I don't even know why I'm responding anymore, because it's clear to me that either your reading comprehension of my posts is poor or you're just cherry-picking statements and changing contexts. Since I've got some downtime, why not feed the troll though.

Back at ya. Let me know when you have actually contributed anything useful to the anesthesia subforum before you start slinging accusations about who's trolling here.

No, Tobin tax is still a crap idea. We can agree to disagree on this one because I don't feel like arguing in circles here.

Whatever you say. I'm not necessarily down with a tobin tax at the percentages Bernie has suggested (0.5% of the total value of a stock transaction), but if you don't think it's a good idea to tax high frequency traders and other investment firms which honestly provide no real economic productivity, but rather just skim of hundreds of millions off of a bunch of 2 millisecond transactions, I don't know what to tell you.

You're taking my medicare and SS comments out of context. I'll clarify further (again) since you've continued to make assumptions about my statements which are false. I never said I don't mind medicare because people pay into it. I said I'm not opposed to a universal system or welfare programs. I believe a certain level of safety net is, unfortunately, necessary to help those incapable of providing for themselves through no fault of their own in order to survive. I never said anything about approving of them because people pay into them. Period. My statements aren't inconsistent, only the assumptions you're making about them.

Additionally, SS is a broken system in it's current state. When it was implemented in 1935 the average lifespan of an individual was ~61 and today it's ~76. The average number of years people lived past 65 (for those who made it to 65) has increased from ~12 years in 1935 (see first link from SSA) to ~20.5 years in 2017 (see second link from OECD). So the average person will collect 8.5 more years of social security today than in 1935 when the policy was enacted, but we haven't changed the age at which someone can apply for full benefits at all. At some point that will have to be adjusted and many people will have to deal with the consequences. It sucks, but that's reality. Also, what are your thoughts on changing benefits based on income level?

Social Security History

Health status - Life expectancy at 65 - OECD Data

Anyone honestly reading your posts in a vacuum would absolutely come to the conclusion that yes, you are opposed to a universal system or welfare programs. If you want to talk about how much you hate most aspects of social programs and then state that you still think they're necessary, I guess that's your prerogative. It does pique my curiosity as to where your vote comes down in regard to supporting these kind of programs when choosing people/policies at the ballot box.

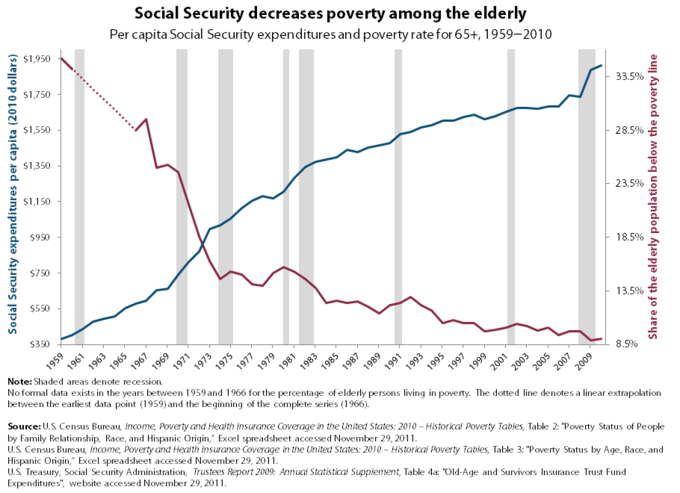

As far as SS, it's only

broken in any capacity because of where payroll taxes are marginally capped. If high wage earners and those who make multimillions from capital gains actually had to contribute a fair share to FICA, it would be a different story. In regard to life expectancy, it's pretty damn disingenuous to use OECD data.

Life expectancy in the United States is 78.6 years, which is a lot less than the 20.5 years past 65yo that you just tried to claim. What's worse, life expectancy is very closely correlated (or causal, even) with poverty.

The gap between life expectancy between the richest and poorest American men is 14 years. I stand by my statement that a blanket raise of the SS age punishes the neediest among us.

Have you ever worked in a VA or been treated in one? Do you know the metrics by which those survey results are measured? Have you ever seen a "5 star" VA hospital as rated by patients? I can say yes to all and have become completely appalled by the deception within the VA system. I have literally seen people die at VA hospitals because of inefficiencies in the system or blatant lack of essential resources (how a hospital doesn't have trach/intubation equipment readily available or in the hospital at all still baffles me). I've seen co-workers break down because their patients suffered unnecessarily and family members threaten to sue over cases they would very likely win at a community or academic hospital be told by administration "good luck suing the federal government" (once in those exact words). I've worked in 3 different VA hospitals and seen major issues which should not exist in all of them. I have family who have worked in 2-3 other VA hospitals/clinics and they've said the same things. So yes, I will say that the VA system is a disaster because I've seen it first hand at multiple institutions. Before med school I actually wanted to work for the VA so I could work with veterans (almost accepted an HPSP scholarship). 5 years later after working in the system, that has changed significantly.

Completely agree with your point about the VA system not receiving the (right) attention it needs. However, I'm pessimistic that more attention would do much as the few major changes made to try and improve the system have essentially just been adding more metrics (which have previously been shown in evidence-based research to not improve outcomes). End rant/

I rotated at a VA back home when I was a medical student and I am staff at a university hospital which is directly across the street from a VA- a VA which my former classmates and another old colleague are anesthesia staff at. Their VA hospital is pretty new so they have access to more equipment than I could ever dream of since our department budget is not that great. That being said, the VA does have a significant amount of dysfunction in that numerous surgical specialties and critical care are not at the point they need to be at since opening and god only knows what's causing the delay at this point.

I absolutely believe that the VAs you've personally seen or that your family have seen have had that kind of dysfunction. Your experience, even though it sounds awful, unfortunately is still anecdotal when you consider there are 170 VA medical centers and another thousand outpatient sites. Similarly, my experience that the VAs I've seen have been about on par in terms of care compared to other hospitals is purely anecdotal to you. Do surveys and their methodology usually suck? They sure do. How about outcomes then?

When comparing mortality and readmission rates for VA vs non-VA in 7900 men with acute MI, HF, and PNA:

"The researchers found that mortality rates were lower in VA hospitals than non-VA hospitals for AMI (13.5 percent vs 13.7 percent) and HF (11.4 percent vs 11.9 percent), but higher for pneumonia (12.6 percent vs 12.2 percent). Hospital readmission rates were higher in VA hospitals for all 3 conditions (AMI, 17.8 percent vs 17.2 percent; HF, 24.7 percent vs 23.5 percent,; pneumonia, 19.4 percent vs 18.7 percent). In within-MSA comparisons, VA hospitals had lower mortality rates for AMI (percentage-point difference, -0.22) and HF (-0.63), and mortality rates for pneumonia were not significantly different (-0.03); however, VA hospitals had higher readmission rates for AMI (0.62), HF (0.97), or pneumonia (0.66)."

Feel free to also peruse

this one ,

this one, and

this one.

Did you actually read my post? Did you miss the part where I said " For now I'm forced to because I'm a resident" in regards to accepting CMS funding? So yes, oh wise one, I actually do know exactly what I'm talking about in terms of how CMS funding works and that fact that I'm currently accepting it (and it does not make me happy).

I'm psychiatry, not gas. So it would be extremely easy in the current climate for me to open up a shop that doesn't accept medicare/caid tomorrow and fill my practice pretty easily. Heck, I could open up a cash only practice in my city tomorrow and have a full patient panel in under 6 months without much excess effort. A plethora of reimbursement models is a (small) part of why I chose my field. Because if worse comes to worst with our healthcare system I can still give the gov the finger and open a PP very easily and still sleep easy knowing I'm providing a desperately needed service to patients in need.

No one is

forcing you to do anything, chief. No one made you go to med school, pick a residency that treats medicare/caid, or accept the CMS gravy that allows us to all finish training. You are

choosing to do all those things. But I guess now that you (almost) got yours, good luck with your purely cash endeavor.

Me though, I just did a case today- thoracoabdominal aneurysm repair with a questionable surgeon on a 50yo incarcerated lady who had every comorbidity under the sun including a previous TEVAR. Likely stratified as super high mortality preop. Of course, entire operation paid for completely by the taxpayers. Was pretty hairy at times, but the patient did great, and my resident had an excellent learning experience since these cases don't come along often at my shop. When I think about the case and your last post, just remember, you're not only giving the finger to the govt when you turn these kind of patients away.

Also, unrelatedly, "gas" is more of an internally used term around here and its use is actively discouraged in situations like med students saying they're applying to "gas." It would be like me saying that you are a pen & notebook resident or a zoloft resident.

So while I do agree with you that Lighthizer is certainly more knowledgeable and this likely won't make a huge difference, Trump was still technically not wrong (which is a phrase that I don't enjoy saying).

Okay, thanks for confirming that you're only arguing about this topic so you can reach the pinnacle of pedantry.