How did you choose your expiry dates for these positions. Personal preference? A specific risk calculation on your end?

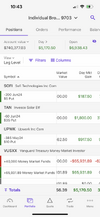

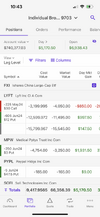

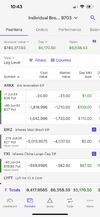

Current portfolio is attached. I’m going to go over rationality of each position.

ARKK - 60 June contracts $37 strike

In an ideal world my strike would be around $35-36. In fact, it was $36 2 days ago, those positions were all closed then when it was a very positive day for arkk. And today, arkk started the day negative, so i went ahead and sold a few positions at $37 strike.

$35 is around the 1 year low point. But the premium for those positions within a 90 day time period is just not worth it. $37 is low enough where i feel very comfortable, i know i can drop strike over time if absolutely needed in that $35 range of 52 week low, while still getting decent premium.

1820 premium received for 40k worth of buying power = 4.5% return in 3 months. 18 percent annualized.

Not bad for 26% downside protection. The 45-60 day contracts just didn't have enough juice at the desired mid 30s strike.

EWZ - 275 contracts $27 strike for june

27 strike I feel pretty good about because in the event EWZ comes close to it, I can drop strike, increase positions, while increasing time. $$25-26 the ETF has bounced basically 4 times in the last 5 years. The only time it has gone below that $25 number was the pandemic low - Unlikely stocks are going back to pandemic lows. 27 strike in 86 days means that even if price comes down into the upper 20s in a month or so (unlikely to happen over night), then I can continue to roll down and out the strike and eventually come out successful. Last year I made 200k on EWZ when I went big when price went down into the 27-28 range - Same concept. Worst case scenario - Price drops to 28-29 range, I drop strike, go long, increase position sizes, concentrate portfolio, and go down to a very safe strike like $23 or $24 (pandemic lows) and essentially collect more premium (Exact playbook that was done the last 2 years that eventually made me hundreds of thousands of dollars - 200k in 2023 alone). Main point is - $27 is low enough that I can manage the position easily and drop the strike a few dollars over time to even pandemic lows if needed.

EWZ is fundamentally great and I expect it to do well over time.

Received 5000 premium (275 contracts) for this ~112000 buying power used. = 4.46% return in 3 months. 18% annualized.

Again - needed 90 days to have meaningful return at this $27 strike that I consider as safe.

FXI 45 contracts $19.85 strike for June

Starter position. Only 45 contracts. If price drops more, I'll drop strike and add more positions aggressively. FXI Has not been below $20 in the last 18 or so years. The last time it was at that level was when the ETF started around 2006. It has bounced and gotten close to 20, but not below it for any significant time. Sounds like a safe bet.

Received $600 in premium (45 contracts) for 13500 buying power. 4.4% return. 18% annualized.

I've actually tried increasing this position multiple times, but the bid ask spread on FXI is always brutal. Even with a huge move in my benefit, bid ask spread has historically been painful so I've never had huge position sizes.

LYFT - 605 June Put $12 strike contracts AND 225 $30 May Call contracts

If you look at the chart for Lyft - Feb 13th it closes around $12. Earnings come out -> Boom -> 18-19 -> Consolidates -> Next round up -> 20+ -> Next round of consolidation to today at 19.48.

$12 seems like a safe number given that this is where lyft was before a blockbuster earnings -> revenue beat, EPS beat + Solid forward guidance + improving margins by 50 bps and increasing total number of rides. Plus it is now solidly profitable with continued expected profitability.

So unlikely it will go back below $12 before the next earnings given the positive momentum of growth and profitability. Today there was a significantly negative day

605 contracts got me $12600 in premium.

This is only half the equation. This is one of those positions where I'm playing a strangle (Sold naked put and naked call) and not just a naked put. For those unaware - A sold naked put does well if stock goes up and makes your strike unlikely to happen. A sold naked call goes up when a stock goes down making your strike unlikely to happen.

I've also sold 225 naked calls for $30 strike - May expiration.

So while I believe Lyft is going to go up (where a naked call becomes negative) - I don't think it will go up all the way to 30 (another 53% rise in 1.5 months - especially since it's come up from $12).

Together - both positions mitigate each other. Negative days - The call is positive. Positive day - The put is positive. The put position size is much larger because I do think the stock is going to go up. The call expiration is only 50 days instead of 3 months because while I dont think it will hit 30 in 50 days, I absolutely think it is going back into the 30s given enough time.

This naked call got me $3200 premium.

Together I got $15800 premium for 170K worth of buying power = 9.3% return in 3 months. 37% annualized.

MPW - 250 contracts June $3 strike

$3 strike. I held $3 strikes when the price went as low as $2.92. Even after it went back above 3, it repeatedly tested $3.1 MULTIPLE times - almost 2-3 times a week for a couple of weeks. Each time, there was tremendous buying support at $3.1. So I feel pretty good about $3 especially now that the dust is settling - Short interest going down, steward assets being bought by united, steward solvency issues more or less almost resolved, all capital transactions repeatedly confirmed the underlying real estate value again and again.

Received $4750 for these 250 contracts and used about 60k in buying power. 8% return in 3 months. 32% annualized roughly.

This is a VERY VERY small position size now that MPW has gone up significantly. When it was around $3-$3.5 - I had 800 contracts for $3 strike, 400 contracts for $2.5 and 400 contracts for $2 strike. I literally had 1600 contracts on MPW when it was right around $3 - Hence I'm up 41k YTD on this from all those positions. Every time MPW dropped, I rolled, increased position size, and went bigger because I believed the fundamentals and believed a recovery was around the corner - Was negative 20k in January on MPW in 2024. Now +41k in March post recovery.

Position size is small - if another dip happens - Will go big again.

Pypl - 5 contracts June $47.5 strike

Only 5 contracts. Starter position. Extremely safe. The last time PYPL was $47 was in 2017 when revenues, earnings and assets were not even close to what they are today - Had a much larger position when it was in the 50s - but now it's a smaller position since profits were taken once it went up.

received $185 premium (5 contracts) - 3700 buying power - 5% return in 3 months. 20% annualized.

I just psychologically like being below $50 on Pypl strikes.

SOFI - 200 June contracts $5 strike

It's hovered around 5 for a very small amount of time in the last 5 years and has not meaningfully gone below it and has seen a lot of buying support at those levels. Plus now there's positive momentum and profitability - so unlikely to go there again and if it does, it should meet a lot of buying interest at those levels. $5 is a very safe bet and obviously allows for strike to be dropped over time in the worst case possible. I'll talk more about sofi in my next post in response to valienteffort

Received 2735 premium (200 contracts) for 50k buying power - 5.5% return in 3 months. 22% annualized.

TAN - 60 June contracts $35 strike

It's an ETF - I dont know much about it. It's a small position so it seems safe lol. Haven't looked much into it. Just know that Enphase is the largest holding and it has a technological advantage over other solar companies. It hasn't been below $40 since 2020 so $35 strike seems safe. Plus only 60 contracts. In the grand scheme, very small position size compared to some other big plays.

Received 4700 and used 75k of buying power. 6.2% return in 3 months. 25% annualized.

UPWK - 385 contracts May $10 strike

This is a little bit of a greedy play and has occasionally made me nervous. In fact, I did decrease position size on this previously when it broke below $12 and went down to 350 contracts. Once it went back up, I increased position size again.

The premium is very juicy. Received 10900 for 1.5 months expiration while using 90k of buying power - 12.1% return in 1.5 months. 96% annualized return.

Revenues are going up, margins are expanding, earnings were actually pretty good, in fact most analysts have increased their price target after the last earnings report. The revenue growth has been decent. The company is now solidly profitable. Last two quarter reports were fairly good. And the first really good quarterly report 2 reports ago - price was $10. So in my mind $10 is going to be a very solid support level.

They also significantly increased their "Take rate" which is the percentage they are able to extract through all transactions taking place through their marketplace. Just last year their take rate was 14-15% and now they are in the 17% range. They did so by increasing costs, and also by adding "advertisement revenue" where contractors can "boost" their job application etc. The only problem is that the total number of buyers is growing very slowly (single digit growth). And the total GMV (Gross merchandise value) - essentially all the money flowing through their platform from people hiring contractors has only shown very small growth - 4% y/y for 2023 vs 2022.

So while their GMV is only modestly growing - but they've gotten better at squeezing the juice, improving margins, reducing costs (significant reduction in advertisement and administrative costs in 2023 compared to 2022), and essentially charging a higher take rate resulting in increasing revenues. So the revenues and income still grew double digits so I'm optimistic that it's not going back down to $10.

I also firmly believe in the space - Hiring cheap contract labor around the world is SO SO SO damn easy through upwork. It's the leader in the space - NOT FIVERR. They have an enterprise solutions arm that is showing double digit growth - I mean...on paper companies should want to export easy tasks internationally. Upwk makes that really easy. I've personally hired multiple people for SEO work, website development, FB marketing through upwork.

But yeah..Great cash on cash returns. Worth the risk especially with growing margins, growing revenue, growing income, increasing analyst price targets, and earnings that have been beating forecasts for the last few times.