4

45408

So? I never said that was a primary determinant of income amongst different fields. Within the same field, you usually do get paid more for working more/harder.And, still, no one cares how hard you work.

So? I never said that was a primary determinant of income amongst different fields. Within the same field, you usually do get paid more for working more/harder.And, still, no one cares how hard you work.

Working more/harder is subjective.So? I never said that was a primary determinant of income amongst different fields. Within the same field, you usually do get paid more for working more/harder.

Jump to a post in this thread that has 2011 Physician Compensation Data (not from recruiters)

You do not need to read this entire, humongous first post. We are discussing physician pay.

These first two questions are discussion points that came up in the first day of this thread. Feel free to give your answers to them, but also feel free to discuss physician pay in any context that YOU find relevant, interesting, or important.

- I'm guessing you've looked into how much money physicians make, or you may be a physician with first-hand knowledge of the compensation. The cost of medical education is increasing, and physician income is more likely to decrease than increase. What are your thoughts about increased debt and decreased wages? What, if anything, are you going to do about this?

- How much is $200K, really? What kind of lifestyle does it afford? Oversimplifying the calculation, it's about $13,000 a month after taxes (calculation is below). What can we really do with that?

If you have thoughts, feel free to contribute now. Reading the rest of the discussion may or may not burden your creativity and you can always come back to it.

Tax Calculation:

Starting as simplistically as possible, in 2011 the average marginal tax rate on $200,000 is 23.88% if you're single, 19.77% if you're married filing jointly. So we'll call it 21%. That's $42,000, which means your over-simplified net income is $158,000. That's $13,166 per month. I didn't scrutinize the calculator but I'm not sure if or how this accounts for state taxes. Feel free to offer suggestions on how to improve the figure, as we are obviously starting with a mere caricature of physician income.

(source: http://www.cpasitesolutions.com/calcs/TaxMargin.html)

__________________________________________________ __________________________________________________ __________________________________________________ __________________________________________________

__________________________________________________ __________________________________________________ __________________________________________________ __________________________________________________

The SRS BzNss Part

tl;dr version 2.0: Physician compensation is going to change. For those of us who choose not to panic, but rather stay the course and go into the unknown future of medicine, what are your thoughts and what do you plan to do about it (besides "specialize")?

The issue of physician pay is a recurring theme on SDN, and it has come up a number of times in the past few days in several unrelated threads; I would like to consolidate the discussion here. Ill start by addressing two things that came up in the other threads, and well see where this goes.

The first issue is money as motivation for becoming a physician (bear with me, I'm not all up on a rant), and the second is the future of physician compensation and the implications of it changing. This is not an OMG O Noes! thread. Many of us are far enough along this path that we wont be avoiding the consequences of fluctuating income, so there might as well be some pragmatic discussion about it.

For housekeeping purposes, here are some things that go without saying, but I will laugh when someone says them anyway:

- I may not respond much during the next week (Finals).

- Dont bother bringing the Benjamin Brown article into this. If you want to reference it as the type of discussion we DONT need to have, you can find it here (blah blah blah shenanigans) and if you enjoy the taste of fallacy enough for seconds: (you must be a glutton for punishment).

- If you take this discussion the way of tabulated net worth of X career vs. Medicine, Im warning you now that you will get crapped on.

- The purpose of this thread is not to help people decide between medicine and another career. If it ends up helping with that, great but let's not tailor the discussion that way. It is meant to be a thread for people who have already wrestled with the decision and have chosen to go into medicine--in spite of the uncertainty of our futures, and recognizing that pessimistic forecasts, while not guaranteed to come true, may indeed and probably have legitimate foundations.

- Any reported physician income is likely to be contested by someone on the forum, regardless of whether the source is anecdotal or actually resembles data. However,

- Correcting a gross misconception about physician income is different than splitting hairs about the current figures. The former is constructive, the latter is not. For current figures, start here:

For inflated ranges from recruiters and the AAMC commentary on them, go here:

- https://www.aamc.org/download/48732/data/compensation.pdf

- http://www.cejkasearch.com/view-compensation-data/physician-compensation-data/#

- http://www.merritthawkins.com/uploadedfiles/merritthawkings/surveys/mha2010incentivesurvpdf.pdf

Moving on from stats, but still housekeeping for the thread:

- Not all physicians are salaried. Some are, others are reimbursed by insurance companies/Medicare/Medicaid based on treatments they administer and procedures they complete, and still others operate on a fee-for-service basis where patients pay cash for (or finance) procedures. While this is usually for elective procedures, there is at least one instance of a general surgeon doing this for cholecystectomies and such, discussed in one of Gawandes books (I believe it was Better, but could have been Complications, and Im not going to dig it up for you). The prevalence and the administration of these payment modalities is quite likely to shift in the future. Lets not overcomplicate that portion of the discussion, but lets also avoid oversimplifying it by talking about all compensation as if it were a salary that materializes out of thin air every two weeks.

- This is not a hijack of the healthcare reform discussion, so lets get two pertinent points out of the way and then leave it alone. First, dipping into physician income is not going to pay for a solution to the healthcare crisis. Dont bother suggesting it, and dont assume that someone else did suggest it. It is still important to note that physician income is simply not speculated to increase (which is the second of the two points from the reform discussion):

- Reform is interested in increasing access to treatment and decreasing its cost. Of all the proposed methods to do this, the suggestions that have any chance of being implemented do not involve an increase in physician reimbursement. This thread is not about solving the healthcare reform Rubiks cube, nor is it about solving the problem of declining physician pay. It is about discussing the implications. Also,

- Dont molest me by bringing Ayn Rand or Ché Guevara into the discussion. And finally,

- You will make a terrible doctor. I will make a terrible doctor. Glad we got that out of the way.

A short time ago, in a thread far, far away, I was provoked by the following comments, which had the making of a good discussion but never took off:

I sort of get the points being made by each side, but where do we go from here?

We cant just end the discussion by saying dont do medicine for the money. And if you disagree, at least state why. I will elaborate on my opinion about this if the discussion heads that way, but I wont take it there from the outset. For now, suffice it to say there are people for whom compensation is a large factor, there are people who dont really care at all, and there are people who are legitimately concerned about being able to pay back their loans and live comfortably doing a job they enjoy.

I no longer take it upon myself to judge motives, and I am not against making a lot of money. But I dont agree with the notion that completing medical school and residency entitles anyone to an awesome income. Education isnt the same valuable commodity that it once was. Having a bachelors degree used to pretty much guarantee that youd be paid well, but it doesnt anymore. Its not valued the same way in the job market, and now theres even a glut of people with Masters degrees moaning about their compensation. Can you read the writing on the wall?

The salaries in those charts above are what we used to be able to expect, but in our lifetime this is going to change. Physician compensation will remain high enough to satisfy many, so this doesnt inspire panic.

If you *are* concerned about it, what do you plan on doing, besides putting your foot down? ... ... Making demands? Maybe throwing a temper tantrum? None of us will be able to waltz into the lifestyle of boats and hoez simply on the merit of having a medical degree.

[This is somewhat of an aside, but I wanted to work it in-- $200K/year is not really that much money, and this is coming from someone who lives well below the poverty line. It is about as much money per month as I live on in an entire year, but I dont get why so many of us consider six figures, $200K, or even $400K to be the holy grail of incomes. Most of us are used to a lot less, but quite frankly I dont find $400K to be that impressive of a goal for anyone who acknowledges money as a motivator. This is just a curiosity of mine; ultimately whether or not the money-motivated have a chance at building real wealth through medicine is of little consequence to me.]

Whats of plausibly more concern (but still not OMG ONOZ territory) is that the cost of medical education (as well as the undergraduate education you have to pay for first) will NOT decrease soon enough for the next generation of physicians to benefit. If the cost ever does go down, it will be well after most of us have paid somewhere in the neighborhood of $200K, plus the juice on our loans.

I dont lament this fact; I am confident in my own ability to generate a satisfactory income and pay back my loans, so in that respect Im kind of sticking my head in the sand and waiting for the proverbial **** to hit the fan with physician compensation. When it does, I will act accordingly.

What about you? Especially those who continue deciding against the opportunity to GTFO and take your talent to another field? If your head isn't stuck in the sand, how are you thinking about handling this?

I'm sorry but WTF. How is it unreasonable to live off 200k pre-tax? I know most pre-meds come from well off families but the level of pretension in this thread is suffocating. As a doctor, no matter what you practice, you'll earn what takes most people half a decade to make.

I'm sorry but WTF. How is it unreasonable to live off 200k pre-tax? I know most pre-meds come from well off families but the level of pretension in this thread is suffocating. As a doctor, no matter what you practice, you'll earn what takes most people half a decade to make.

I like my job. I think it's really cool. Yeah, I complain about hours, dumps from other services, and non-compliant patients, or whatever, but there isn't much else I'd rather be doing. Maybe if I could fly a fighter jet or be a navy seal that would be cooler.

People are still on this? Move on.

For all those that think 200k a year is just too little and they can't live off of such menial wages I have a simple advice: go do something else.

I haven't seen ANY posts in this thread directly saying it ISN'T good money. It's all relative. It's just a discussion of decreasing wages and increasing debt.

Not one person said that you can't live comfortably on that. There was a point I was hinting at, which Slack3r made quite nicely. Living comfortably =|= the cars, boats, and multiple homes that some people might think they can pull off with $200K.

To extend that to a conclusion I will draw later, if you say that money is your motivator and you're happy with low six-figures, either 1) money isn't truly what motivates you or 2) you have a serious lack of ambition.

Excellent post, thank you.

Personally, I'll be satisfied if I'm able to pay off my loans without much hardship within five years of finishing residency and am able to live relatively comfortably and save for retirement after my loans are paid off. This probably means a salary of around 200k. I believe most doctors will still be able to do this in the coming years. The field of medicine still remains brighter than almost any other field out there in terms of jobs and job security.

In my opinion, once you start crossing the 200k threshold for student loan debt, that's when things start getting a bit nauseating especially when you factor in all the uncertainty which you have mentioned. Unfortunately, more and more students every year are crossing this line. IBR and 25 year re-payment plans have made this do-able, but you are ultimately becoming a wage slave to the government at that point and you're paying an insane amount of interest.

To say that you won't make money or have an easy lifestyle as a physician is also kind of a loaded statement. Honestly I don't know any practicing physician (who or whom) has been unable to pay off their loans, buy a house, have a family/life, and do kind of whatever they want. Really no licensed physician works more than they have to (of course if you buy a $1.5 million house and lambo you may have to but you chose that). It really seems people are just pissed that medicine has really moved on from its glory days, back in the 70's and 80's when being a doctor was the greatest job ever and a doctor could go out and play golf 3 times a week or so I've been told. What really grinds my gears is when people go off on rants about physicians not making even 100K and its almost like really salaries are going to drop 40 - 50,000 over night, just like that ya. Of course I really don't understand compensation or billing so I'm really not qualified to comment, but if things get so bad we can always write scripts for weed on the side

I honestly could see myself living very comfortably with 200k every year.

Are the average salaries really supposed to dip down so much?

Peds, family practice, and many OBGYNs (my future field) don't necessarily make that much.

Bravetown, agreed. Do remember that the majority of MD students have an albatross of loans hanging around their neck until they're 40-45. Also recall the opportunity costs of NOT earning an income during the 4 years of med school.

im graduating from a family medicine residency in two months [ extremely excited ]. i knew that entering into this field would put physician compensation at lower numbers than the specialists.

even though the salary is lower, i am pretty satisfied. i think 200k is a lot of money! i'll be making a little less than that after graduation. as a resident, i make roughly 50k per year and am able to put money away for retirement and still have fun. putting that into perspective, when i start my "real" job, i will feel very well off. have you read the book, The Millionnaire Next Door? i highly recommend it.

over the three years of residency, i've looked into alternative practice models for primary care that would either increase the quality of life as a physician or increase the compensation or both. ie: ideal medical practice model, direct-pay practice, concierge care, becoming a principal investigator for clinical trials, cosmetic medicine, doing procedures, taking on administrative roles, etc. what i found is that it is possible to increase your income.

with that said, it takes a certain risk (financial, time commitment, success vs fail) to delve into those kinds of potential income streams. are you willing to take that risk? i was. until i remembered my loans.

so how do i plan to handle this whole physician income thing? my first goal is to eliminate my loans. i'm accomplishing this by working at an NHSC approved site and have the NHSC pay my loans for me in return for 2 years of my life. for those with more debt than myself, you can receive 25-30k per year free for working at a rural site.

in the meantime, i'm getting an MBA to enhance my administrative worth in medicine which will yield a higher income in the future.

im looking forward to hearing everyone else's plans for the future. and good luck!

While money is not my primary motivation for going into medicine, it will go a long way in making me more content to work 60+ hours/week (even post-residency) for my entire career, including nights, weekends, and on-call.

I wouldn't mind 200K/year or even a bit less to do what I love, given the 12+ years of post-secondary training/education, if I only had to work 8-4, M-F.

But I, like OP, cannot predict the future. I know this is what I want to do regardless of the uncertainties that lie ahead. When the "proverbial **** hits the fan", I too will also act accordingly. Until then my biggest concern is having my chosen career and the dignity with which I view it be demonized by media-hysterics and exploitative politicians.

I think it's important to point out that most non-surgical (who are compensated quite well) do not work over 60 hours a week. Also, 8-4 just isn't realistic in today's society if you're in the top working class group. Sure if you are super super rich you can pull that stuff, but even ibankers, consultants, top executives are putting in much more than the 8-hour a day, 5 day a week work. If they weren't, the market would very quickly find someone that would.

Great job OP but I think that most people won't read the entire first post. Also, too many stupid people on this forum that enjoy arguing/complaining for this to really be too productive.

Any way, as someone that aspires for academia, it's very likely my salary will be even lower than that of my private practice peers. What I would love to see is a real, no BS workup of what a physician salary would give. Perhaps, since everyone loves criticizing every little tax level or food payment, we could make it a group effort so everyone is mostly satisfied. Hell we could even produce 5 different workups. Either way, there's a lot that's said both way about what a primary care income will get you or what $400,000 will get you and sometimes I wonder if my future colleagues simply have extremely expectations or contrastingly intend to eat bread and water for life.

When someone tells me $200,000 is not a lot of money...what does that mean? When someone says $400,000 is not a lot of money--what? It's more money than most of us can really imagine dealing with unless one of our parents/close friends was pulling in that kind of bank and even then, we don't know what they were spending it on.

Hardly any other profession "guarantees" a good wage so long as you get there are keep your nose clean. I'm of the mind that almost anyone can become a doctor if they work hard. The same cannot be said for becoming ultra rich. The billion dollar ideas, the athletic skill, and the sheer luck that goes into making the super successful cannot be achieved by everyone. While hard work and intelligence are CERTAINLY in there, they are not the only factors.

If medicine guaranteed you'd become a multi-millionaire by taking on 8 years of postgraduate training, we would have MANY more applicants than we do now.

Medicine promises employability and a good wage in virtually any situation. It might not be the "fast-track" to money, and I'll leave your interpretation of "a lot of money" up to you, but the path is pretty well scoped out. You know exactly what you need to do, and when your reach the other side, you won't have trouble finding and keeping a job. And in the past, you may have expected a good income, and not nearly as much debt as today.

I didn't get into medicine for money, per se, but if I wasn't confident in my ability to pull ~$200k/year, I would've gone elsewhere.

Honestly even with my debt load I feel I can make quite a comfortable living for myself at ~$200000 per year.

Like a lot of people have said I am not going into medicine for the money,but it is a nice perk so to speak.

Also the real reason to go into medicine:

200k is a pretty nice sum, but the question it raises is how hard would you be willing to work to earn it? I mean, is this an 8-5 FP or 3/12 EM doc we're talking about, or is this a >60h/wk + call general surgeon? At what point does doing a job you love not become worth the compensation you receive?

I think too many people feel physicians should be compensated due to the extensive training and "sacrifices" that pre-meds/med students/residents must make in order to become a BC physician. I think doctors will always be compensated relatively well because of the services they provide; doctors will always have relatively high "economic rent", for those economically inclined. There aren't many alternatives for quality medical care (DNP's aside) so I do believe we will always be remunerated fairly well. Even looking at countries with (gasp) universal healthcare (Canada) or single-payor (NHS in Britain), physicians still make six figure salaries.

That brings me to your next point: how much is a six figure salary?

For argument's sake let's assume a $200k per year salary. I'm assuming this salary is not unattainable for any field in medicine. I'm also assuming that physician salaries will be unlikely to drop much lower than this point for most specialties.

$200,000 minus taxes (we'll assume 40%) gives us $120,000 per year take home pay, or $10,000 per month. Assuming $350,000 in loans at 6.8% interest over 10 years (monthly payment of $4000), leaves you with $6000 per month take home pay, or $72,000 per year. Not a lavish lifestyle, but you won't be living in a box eating ramen either.

Now, some will still posit that $200k is not a lot. I grew up on a slightly less than $200k household income. We don't own a boat, or a vacation home, or a Maserati....but both my parents drive luxury cars, myself and my 2 siblings have our own vehicles, I've never gone hungry and I've never been disappointed on Christmas at a dearth of presents under the tree. We took vacations as a family, not to Europe or 5 star resorts, but we did alright for ourselves. Basically, my parents made enough to provide a middle to upper-middle class lifestyle for themselves and their three children.

Now the next logical point would be: is it fair for a doctor who "sacrifices a decade" in training and several hundred thousand dollars of debt make only marginally more than a couple with bachelor's degrees?

I think this brings us back to the point so oft trumpeted around these forums: don't do medicine for the money...which is, I think, both true and false. As elucidated above, medicine hardly affords an opulent lifestyle (at $72k you'll be ballin on a budget) and I'm not sure it should. No other career path, save NBA player or rap mogul, guarantees the salary medicine does. Sure, their are outliers in every field and I know some idiot will post that a guy their friend's friend's cousin knows makes $XX,XXX,XXX doing some menial job, ipso facto: medicine sucks. Those who go into medicine EXPECTING that their medical degree should automatically entitle them to money and b!tches (which always follow money, clearly), as stated ad nauseum on these boards, will be thoroughly disappointed. And rightfully so, nobody is entitled to anything. Too often people consider medicine because "doctors make bank". Then they're told, don't do medicine, do dentistry: they work 3 days a week and make $250k a year. Check out DentalTown or other forums and see how many dentists are chasing the "million dollar practice" pipe dream. There are plenty of dentists that are hurting also, and dental school tuition is even worse than med school. You think $200k in debt is bad? Try $400k+. Nobody is going to hand you $$$ based solely on the letters after your name. A medical degree puts you in a position to maximize your income, but it's hardly, HARDLY a guarantee. I think too many people forget that.

That being said, I do believe there is, and always will be, money to be made in medicine. Business acumen and niche markets will determine who will make those coveted "half million dollar" salaries in the future. Things like concierge medicine, cash practices, and cosmetic procedures have already proven to be effective means of maximizing income. We have to assume that physician salaries (by virtue of insurance or government payments) will not rise. If anything, we're looking at significant decreases in many fields. Therefore, identifying and exploring such niche markets will be the name of the game in the future.

True but I don't think anyone on this forum is actually concerned about their debt. We say we are, because it's a lot to pay and blah blah blah. But everyone knows that barring irresponsible spending, the debt will be paid while still allowing us to live quite well since mostly it gets paid over 20-30 years if it's large.

I haven't seen any doctor that is struggling to balance work and paying off their debt with the exception of a few family practice that it later turns out were not sensibly using their money in pretty egregious ways.

But instead of everyone arguing whether it sucks to have the debt or not, can we do a breakdown? I don't understand enough of the minutia to do a detailed breakdown that won't provoke squabbling but surely some people here have that kind of knowledge.

The ignorance of people towards what a good salary is astoudning. What can you do with 13k a month after taxes? Really? My parents make a bit less of that with a family of 8 people, and we all live damn well. All of my siblings drive nice, new cars. We all had undergrand paid for (I am the exception, I got through undergad on saved money and scholarships in return for my parents funding part of medical school), lived in a very nice home, etc. If you guys really think 200k can't afford you a damn good lifestyle, you're a fool.

Not one person said that you can't live comfortably on that. There was a point I was hinting at, which Slack3r made quite nicely. Living comfortably =|= the cars, boats, and multiple homes that some people might think they can pull off with $200K.

To extend that to a conclusion I will draw later, if you say that money is your motivator and you're happy with low six-figures, either 1) money isn't truly what motivates you or 2) you have a serious lack of ambition.

And for the record, I have seen what $160K can do and it is beyond comfortable. I have also lived on less than $13K a year, let alone a month. So if it's me you're calling "ignorant," I'll accept your rebuke and graciously suggest that you read through the rest of the thread.

This was a promising thread before these two divas started catfighting.

Just so I can steer the thread back on course, here are my two cents:

- Doctors will, in the foreseeable future, always have job security. Even if they are let go by a struggling hospital/practice, there is such a shortage of doctors nationwide that they will certainly be scooped up somewhere, so long as they are not picky.

- I think everyone has agreed on this point: 200k is not wealthy by any stretch of the imagination, but you will not have to worry about putting food on your plate, funding your kids' college, etc.

- If you go into ANY field for the money, you will likely be miserable for the next few decades, medicine is no exception.

These are reasons why I started my personal finance blog - see below. Physicians need to start being smart with their money, saving appropriately, getting involved in other ways to accumulate wealth, etc. You can't just sit back and count your gold coins anymore.

I'm sorry but WTF. How is it unreasonable to live off 200k pre-tax? I know most pre-meds come from well off families but the level of pretension in this thread is suffocating. As a doctor, no matter what you practice, you'll earn what takes most people half a decade to make.

I haven't seen ANY posts in this thread directly saying it ISN'T good money. It's all relative. It's just a discussion of decreasing wages and increasing debt.

But think about that 200K in context of how many hours you work, excluding grueling time spent in training, the importance/stress involved in practicing medicine, medical school debt, and the overhead involved in maintaining a practice (malpractice insurance, taxes, etc.).

When finance/i-banking guys are making way more than that, with much less training, stress and debt I don't think its asking to much to want to be well compensated.

People are still on this? Move on.

For all those that think 200k a year is just too little and they can't live off of such menial wages I have a simple advice: go do something else.

I'm not trying to be a jerk, but you've missed the entire point of both discussion angles you address. No one has said that $200K is "too little," or that it's "menial wages." And the discussion is meant to be for people who have already decided NOT to do something else. It isn't a preemptive b!tchfest about not having enough money. It's just a discussion about how we think we might deal with the changes in the future.

How much is $200K/year? tl;dr: $8000 a month.

Assuming a debt of $200K paid on a 20-year repayment plan, your monthly payment would be in the neighborhood of $1520 (http://www.finaid.org/calculators/scripts/loanpayments.cgi). Assuming a debt of $250K, your monthly payment would be around $1900 (http://www.finaid.org/calculators/scripts/loanpayments.cgi). Hilariously enough, that calculator says:

If your debt is $300K, it suggests you need a salary of $275K to comfortably make payments over 20 years. Lets just call the monthly payment amount $1600 for a debt amount close to $200K. If you wanted to pay it off in 10 years, you would have to pay $2300 per month.

Assuming you want to save the most you can for retirement, youll max out your 401K by putting in $16,500 of your pretax income each year. This will lower your taxable income in this hypothetical from $200K down to $183,500. If you maxed out an IRA each year it would be another $5,000 per year. If you owned your own practice there would be different contribution limits and tax implications; we wont go there in this hypothetical.

Your new pre-tax income is $183,500. The marginal tax bracket for federal income tax on that amount ranges from 18% - 25% depending on whether you file independently or with a spouse (http://www.dinkytown.net/java/TaxMargin.html). Well call it 21% for the sake of easy calculations. Tax burden varies by state, but the average is just under 9% (http://cfo.dc.gov/cfo/frames.asp?doc=/cfo/lib/cfo/09STUDY.pdf), so were at 30%. 0.3 * 183,500 = $55,050. Youd be left with $128,450, but keep in mind youve already put $16K away for retirement.

This is $10,704 per month. If you decided to max out a Roth IRA that would require another $417 per month, leaving you with $10,287 per month.

Take out the loan payment of $1600 discussed above, and you have $8687 per month. For the 10-year repayment plan, taking out $2300 drops you down to $7987 per month. Your mileage may start to vary tremendously here, depending on your regional cost of living and the lifestyle choices you make.

Just for example, if you tried to buy a million-dollar home, with a 30-year mortgage at 5.5%, your monthly payment would be around $5978, leaving you with $2009 per month to pay for cars, gas, groceries, utilities, saving for your kids education, and whatever other expenses you have. Take the same mortgage terms on a $500,000 house and your payment is about $3000 per month depending on property taxes and home insurance (http://www.bankrate.com/calculators/mortgages/mortgage-payment-calculator.aspx). That could afford you a very comfortable house in many parts of the country, but I wouldnt expect it to go far in NYC. Either way, you are left with about $5000 per month.

Assuming youre willing to put $1000 per month toward a car or cars for you and your family (leaving you with $4000/month), you could afford $56,000 worth of vehicle (http://autos.msn.com/loancalc/newloan.aspx?calc=price&dp=5000&trm=5&int=120&pmt=290). This could be one fairly nice car, 2 x $23,000 cars, or any other combination. If youre willing to put $2000/month toward cars (leaving you with $3000/month for everything else), you could afford $108K worth of car. You could also put that extra money into a larger mortgage, so this is well past the point where the breakdown becomes highly individualized.

Basically, making $200K per year with a debt burden of about $200K, after maxing your retirement contributions and making the minimum monthly payment on your loans, you would be left with around $8,000 per month for mortgage/rent and living expenses, investment, or to otherwise allocate as you please. As has already been mentioned, you can live comfortably but this wont afford you a lavish lifestyle of vacation homes and Lamborghinis.

The debt is very concerning to me personally. None of us know anyone unable to pay off their loans because tuition probably wasn't nearly as high when the attendings we know were going through the process. But if the trend keeps up and tuition rises while wages fall ... we may have a situation on our hands.

Excellent post, thank you.

Personally, I'll be satisfied if I'm able to pay off my loans without much hardship within five years of finishing residency and am able to live relatively comfortably and save for retirement after my loans are paid off. This probably means a salary of around 200k.

In my opinion, once you start crossing the 200k threshold for student loan debt, that's when things start getting a bit nauseating especially when you factor in all the uncertainty which you have mentioned. Unfortunately, more and more students every year are crossing this line. IBR and 25 year re-payment plans have made this do-able, but you are ultimately becoming a wage slave to the government at that point and you're paying an insane amount of interest.

Do remember that the majority of MD students have an albatross of loans hanging around their neck until they're 40-45. Also recall the opportunity costs of NOT earning an income during the 4 years of med school.

1. Military medicine FTW! - They pay for my school, and pay me to go to school.

2. Military medicine FTW! - Lower cost of living while on active duty, tax free income while deployed to certain regions, go career and earn half my base pay after retirement, allowing me to not only work and get that check on top of everything, but if I want to I have income security giving me the ability to spend less time working and more time volunteering. And 200k is a crap ton of money, I could live very comfortably off 50k. I'm a very frugal person and manage/invest my money very well.

And the best part of military medicine - I get to serve!

There's a great spreadsheet (made by someone taking the military scholarship) comparing the military doc and the non-military doc salaries and debt. I think its around 10 years into practice that the non-military doc catches up and then takes off. Of course the military doc is debt free right after so there's that, but to each his own. And dude totally agree with you 200k is a definitely a crap ton of money could definitely live well off that.

found a link this dude's numbers could be off, but they look relatively ok: http://halfmd.wordpress.com/2007/03/23/financial-analysis-of-the-health-professions-scholarship-program/

he commits 100% of residency salary to paying off loans and assumes no interest. Plus 30k tuition, which many schools are higher. The figures are pretty off to be honest.

That's true. I think family medicine doctors in the military start earning more money than their civilian counter parts after year 11 or so. Other than that, the odds of making more money are slim. But the feeling of being debt free and being able to start investing/saving for retirement while still a med student has got to be worth some of the higher pay your civilian counterparts will be recieving. And if you live in a place like Texas, where cost of living and tuition is really low, you're going to be doing pretty dang good. I'm also going to be doing a different program than the guy in the link you posted (I'm doing HSCP through the Navy, he did HPSP), which works out better if you plan on staying in the military for longer and if you live in a state like Texas.

Also, it's something I want to do, not something I feel I have to do for the money.

The figures are definitely way off (and the military pay used is outdated), and it's important to keep in mind that many that go the military route either separate or transition to a Reserve component after their initial commitment is up.

True but I don't think anyone on this forum is actually concerned about their debt. We say we are, because it's a lot to pay and blah blah blah. But everyone knows that barring irresponsible spending, the debt will be paid while still allowing us to live quite well since mostly it gets paid over 20-30 years if it's large.

I haven't seen any doctor that is struggling to balance work and paying off their debt with the exception of a few family practice that it later turns out were not sensibly using their money in pretty egregious ways.

But instead of everyone arguing whether it sucks to have the debt or not, can we do a breakdown? I don't understand enough of the minutia to do a detailed breakdown that won't provoke squabbling but surely some people here have that kind of knowledge.

Problem is, neither doctors or patients (generally) get to decide what the service is worth. Some dude who came up with RVU's, government regulations, and insurance reimbursement schemes decide what your service is worth.

I don't think this thread needs to delve into discussing Free-market medicine, which I unintentionally just hinted at. I think we ought to focus on the realities facing current students/physicians. How to reduce debt (finding best repayment plans), possible ways to increase income, and how to make the most out of the money you DO make.

Truth is - I don't think anyone is worried about being poor or not being able to repay their loans, but there is no reason physicians shouldn't fight for better reimbursement, hours, and autonomy.

What are the chances of reform in general reimbursement schemes? Not just a shake-up of RVU's, but a shift in the way physicians are paid (Procedures vs Outcome... etc.)

I haven't seen ANY posts in this thread directly saying it ISN'T good money. It's all relative. It's just a discussion of decreasing wages and increasing debt.

When finance/i-banking guys are making way more than that, with much less training, stress and debt I don't think its asking to much to want to be well compensated.

But think about that 200K in context of how many hours you work, excluding grueling time spent in training, the importance/stress involved in practicing medicine, medical school debt, and the overhead involved in maintaining a practice (malpractice insurance, taxes, etc.).

If your debt is $300K, it suggests you need a salary of $275K to comfortably make payments over 20 years. Let's just call the monthly payment amount $1600 for a debt amount close to $200K. If you wanted to pay it off in 10 years, you would have to pay $2300 per month.It is estimated that you will need an annual salary of at least $229,002.00 to be able to afford to repay this loan. This estimate assumes that 10% of your gross monthly income will be devoted to repaying your student loans. This corresponds to a debt-to-income ratio of 1.1. If you use 15% of your gross monthly income to repay the loan, you will need an annual salary of only $152,668.00, but you may experience some financial difficulty.

We cant just end the discussion by saying dont do medicine for the money. And if you disagree, at least state why.

Don't go into medicine for money or an easy lifestyle. Seems simple, but I have classmates graduating now who are suddenly surprised.

What we lack in monetary compensation compared to our peers, we do have some of the best job security around (and tenure if you're going academic).

... if you are becoming a doctor for the money then you are probably becoming a doctor for the wrong reasons.

While money is not my primary motivation for going into medicine, it will go a long way in making me more content to work 60+ hours/week (even post-residency) for my entire career, including nights, weekends, and on-call.

Making debt your reason for not becoming a physician I would agree would be a bad decision, but becoming a physician simply for the money is a bad decision as well.

Regarding the debt, people get stuck on this ~$200K figure, but if you have to finance 2 years of post bacc and 4 years of med school, you're going to finish with more debt than that. Add 4 to 7 years of lost wages and your sticker price could easily reach $700K before interest. In many cases it would be higher.

Regarding choosing medicine solely for the money, the range of compensation is too broad to make such a blanket statement. If you think it's a strong financial decision to go $700K in the hole for a $150K/year income, which you won't even see for a decade, then you might want to check your assumptions. The fact is, some people have very low lost wages, others are giving up a lot. Some people will incur no debt, others will enter repayment on a balance of $400K. As physicians, some will earn $120K in a year, others will net $1.2 million.

"Don't do it just for the money" and "don't worry about the debt" don't apply to everyone.

I agree with this as well. However, I feel that the happier you are in your profession, the more productive you will be which will benefit you and the people around you. Call me an optimist or someone living in a fantasy land, but that's just the way I feel.

I used to care whether or not people chose medicine for the money. Now, I dont.

Myth #1: Caring about money is unethical.

It can be a slippery slope, but considering reimbursement (and how to maximize it) can be done from an ethical position, without a conflict of interest.

Myth #2: If you are getting into medicine for the money, youll hate your job.

Money-motivated physicians can end up being quite happy, as well as excellent and pleasant clinicians. Altruistic humanitarians who got into the game with pure hearts and little concern for money can end up miserable. And theres no clause about whether either side has to understand the opportunity cost ahead of time, but the people who are money-motivated usually do.

Myth #3: The opportunity cost of medicine is too high, considering what physicians are paid. Here, check out this spreadsheet that proves a UPS driver will end up with a higher net worth than a doctor.

Everyones opportunity cost is different. The 27 year-old first year med student with 2 kids had to make different sacrifices than the 22 year-old that came straight from college. People will take on varying degrees of debt, receive varying levels of fulfillment (money aside), and the spectrum of physician income is way too broad to make generalizations about whether or not its all worth it. You could make $120K a year, or $200K a year, or $400K a year based on specialty choice alone. Start talking about owning a practice or two (and putting in massive hours) in fields like plastics, optho or radiology, and netting $2 million a year doesnt sound out of the question. If youre going into medicine for the money and to you that means $150 - $200K per year, then I do wonder if youve adequately considered the opportunity cost. And I suppose part of the original point of this thread was to consider that the opportunity cost of a career in medicine is changing. On the whole, we are giving up more to make less in the future.

Myth #4: Medicine is virtually the only career that guarantees a six-figure salary and high job security.

This is a favorite around here. The fact is, if you took the (minimum) 7 years that you would devote to medical school and residency and invested them into a different career, you could find plenty of ways to make $100 - $250K. Its hard to argue with the job security physicians enjoy, especially considering the medical needs of the aging population and the obesity epidemic in this country. There arent other industries as a whole that can compete with the combination of security and a six-figure income, but to leave it at that ignores issues like length of training, hours worked per week, and liability, i.e. the probability that youll be sued and lose a huge chunk of money. There are, for lack of a better word, easier ways to make six figures that come with a different set of risks, one of which is often lower job security.

im graduating from a family medicine residency in two months [ extremely excited ]. i knew that entering into this field would put physician compensation at lower numbers than the specialists.

even though the salary is lower, i am pretty satisfied. i think 200k is a lot of money!

I just wish there was more parity among specialties. At my specific institution, I know for a fact that the gastroenterologists are making WAY more money than almost every other specialty, and that their reimbursement per RVU is through the roof.

They are definitely making more than my surgery attendings (all of whom are fellowship trained), with better hours and less risk.

I'm not out to take away someone else's income, but it honestly feels rather demeaning to be told that your specialty isn't "worth" as much as another, just because their set of procedures pays better than yours.

I bet pediatricians and family medicine docs feel the same.

I'm not going to put out a number out there for what peds/FM deserves to make, because I don't know what that would be. What I do know is that on average, surgeons work more than either of those specialties, our residency is definitely longer and more difficult, and our malpractice risk is substantially higher than theirs. I'm sure they can see why we might be better reimbursed than they are, and I think that's pretty fair.

Hmm...pediatric infectious disease specialists train for 6 years total (one more than general surgery). Their training hours are not, under current work hour rules, any different than general surgery training. That the 6 years is easier than general surgery training is an opinion that I don't agree with, but you have a right to it as I do to my view. They actually make less than if they didn't do the extra 3 years of pedi ID fellowship. Salaries quoted are after malpractice insurance and I'm not sure that risk of malpractice should mean higher compensation after that is accounted for. Post-training, many pedi subspecialist work very long hours, not so different than surgeons.

Regardless, and this might surprise you, pediatricians, both general and subspecialist, do not necessarily think that surgeons deserve a greater salary than they do.

Now you're comparing a fellowship subspecialty to a non-fellowship general residency graduate. Most surgeons go into fellowship training now (70% or more). The work hour restrictions might not be any different, but I know that the peds residents at my program work less than we do. They have outpatient months with no call responsibilities and no weekends. Now, that was their choice, and this was my choice, so I don't begrudge them that.

Also, I've heard infectious disease is a low-paying specialty across the board, although I have no idea why.

To me, it's being paid for the stress. I'm sure your job can be very stressful and intellectually rigorous at times, and I would reasonably expect to pay you more for an hour of your time when you're caring for a critical neonate than a well-child check.

Sticking with the average individual from either specialty rather than outliers, surgeons work more, trained for longer, and have more risk (as measured by lawsuit rates). If someone has a legitimate reason for why a typical pediatrician should be paid equal to or more than a typical general surgeon, I'm interested to hear it.

Seriously. Who gives a **** about any of that? In this country we pay people with low IQs and hormone abnormalities millions of dollars to carry a ball over a line. You don't "deserve" to make a single dollar based on how much you work or how risky your job is. You remind me of cops who bitch about how dangerous their job is - duh - "it's why you carry a gun". You knew your hours and your often thankless job and your approximate compensation when you signed up, the rest is bull****. You ONLY have a right to get paid whatever you can get someone to pay you for whatever they think you're worth. That's it, homes - nothing more, nothing less. No one else cares how hard you work

No sh-t, Sherlock.

The current system has nothing to do with what the patient thinks your services are worth, and everything to do with how much money one large aggregate group of lobbyists representing one group of special interests can extract from another.

Wrong. It's a lot more. It's a trillion dollar industry with our government vested with hundreds of billions of dollars. It's nice that you think it's as simple as being paid what someone thinks you're worth, but it's not.

Problem is, neither doctors or patients (generally) get to decide what the service is worth. Some dude who came up with RVU's, government regulations, and insurance reimbursement schemes decide what your service is worth.

I don't think this thread needs to delve into discussing Free-market medicine, which I unintentionally just hinted at. I think we ought to focus on the realities facing current students/physicians. How to reduce debt (finding best repayment plans), possible ways to increase income, and how to make the most out of the money you DO make.

Looks like I'd be almost right in the middle with OB.

- Not all physicians are salaried. Some are, others are reimbursed by insurance companies/Medicare/Medicaid based on treatments they administer and procedures they complete, and still others operate on a fee-for-service basis where patients pay cash for (or finance) procedures. While this is usually for elective procedures, there is at least one instance of a general surgeon doing this for cholecystectomies and such, discussed in one of Gawandes books (I believe it was Better, but could have been Complications, and Im not going to dig it up for you). The prevalence and the administration of these payment modalities is quite likely to shift in the future. Lets not overcomplicate that portion of the discussion, but lets also avoid oversimplifying it by talking about all compensation as if it were a salary that materializes out of thin air every two weeks.

I have been reading up on some cash-only practices, or those opting out of medicare, as possible ways to increase autonomy and reimbursement. I chose two to post that reflect the different ends of reimbursement and practice type (office visit vs procedural): Family medicine and Ortho.

This is an Orthopedic Group Round Table discussion on opting out of medicare, going cash only, and becoming out-of-network providers. A variety of practices and doctors are consulted on the impacts and hurdles.

http://www.orthosupersite.com/view.aspx?rid=26705

Overview

There are three primary types represented:

-Practices opting out of medicare.

-Practices going cash-only.

-Practices acting as third-party or out-of-network providers.

General Trends

Increased reimbursement in all cases, and reduced patient volume and paperwork.

Highly reduced patient population over 65 (duh), even when willing to treat previous medicare patients for free.

Most provide assistance to patients in billing their own insurance.

Charity and discounts at your own discretion.

A variety of pay schemes are feasible (Cash up front, payment plan).

Ethical hurdles from access to care, and increasing disparity.

Not viable in all locations and practices.

Most examples are quite old, and may not be as applicable today and in the future.

The second article is a family practice physician who decided to decline a salaried position at an academic center in order to go cash-only.

http://www.modernmedicine.com/modernmedicine/article/articleDetail.jsp?id=652945

Overview

Established in 2002 (article written 2010).

Accepts no insurance or Medicare.

See's at most 16 patients per day, and goes home at 5pm every night.

Pre tax net income between $275-495K per year (broad range, but directly from the article)

Has 2,500 active patients.

Keeps costs low by eliminating insurance administration duties, keeping a minimal staff, and negotiates low outsourced lab fees.

Has a price board out in front of his office ($45 Office visit, $25 Sport physical, $25 Lipid panel, etc.).

Gives patients print-outs of prepared CPT and ICD-9 codes for their visit if they wish to file their insurance.

Very low wait times, and long patient interaction times (5min/50min)

Keys to success include his quality time spent with patients. Low costs alone aren't enough. Patient satisfaction made his practice grow rapidly.

(Side Note) Physicians not accepting insurance in North Carolina went from .1% to 5% over three to four years.

Obviously these are limited in scope, and I'm sure it isn't easy to set up a cash only practice (even more so for procedural ones). Also, with the healthcare system in serious flux at the moment, it is hard to say if the idea is still reasonable. At least it is proof of concept that it can be done, and generally raises reimbursement and lowers paperwork hassles and general workload.

At first I had issues with charging cash, but when you consider what most co-pays are.

A question, since I am not 100% sure how insurance works, why would the patients file with their insurance?

Insurance plans will generally reimburse a percentage of their "usual" fee to providers. It varies. For my plan, I get 70% reimbursed of their normal fee to the provider. In all, about half comes back to me.

Cutting out the middleman, as in most other examples in business, saves the customer money and gives the provider a bigger cut.

Eliminating the middleman, never as simple as it sounds. 'Bout 50% of the human race is middlemen, and they don't take kindly to being eliminated.

The way that a cash practice works in general, and the beauty of it, is this.

1. Patient has a health issue that they want resolved.

2. They go to private practice that is a cash-practice. They write a check to for the service that they are provided at the point of service.

3. Practice give the patient a sheet of paper with a description of the service provided.

4. Patient provides that paperwork to their insurance company and commences trying to get reimbursed directly from their insurance company.

Biggest benefits:

1. Practice is paid at the time of service; there isn't a time/value of money kick to the shin as you wait to be paid for a service you've already provided.

2. You don't have to pay someone to work full-time getting your deserved reimbursments from insurance companies.

3. You are paid WHAT YOU THINK YOUR SERVICE IS WORTH, not what an insurance company wants to pay you or thinks your service is worth.

4. In my experience, the attitude of a customer who is paying out of pocket for their care tends to be much different than the "give me the healthcare I deserve" customer who has no skin in the game, or whose skin in the game is isolated from the treatment/payment process.

Of course, for multiple reasons there is no longer any sort of real free market for most of medicine, but the overall point still stands: You make whatever you can get paid. And no one still cares how long you work.

Doc's could solve all their problems with a real union and a national strike until all the people REALLY making money came to their sense . . . but that would 1) be like herding cats and 2) obviously ethically and morally problematic.

It would also be illegal since physicians would be breaking anti-trust laws. Not sure if academic/salaried physicians are excluded from that though.

Illegal?

Let me beg the question here and for argument's sake agree that it is "illegal". What are they going to do arrest everyone? Who gives a **** if it's "illegal" or not? Don't go to work. See what happens.

Kind of goes against the oath you take as a physician to let patients die w/out treatment just so you can get a pay raise.

the problematic moral and ethical "issue" was noted above

Why don't people realize that if you have one of these you'll be able to save an open another practice and then another and so on? Easy math: $275,000 per year x 10 practices=$2,750,000 per year (before paying other physicians salaries).

Zealot those numbers look good and all, but what about the debt required to open each practice? Gross income doesn't really provide the whole picture.

Zealot those numbers look good and all, but what about the debt required to open each practice? Gross income doesn't really provide the whole picture.

I think everyone is freaking out about the salaried jobs in medicine. The major of doctors are too engulfed in science to get business or have the motivation to pursue it. Therefore, if you are good at business + medicine you will make far more than the average doctor.

I think most people are mad bc the golden million dollar 9-5 job isn't waiting for them at the end of residency.

Also I think you overestimate the ease of starting a business. To be an effective small business owner you better be dam good at wearing several hats. If you can't excel at medicine, marketing, HR, legal issues, management, sales, etc....your model will crash and burn.

Yes, that is the entire point of the thread. Compensation is changing, and perhaps will not be as great as we would like. Discuss.

Here are the Cliff's for what people said:

- Don't do medicine for the money

- Run a cash practice

- Rely heavily on your spouse's income

I knew that it might be interpreted that way, but I'm not estimating the ease of starting a business. There are 5 or 6 instances where I acknowledged that what I presented is NOT a business model, it's a chart full of fallacy. The point is, a business model could be built around the goal of owning multiple practices.

While it would be nice to excel at marketing, HR, legal issues, and sales on top of medicine, it's much more feasible to recognize it when you are weak in an area, and judiciously contract those responsibilities out to other professionals. If a doctor (or dentist, or whatever) had to master all of those skills by him or herself to run a successful group of practices, it would never happen, and there wouldn't be contract companies that handle other people's accounting, HR, sales, marketing, etc.

I disagree...thats the difference between a small and medium size business. If it was as easy as hiring out to professionals small businesses would never fail.

I am speaking from the prospective of having started and own a small business. If you think you can hire everything out initially, thats not realistic.

If you have 5 million in starting capital then go for it and hire a bunch of support staff (and someone who has experience managing them). However, 99.9% of the people who graduate med school in debt will have to figure out how to do it themselves.

Yes I realize many practices use lets say billing services, but some of the highest paid doctors I see either have no support staff or run a big enough practice where the support staff is distributed across the income of many physicians. This is the very reason by the time we are doctors most practices will be large.....costs are rising.

My point is you are telling a way of making money through business not medicine. Which isnt what people signed up for.

Here are the Cliff's for what people said:

- Don't do medicine for the money

- Run a cash practice

- Rely heavily on your spouse's income

Actually, we don't disagree and we're speaking from similar levels of experience. I'm not advocating hiring everything out; I said that I would start with one administrative employee and an accountant. There's not a lot of HR skill needed to handle that. As you stated, needs change as businesses grow, but bigger business can diffuse the cost differently. Sure, you have to figure it out on your own initially. But initially, there's less to figure out. You don't start by contracting everything out to other professionals because there's not much to contract out; you'd be paying them for nothing, or at best for things you should be able to figure out.

Regarding small vs. medium business, the point is that you start small (with much less to manage in the way of HR, marketing, and overhead) and eventually grow it into a medium-sized business.

I couldn't possibly be "telling a way of making money through business, not medicine," because that's a false dichotomy. The idea would be to make money through medicine and business. The two aren't mutually exclusive, and you couldn't set up this business as some random entrepreneur with no medical credentials.

I just wish there was more parity among specialties. At my specific institution, I know for a fact that the gastroenterologists are making WAY more money than almost every other specialty, and that their reimbursement per RVU is through the roof.

They are definitely making more than my surgery attendings (all of whom are fellowship trained), with better hours and less risk.

I'm not out to take away someone else's income, but it honestly feels rather demeaning to be told that your specialty isn't "worth" as much as another, just because their set of procedures pays better than yours.

I agree having the medical degree is essential when it comes starting a successful practice. Here is my point, 95% of the people on this thread and pre-meds in general are not pursing medicine with this interest.

The problem is you spend 4 years of undergrad + 4 years of med school + 3+ years of residency none of which even tangentially prepares you to run a business. Unless you have outside experience or get lucky it probably will not work as well as most would hope.

There is TONS of money in medicine but its not made by you seeing patients.

I completely agree with you, and I think there is plenty of good discussion that could be had by the 95% who are more interested in salaried positions than in running a business. That is what I had originally hoped for with this thread, but I overestimated the level of interest there would be in such a discussion.

I completely agree with you, and I think there is plenty of good discussion that could be had by the 95% who are more interested in salaried positions than in running a business. That is what I had originally hoped for with this thread, but I overestimated the level of interest there would be in such a discussion.

How much is $200K/year? tl;dr: $8000 a month.

Assuming a debt of $200K paid on a 20-year repayment plan, your monthly payment would be in the neighborhood of $1520 (http://www.finaid.org/calculators/scripts/loanpayments.cgi). Assuming a debt of $250K, your monthly payment would be around $1900 (http://www.finaid.org/calculators/scripts/loanpayments.cgi). Hilariously enough, that calculator says:

If your debt is $300K, it suggests you need a salary of $275K to comfortably make payments over 20 years. Let's just call the monthly payment amount $1600 for a debt amount close to $200K. If you wanted to pay it off in 10 years, you would have to pay $2300 per month.

Assuming you want to save the most you can for retirement, you'll max out your 401K by putting in $16,500 of your pretax income each year. This will lower your taxable income in this hypothetical from $200K down to $183,500. If you maxed out an IRA each year it would be another $5,000 per year. If you owned your own practice there would be different contribution limits and tax implications; we won't go there in this hypothetical.

Your new pre-tax income is $183,500. The marginal tax bracket for federal income tax on that amount ranges from 18% - 25% depending on whether you file independently or with a spouse (http://www.dinkytown.net/java/TaxMargin.html). Well call it 21% for the sake of easy calculations. Tax burden varies by state, but the average is just under 9% (http://cfo.dc.gov/cfo/frames.asp?doc=/cfo/lib/cfo/09STUDY.pdf), so we're at 30%. 0.3 * 183,500 = $55,050. You'd be left with $128,450, but keep in mind you've already put $16K away for retirement.

This is $10,704 per month. If you decided to max out a Roth IRA that would require another $417 per month, leaving you with $10,287 per month.

Take out the loan payment of $1600 discussed above, and you have $8687 per month. For the 10-year repayment plan, taking out $2300 drops you down to $7987 per month. Your mileage may start to vary tremendously here, depending on your regional cost of living and the lifestyle choices you make.

Just for example, if you tried to buy a million-dollar home, with a 30-year mortgage at 5.5%, your monthly payment would be around $5978, leaving you with $2009 per month to pay for cars, gas, groceries, utilities, "saving for your kids' education," and whatever other expenses you have. Take the same mortgage terms on a $500,000 house and your payment is about $3000 per month depending on property taxes and home insurance (http://www.bankrate.com/calculators/mortgages/mortgage-payment-calculator.aspx). That could afford you a very comfortable house in many parts of the country, but I wouldn't expect it to go far in NYC. Either way, you are left with about $5000 per month.

Assuming you're willing to put $1000 per month toward a car or cars for you and your family (leaving you with $4000/month), you could afford $56,000 worth of vehicle (http://autos.msn.com/loancalc/newloan.aspx?calc=price&dp=5000&trm=5&int=120&pmt=290). This could be one fairly nice car, 2 x $23,000 cars, or any other combination. If you're willing to put $2000/month toward cars (leaving you with $3000/month for everything else), you could afford $108K worth of car. You could also put that extra money into a larger mortgage, so this is well past the point where the breakdown becomes highly individualized.

Basically, making $200K per year with a debt burden of about $200K, after maxing your retirement contributions and making the minimum monthly payment on your loans, you would be left with around $8,000 per month for mortgage/rent and living expenses, investment, or to otherwise allocate as you please. As has already been mentioned, you can live comfortably but this won't afford you a lavish lifestyle of vacation homes and Lamborghinis.

I'm pretty sure it's impossible to overestimate the level of interest in an income thread...unless your estimation was infinity posts.

I can only speak for myself: I'm interested, but I lack the knowledge to be able to participate productively. Also, I'm being attacked by wee turtles.

The halls of ivy league business schools are littered with the corpses of wannabe i-bankers. Good luck with that. Let me know how it tuns out.When finance/i-banking guys are making way more than that, with much less training, stress and debt I don't think its asking to much to want to be well compensated.

I completely agree with you, and I think there is plenty of good discussion that could be had by the 95% who are more interested in salaried positions than in running a business. That is what I had originally hoped for with this thread, but I overestimated the level of interest there would be in such a discussion.

If you guys want to make money, I suggest you look at dentistry. It shouldn't be more than a couple of years now that dental school admission will be more difficult than med school admission.

http://www.wsjclassroomedition.com/archive/05apr/care_dentist.htm

Why Dentists Are Smiling

They Now Average Higher Incomes Than Some Physicians

ftp://ftp.mgma.com/survop/glacierpublishing/Completed Projects/AU 2010/AU_2010 internal.pdf

This is the true Physician compensation survey.

I appreciate the interest, and I guess we'll see what happens. I never knew you were a grounds-keeper, maubs.

These numbers are wayyyyy offf. But hey, I'll be pleasantly surprised if they turn out to be true.

If you guys want to make money, I suggest you look at dentistry. It shouldn't be more than a couple of years now that dental school admission will be more difficult than med school admission.

http://www.wsjclassroomedition.com/archive/05apr/care_dentist.htm

Why Dentists Are Smiling

They Now Average Higher Incomes Than Some Physicians

These numbers are wayyyyy offf. But hey, I'll be pleasantly surprised if they turn out to be true.

But think about that 200K in context of how many hours you work, excluding grueling time spent in training, the importance/stress involved in practicing medicine, medical school debt, and the overhead involved in maintaining a practice (malpractice insurance, taxes, etc.).

When finance/i-banking guys are making way more than that, with much less training, stress and debt I don't think its asking to much to want to be well compensated.

They don't have any 80 hour caps. Working 100 hours a week as an ibanker isnt uncommon and if you don't make associate (most won't), you're gone after 3 years.

They don't have any 80 hour caps. Working 100 hours a week as an ibanker isnt uncommon and if you don't make associate (most won't), you're gone after 3 years.Based on what? This is a survey of 60,000 physicians and this doesn't include non cash bonuses.

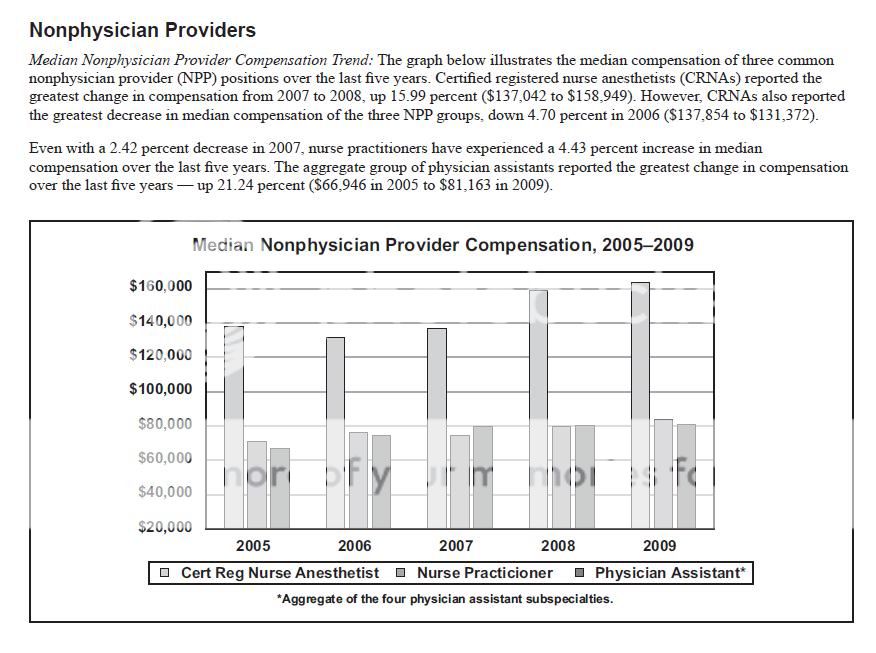

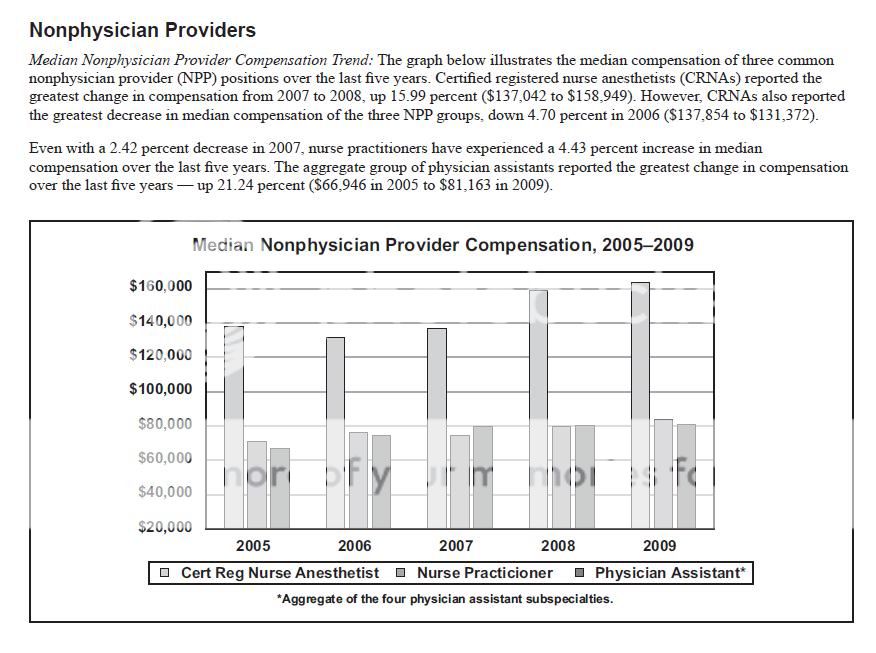

In this report you will find:

- Data on 19,048 faculty physicians and nonphysician providers categorized by specialty;

- Data reported from 2,191 managers from 581 clinical science departments;

- Data reported for 135 physician specialties and 18 nonphysician provider specialties...

Response Rate

Invitations mailed---------------------3,071----100.00%

Undeliverable----------------------------10------0.33%

Invitations reaching recipients---------3,061-----99.67%

Responses------------------------------590-----19.27%

Excel surveys---------------------------267-----45.25%

Web surveys----------------------------323-----54.75%

Paper surveys------------------------------------00.00%

*Ineligible or incomplete surveys------------------91.53%

Completed surveys included in the report--581

**Gross response rate----------------------------19.27%

***Net response rate-----------------------------18.98%

*Missing required answers; not a full year of data; not a clinical science department.

**(Number of responses divided by the number of questionnaires reaching recipients) × 100.

***((Responses minus ineligible or incomplete surveys) divided by questionnaires reaching recipients) × 100.

1: Department Revenue per FTE Faculty Physician

Responding Departments

Anesthesiology--------------------$641,670

Dermatology-----------------------$859,537

Emergency Medicine---------------$431,155

Family Practice--------------------$378,251

Internal Medicine/Medicine---------$502,052

Neurology-------------------------$409,972

Obstetrics/Gynecology-------------$683,871

Ophthalmology---------------------$925,284

Otorhinolaryngology----------------$759,212

Pathology--------------------------$772,723

Pediatrics--------------------------$530,779

Physical Medicine & Rehabilitation---$405,436

Psychiatry-------------------------$498,082

Radiology--------------------------$702,808

Radiation Oncology---------------$1,066,703

Surgery----------------------------$771,155

Surgery: Neurological-------------$1,114,597

Surgery: Orthopedic--------------$1,021,923

Urology----------------------------$850,180

ftp://ftp.mgma.com/survop/glacierpublishing/Completed Projects/AU 2010/AU_2010 internal.pdfAll Primary Care:*-------------$158,218

Family Practice*--------------$164,469

Internal Medicine-------------$161,916

Pediatrics*-------------------$141,869

All Specialists----------------$235,587

Anesthesiology---------------$300,000

Cardiology: Invasive----------$295,050

Cardiology: Noninvasive-------$240,781

Emergency Medicine------ ----$223,385

Endocrinology/Metabolism---$157,000

Gastroenterology-------------$247,646

Hematology/Oncology--------$212,897

Infectious Disease------------$159,502

Maternal and Fetal Medicine---$296,933

Neonatal Medicine-------------$208,762

Nephrology--------------------$183,093

Neurology---------------------$160,000

Obstetrics/Gynecology---------$214,677

Ophthalmology-----------------$233,460

Otorhinolaryngology------------$275,000

Pathology: Anatomic-----------$214,557

Psychiatry---------------------$164,537

Pulmonary Medicine-------------$183,475

Radiology: Diagnostic-----------$350,000

Rheumatology------------------$166,767

Surgery: General---------------$280,121

Surgery: Orthopedic------------$400,335

*Represents specialties withsubspecialty groupings that are new in the 2009 data. Primary care now includes the subspecialties internal medicine: pediatrics, hospitalist: family practice, and hospitalist: pediatrics.

Median Compensation Levels by Geographic Section

---------Primary Care---Specialty Care

Eastern----$165,000------$242,460

Midwest----$167,538------$238,841

Southern---$150,054------$227,928

Western----$147,272------$229,464

MGMA numbers are generally regarded among physicians as accurate. The government numbers are the fantasy. I wouldn't take a no call 4 day a week job for what they say anesthesiologists average. Surgical subspecialists make more than we do.

The linked "recruiter" numbers discarded as fantasy are also realistic. That's a fact, Jack.

I'm not arguing at all, but this is what I could find for methodology in the PDF:

I think what's confusing is that the first numbers you come across aren't income numbers, they are average department revenue divided by the number of physicians in that department, and are quite a bit higher than the income numbers reported later.

The actual data in the report is a lot more sophisticated than this, showing fluctuations from 2005 to 2009, but the '09 figures for income are:

ftp://ftp.mgma.com/survop/glacierpublishing/Completed Projects/AU 2010/AU_2010 internal.pdf

The difference in median income between primary care and some amalgamation of all "specialty care" by region:

Just something interesting that's also in the report: