10-12% return on investment...

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Where is Dave Ramsey getting these kind of returns?

- Thread starter Splenda88

- Start date

- Joined

- Apr 10, 2018

- Messages

- 586

- Reaction score

- 187

10-12% return on investment...

He described berkshire hathaway to a T. It has increased 20 fold over the last 20 years and has not performed all that well the last 5 years.

- Joined

- May 30, 2010

- Messages

- 2,165

- Reaction score

- 2,063

We've been 10+ year bull market, so there's going to be a correction.

Eh, maybe. It's sort of like the Yellowstone Volcano. We have been "due" for an eruption for a long time -- doesn't necessarily mean it will happen. The DJI could break 40k before any sort of meaningful correction for all we know.

I don't agree with your statement, but anything is possible.

Eh, maybe. It's sort of like the Yellowstone Volcano. We have been "due" for an eruption for a long time -- doesn't necessarily mean it will happen. The DJI could break 40k before any sort of meaningful correction for all we know.

- Joined

- Nov 6, 2003

- Messages

- 44,860

- Reaction score

- 30,569

Investing isn't really Dave Ramsey's forte. I think his strong suit is basic financial literacy and behavioral modification to stop spending addiction and to live frugally while applying his debt snowball (smallest balance gets priority) even if it's not the "best" way mathematically. IMO he's decent for small business and entrepreneurial leadership advice.10-12% return on investment...

There's quite a few discussions around the web on his 12% unicorn return. He's got a brand to sell I guess.

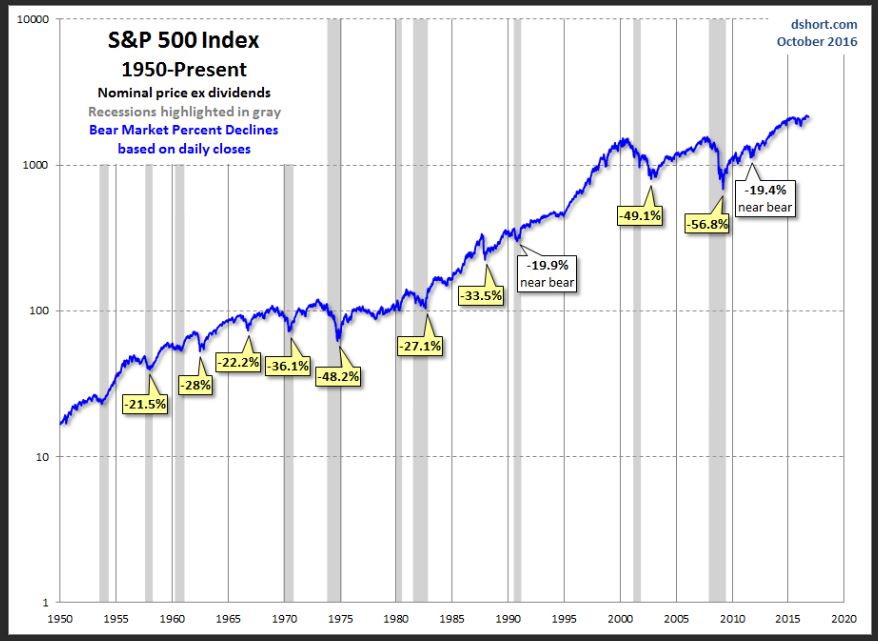

Dave was born in 1960. If he started his investing at age 19 (1979), the S&P cagr since then is approximately 12% with a mean annual return of 13%. There have been ups and downs, but that's basically been the market return for the previous 40 years.

Now that isn't inflation adjusted and it's probably not likely to continue for the next 40 years at that same rate, but during Dave's investing lifetime a 12-13% annual return has basically been "average".

Now that isn't inflation adjusted and it's probably not likely to continue for the next 40 years at that same rate, but during Dave's investing lifetime a 12-13% annual return has basically been "average".

- Joined

- Nov 5, 2011

- Messages

- 4,963

- Reaction score

- 2,959

Dave was born in 1960. If he started his investing at age 19 (1979), the S&P cagr since then is approximately 12% with a mean annual return of 13%. There have been ups and downs, but that's basically been the market return for the previous 40 years.

Now that isn't inflation adjusted and it's probably not likely to continue for the next 40 years at that same rate, but during Dave's investing lifetime a 12-13% annual return has basically been "average".

hey mind sharing where you see those numbers? I’ve been looking at various s&p index funds and the historical average seems to be ~7%

hey mind sharing where you see those numbers? I’ve been looking at various s&p index funds and the historical average seems to be ~7%

sure that is a "long term" average, but there are periods above and below that. It just happens that 1979-2019 is way above that with the large bull runs of the 80s, 90s, and 2010s cooked into it. Also I believe the 7% return historically is after inflation adjustment, so before inflation it would be closer to 10% per year.

This calculator from MoneyChimp let's you plug in whatever start and end year you want and can show either nominal or inflation adjusted real returns.

You can also just look at this chart from MacroTrends and simply see the open, close, highs, and lows for each year.

Similar threads

D

- Replies

- 130

- Views

- 7K

- Replies

- 4

- Views

- 173

D

- Replies

- 7

- Views

- 2K

- Replies

- 26

- Views

- 3K