I am pretty much your friend when it comes to this.

I've been following your posts, how-tos, and explanations and threw $40k into an account to see if I could even understand the basics of options and it just didn't go well at all. And I like to think I have a good understanding of protecting against downside risk.

I don't think I'm an idiot (I had no problem with vector calculus and differential equations back in college) but this stuff didn't stick.

It took a lot of "market tuition" to realize this... even with what seemed to be low-risk positions.

I do think you have a gift if you're able to do this and continuously beat the market

Here’s what I’ve learned in my years as an options trader and where i think people go wrong.

People are scared of Margin, they are scared of leverage aka naked puts. It’s almost impossible to beat spy with cash covered positions - it’s a risk reducing strategy - lower risk lower reward.

But naked puts are one of the best deals in trading - you leverage, but for free. There’s no interest on the leverage - you just have to be careful and not be stupid to blow up your account.

So…. Once you accept that leverage is your friend. Then the next thing to realize is that you need to use leverage as a tool to decrease risk. Odd statement right? I mean how can leverage decrease risk? But…. Leverage let’s you have strike prices that are so so so far out that they are so unlikely, so it’s usually a winning bet with very low probability of failure, while still getting very meaningful return.

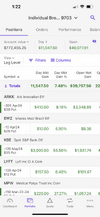

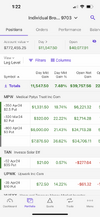

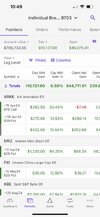

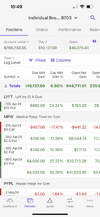

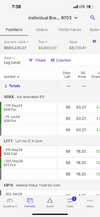

With that in mind - let’s look at one of my larger holdings:

Lyft

325 put contracts sold for $13 strike, june expiration (3 months), $28 per contract premium received.

If this was cash covered - that’s $28/(1300-28) = 2.2% return in 3 months. Todays price $20.28, so about a 36 percent downside protection before you’re in the money.

But 2.2 percent return in 3 months = 8.8 percent annualized. I mean…. It’s okay. But not the greatest return ever.

Now if your account was approved for naked puts. You only need $250 minus premium = $250 - $28 = $222. Now all of a sudden your return is $28/222 in 3 months = 12.6%. So….12.6% in 3 months with 36 percent downside protection.

similarly i have 150 $12 strike positions too. $18 premium per contract - $18/232 = 7.7 percent in 3 months. That’s a 40 percent downside protection compared to todays price.

Those two positions are about 12k in premium. Not bad right?

Now here’s the other side of the equation why i feel $13 and $12 are decent strike positions.

If you look at the chart - lyft was at $12 ish before earnings. They beat earnings on both revenue, and bottom line, and increased their total number of rides and on top of that forecast improving margins moving forward. And continued profitability - they were a company losing money, but they’ve transitioned to positive cash flow and income and improving margins - all great news. Market reacted happily - stock goes to $17 overnight on the good news of earnings. And it’s continued it’s positive momentum since, increasing wildly over the last 3-4 weeks - hitting 20 today.

Now $12 is the price before all this positive news. There’s going to be A lot buying support anywhere near those levels (i mean over night it went to 17 because $12 was too cheap for the positive growth). Plus all the moving averages are now being pulled up above $12, which will all be solid support levels.

So it’s what i think a solid risk adjusted return. Yes my larger position is $13 strike and not $12, but i can always roll and move it down and decrease my return if absolutely needed. Still positive return none the less.

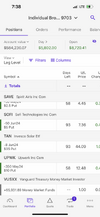

And that’s the kind of thought process that’s going into my trades - same thought process for upwk, mpw, pypl. And then the rest of the portfolio is puts on etfs like ewz, arkk, fxi, tan.

Edit:

Now the fear mongers will say that 325 contracts for $13 strike is a maximum loss of $422k. But realistically - things don’t go to 0. There is Inherent value in the lyft brand, their revenue, their income, their growth, them being a household name. Their ipo opening day price was $78 - so $13 is a bargain price. It’s a point at which a trader can maneuver around, prolong expirations, drop strikes and eventually make it work through recovery in the event of a 35-40 or even 50 percent drop. Like mpw dropped from $8 to $3, as a trader, i still worked it out by managing positions. The underlying fact of the matter remains - the financials are solid, lyft isn’t going bust. So while people freak out at the theoretic maximum loss - but it shouldn’t go to $0 when it has 4-5 billion in revenue, growing margins and growing income.

See the theory?