- Joined

- May 26, 2010

- Messages

- 3,546

- Reaction score

- 2,093

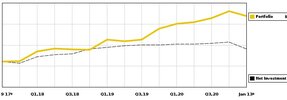

Any opinions? I went in heavy in March and April. I did okay and I'm exiting now. I don't think a crash is imminent and I'm sure it will still go up for the next few weeks at least. There seems to be a lot of stimulus money being kicked around and I'm sure it will fuel the market but really, how long can this continue? I'm not sure but I don't want to stick around to find out. I'd rather remain on the sidelines and wait for the next downturn. That will be my cue to jump back in.

Same with the real estate market. It's being buoyed by low-interest rates. It'll be interesting to see what happens with the next housing crash, which I predict will be in 2027, give or take a year or so. Will the government push negative interest rates or will the crash be significant?

Same with the real estate market. It's being buoyed by low-interest rates. It'll be interesting to see what happens with the next housing crash, which I predict will be in 2027, give or take a year or so. Will the government push negative interest rates or will the crash be significant?