Currently trading the following:

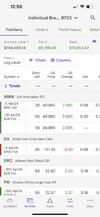

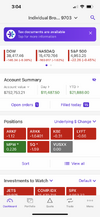

ARCH, GOOG, HCI, META, MOD, MPC, MSFT, NVDA, VIST, ANF, APP, CLS, GRBK, MHO, POWL, SMCI, STRL, TMUS, VST

1mo performance is 5.3%, 3mo is 15.5%. I had some losses during 4th quarter of '23 and part of that was that I didn't have good stop losses placed and I'd have decent performance but one or two stocks would lose 10% over 2 days or something like that and I wouldn't notice and would exit the position too late. I'm definitely tech heavy going into '24. I need to exit most of my energy positions as it's evident that sector is not doing well lately but bias is a difficult thing to overcome. Most active sectors for '24 so far are XLK (4.8%), XLV (2.1%), XLC (6.9%), XLF (2.8%) Technology, Healthcare, Communication, Financial respectively.

Am currently updating my SeekingAlpha screeners and making lists specific for the most active sectors to see if I can find any other potentials. I use ChatGPT to parse the data into something I can easily cut and paste into TradingView and for some odd reason when I try to parse the screener data it always gives me a warning about "terrorist organizations" and I have to correct it and remind it that it's simply a list of tickers, not a terrorist organization. I asked it which ticker is making it think there is a terrorist organization and it plays coy and gives me the following:

"I apologize for any confusion. I don't think it's a terrorist organization, and there's no specific symbol or keyword that's making me think that. My responses are generated based on patterns in the text data I've been trained on, and I do not have the ability to make value judgments or assumptions. If there was any misunderstanding or miscommunication, it was unintentional. If you have any further questions or requests, please feel free to ask, and I'll be happy to assist you."

I probably have more SeekingAlpha Alpha picks in my portfolio than I usually do but have been following their picks more closely over the past 6 months. I'm kind of impressed by the portfolio performance. They are up 86% since July '22 compared to SPY 29%. I only take positions in the ones that have bullish ichimoku criteria. POWL is an exception but I've been holding that one for a long time and it's a fairly small position.