- Joined

- Jul 27, 2011

- Messages

- 2,257

- Reaction score

- 2,923

Sharing this milestone with folks to possibly inspire others and maybe share with others some alternate investments. This july marks exactly 3 years from my residency graduation and we hit the 1M net worth milestone a few days ago.

Some of our success has been because of the usual things: spent less, invested a big chunk of our income, lived in a cheap-ish cost of living area, negotiated for higher incomes.

But a lot of our success has been because of a very non-traditional approach to investing. Here's a breakdown of our portfolio and the significant alternate investments that I would highly encourage others to educate themselves about.

Current portfolio:

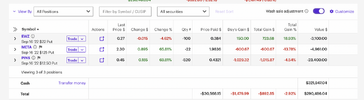

4% cash, 36% Passive syndicate real estate investments, 30% options (premium harvesting through naked puts), 20% in retirement accounts (of which 90% stocks and 10% bonds), and lastly 10% net worth in our personal home equity.

I've talked plenty about options in the past, so not going to dive into that topic. But in the last 1 year, I've also jumped head first into the world of passive syndicate investing which I've never talked about here and wanted to give others a glimpse into these opportunities that most doctors qualify to invest in:

I currently have about ~370k in 14 different syndications. The following is the breakdown of these investments:

Syndications I've invested in:

1) 85k in office space (30k in Atlanta Financial Center and 30k in 200 W jackson Chicago which is the building next to Sears tower - both these are with nightingale properties as sponsor, 25k in an office space opposite the great mall of America in Minneapolis (sponsor = Hemel companies)).

2) 215k in multifamily ( 25k in an Apt complex in Miami (sponsor = Lynd capital), 25k in an apartment building in orlando, 30k Ashcroft capital which is a multifamily fund consisting of 6 apt complexes, 40k with BAM capital - another fund with 6 properties, 15k in an Apt in Des Moine, 25k with Foulger Pratt in a DC new construction and another 25K with them in a Apt complex in Fort worth Tx, 30k in 3 apt complexes in Norman OK with trident real estate).

3) 40k in Self storage of which 20k is with a fund with Van west group, and 20k with Ziffcre, will increase to 50k over this year as more properties are acquired in the fund.

4) 30k in medical office buildings through NEMI fund 4.

All except a couple of the above investments have been through either crowdstreet, equitymultiple, and realcrowd. Crowdstreet has some of the best deal flow and some really great deals have come on it.

Pros of syndications:

1) Diversity - multifamily, office, industrial, storage, retail, geographic diversity, sponsor diversity with a few clicks while sitting at home.

2) Truly passive and headache free once you've done your due diligence.

3) Tax benefits of paper losses due to depreciation

4) 15 - 20% returns depending on the deal. Roughly you're looking at doubling your money in 5 years on average in real estate.

5) Rental checks

6) Leverage sponsor experience and expertise. I mean someone with 1B of assets under management is probably better equipped at maximizing a property than I am.

7) no correlation with the stock market, true diversity.

Cons of syndications:

1) A LOT of state income tax forms -_- Basically state income tax forms for every state I'm a K1 partner in a property.

2) No control - Sponsor decides everything

How to start:

1) Read "the hands off investor".

2) Join crowdstreet and get a taste of reviewing deals

Last thoughts:

1) debt is a tool if used wisely. Too many doctors are rushing to pay off "good debt" like mortgages. I paid off my student loans too aggressively, I wish I hadn't, I'd be worth a lot more today if I hadn't.

2) EM was financially good to me but I wish I had done something else. In hindsight I would pick Radiology, ortho, FM, anesthesia, or PM&R over EM. But I can't complain honestly. 3 years ago I was worth around negative 100k when I graduated residency, so EM has helped me do a 1.1M swing in net worth in 3 years.

3) I think I'll consider myself financially independent in another 2-3 years when we hit 2M in networth given that I don't rely on the SP500 for returns (mostly not at least for a majority of my portfolio).

I hope this was helpful to others, if anyone has any questions about details about the deals that I'm in or my thoughts about the sponsors, then PM me and I'd be more than happy to discuss these things.

Edit: This is not investment advice, do your own due diligence, I'm not selling anything. But just throwing out investment ideas for doctors who are accredited investors who have a higher risk appetite than a stock:bond portfolio.

Some of our success has been because of the usual things: spent less, invested a big chunk of our income, lived in a cheap-ish cost of living area, negotiated for higher incomes.

But a lot of our success has been because of a very non-traditional approach to investing. Here's a breakdown of our portfolio and the significant alternate investments that I would highly encourage others to educate themselves about.

Current portfolio:

4% cash, 36% Passive syndicate real estate investments, 30% options (premium harvesting through naked puts), 20% in retirement accounts (of which 90% stocks and 10% bonds), and lastly 10% net worth in our personal home equity.

I've talked plenty about options in the past, so not going to dive into that topic. But in the last 1 year, I've also jumped head first into the world of passive syndicate investing which I've never talked about here and wanted to give others a glimpse into these opportunities that most doctors qualify to invest in:

I currently have about ~370k in 14 different syndications. The following is the breakdown of these investments:

Syndications I've invested in:

1) 85k in office space (30k in Atlanta Financial Center and 30k in 200 W jackson Chicago which is the building next to Sears tower - both these are with nightingale properties as sponsor, 25k in an office space opposite the great mall of America in Minneapolis (sponsor = Hemel companies)).

2) 215k in multifamily ( 25k in an Apt complex in Miami (sponsor = Lynd capital), 25k in an apartment building in orlando, 30k Ashcroft capital which is a multifamily fund consisting of 6 apt complexes, 40k with BAM capital - another fund with 6 properties, 15k in an Apt in Des Moine, 25k with Foulger Pratt in a DC new construction and another 25K with them in a Apt complex in Fort worth Tx, 30k in 3 apt complexes in Norman OK with trident real estate).

3) 40k in Self storage of which 20k is with a fund with Van west group, and 20k with Ziffcre, will increase to 50k over this year as more properties are acquired in the fund.

4) 30k in medical office buildings through NEMI fund 4.

All except a couple of the above investments have been through either crowdstreet, equitymultiple, and realcrowd. Crowdstreet has some of the best deal flow and some really great deals have come on it.

Pros of syndications:

1) Diversity - multifamily, office, industrial, storage, retail, geographic diversity, sponsor diversity with a few clicks while sitting at home.

2) Truly passive and headache free once you've done your due diligence.

3) Tax benefits of paper losses due to depreciation

4) 15 - 20% returns depending on the deal. Roughly you're looking at doubling your money in 5 years on average in real estate.

5) Rental checks

6) Leverage sponsor experience and expertise. I mean someone with 1B of assets under management is probably better equipped at maximizing a property than I am.

7) no correlation with the stock market, true diversity.

Cons of syndications:

1) A LOT of state income tax forms -_- Basically state income tax forms for every state I'm a K1 partner in a property.

2) No control - Sponsor decides everything

How to start:

1) Read "the hands off investor".

2) Join crowdstreet and get a taste of reviewing deals

Last thoughts:

1) debt is a tool if used wisely. Too many doctors are rushing to pay off "good debt" like mortgages. I paid off my student loans too aggressively, I wish I hadn't, I'd be worth a lot more today if I hadn't.

2) EM was financially good to me but I wish I had done something else. In hindsight I would pick Radiology, ortho, FM, anesthesia, or PM&R over EM. But I can't complain honestly. 3 years ago I was worth around negative 100k when I graduated residency, so EM has helped me do a 1.1M swing in net worth in 3 years.

3) I think I'll consider myself financially independent in another 2-3 years when we hit 2M in networth given that I don't rely on the SP500 for returns (mostly not at least for a majority of my portfolio).

I hope this was helpful to others, if anyone has any questions about details about the deals that I'm in or my thoughts about the sponsors, then PM me and I'd be more than happy to discuss these things.

Edit: This is not investment advice, do your own due diligence, I'm not selling anything. But just throwing out investment ideas for doctors who are accredited investors who have a higher risk appetite than a stock:bond portfolio.

Last edited: