D

deleted103644

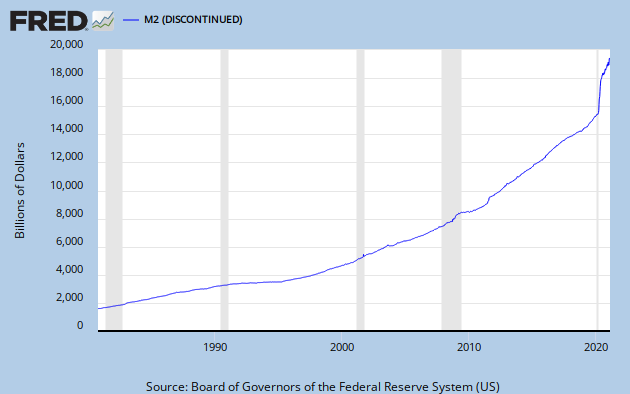

I understand what a log curve is, and the reason I wouldnt use it is because it hides the nature of the exponential increase and makes it look like everything is steady and stable, which is clearly not.

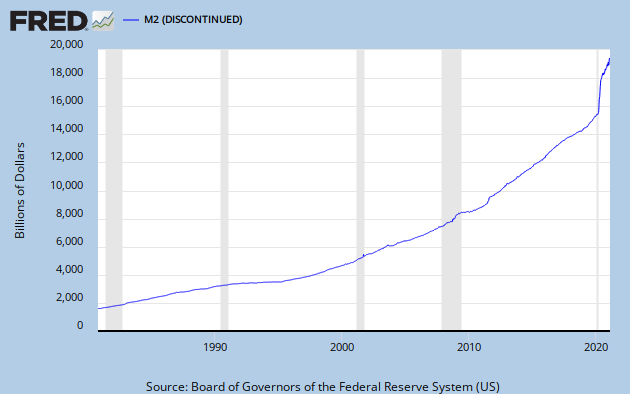

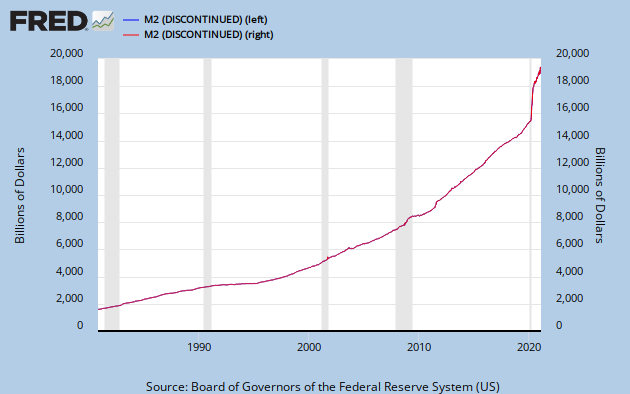

If you accept that the money supply should grow exponentially than why dont you just buy gold, since as shown from the graphs when you increase the money supply it devalues the dollar and causes the price of gold and other commodities to increase. Though I dont see how the two rounds of quantitiave easing by the federal reserve that injected more than $1 trillion dollars in such a short span (take a look at the bumb around 2008, u can actually see it in both graphs) accounts for population growth.

You claim my examples are fringe and anecdotal, though I showed you a website of someone recording their prices as the years have gone by. Many people I have talked to have noticed an increase when shopping for groceries. Though it would be hard to notice since the changes in cents is very little for example, can of beans going from 70 cents to 77 cents or milk going from 3.5 to 3.8. Do you truly believe that guy just made up those numbers on his blog and Im just lying to you about my own experiences?

You may continue to believe in this delusion that food prices are stable or going down, but most people know whats going on.

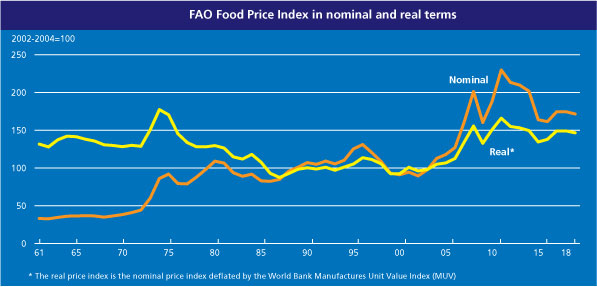

I didn't say food prices were stable, that's kind of the whole point in leaving it out of inflation measures (lots of fluctuations due to the cost of oil and crop yields).

Food prices are actually going down relative to a couple of years ago, and have been swinging wildly up and down over the last decade.

Your examples are still anecdotal (you and your acquaintances) and fringe (a random guy's blog - also sounds anecdotal).

And I don't buy gold because it is overvalued. There are better things to buy that keep pace with inflation (or generally do much better). (I do have some gold in my portfolio for diversification, but it's a very small percentage.)