be covered but rather because they come in with a pre-existing expensive condition. If I wanted coverage for a $1 million/year treatment and my chance of actually getting said disease was 1%, then the actuarially fair premium would be $10,000 per year. But if I have that condition and then want coverage for it, then the actuarially fair premium would be $1 million/year - it's just pre-paid healthcare at that point. That's the key difference. Expensive pools now are expensive due to the latter and so-called "high-risk pools" which are really "lots of sick people" pools rather than the former. The point is, if I want more expensive coverage for a condition I don't have yet but might come down with in the future, I should be able to purchase it at a reasonable (actuarially-fair plus some load) price if the public option doesn't cover it.

I understand what risk pools are, but thank you. It seems like the collective "let's give everyone favorable risk pools" in this instance is overshadowing the "let's give everyone the ability to choose their care." But this relates to my last point too, so let me respond after this last quote.

You lost me at coercion. Nobody "opts" into a private system. By definition, the private system is one that naturally occurs in a society where free markets rule. Even if being in a private system is a force of coercion, I'm not suggesting that we as a society need to stick with the private-only sector. I'm saying, as I have been since the beginning, that I am firmly against any single-payer system. Again, a single-payer system is a system where, surprisingly, there is only a single payer. I'm also against any system that has such weak private competition as to make it effectively a single-payer system. If the government has decided that it will pay $50,000 per QALY and no more and I believe that my life is worth $100,000 per QALY, why shouldn't I be able to take out a policy for the remainder?

Your reasoning appears to go "public system is something" ergo "no public system is default."

The "defaultness" here is not relevant, we're discussing two different sets of policies because both can be instituted (i.e. we can have a private system without so many of the burdens of our own and we can have a single-payer or two-tiered system, call it what you may.) Because of that, we have to ask what in a system that is public but which offers private options (like those in aforementioned countries) makes the competition weak. These are countries in which, again, the public burden of healthcare is lower, meaning that they should if anything have more of the income designated for health spending to set aside for private insurance. Yet, as you probably are aware, 33% of the health insurance market share in the United Kingdom doesn't belong to private insurers.

If a theoretical Brit has the real option to enter into a private insurance that covers medications that the NHS won't, but, most likely does not, what is keeping him or her out of that risk pool? It doesn't appear to be t

he exorbitant cost of the private option. Now, this person in the majority has the option to continue using the NHS or live in a private system that may cost him more (

and the citizens of the UK overwhelmingly don't want to get rid of their NHS)—if we were to institute such a private system, would his transition into his less desired choice be

coercing?

And if such a system has the merit on its own of more favorable risk pools for those seeking alternative treatment options, are those individuals which in countries with public health insurance (who we can assume would also exist in a homologous system in the United States, else 33% private market would never become an issue) not also having their agency and, in your words, "self-determination" curbed for the sake of, instead of their country, the other members of their alternative higher-cost-drug-paying risk pool? It seems like your reasoning of prioritizing this self agency is selective to you and those who would, private or public insurance aside, choose to enter into that pool regardless of system. If those were or are numerous enough in America to cushion expensive risk pools, then we're discussing a non-issue because nobody wants to make private insurance illegal and those risk pools would populate themselves. If they are not and we need a limited public system so that people are sufficiently incentivized to go into the private alternative, are we not taking those people's right to a favorable choice away as well? And in the process hurting the public risk pool (see my point after your second quote) for the sake of the alternative?

This is a very wordy way to stress my earlier point that, in a system with a public default option, the private alternatives exist and occupy a market share consistent with public options. If they aren't more competitive, it is not because of the law but because their target public prefers the public alternative, which is as much a reflection on agency and self-determination as the choice of someone who

doesn't like the public alternative.

Edit: typed first point, meant to say second