Thanks for explaining how you take profits. More important, I would be interested in how you take losses. You're applying lots of leverage through options so what if prices keep going down and the puts you sold are worth more. Do you buy back at a loss? Because if you keep sitting on them, you can lose even more with gamma and implied volatility increase without have the price of the underlying to be lower than strike price. Or are you going to sit on the option until expiration? When losses happen, they happen big. Wasn't it OptionSellers that went broke and lost over 100% of their client's money through strangles?

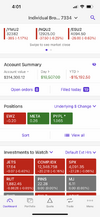

I took 2 very big losses on arkk and arkf this year. My account is negative only because of those 2 positions. Between the two i took a 60k loss, essentially went in and saw multiple days of 10+ percent declines in the ETFs. It was an ETF!! It was ridiculous - spy would drop 1-2 percent and arkk would drop 8-12 percent. I Dropped strikes, extended trades, briought arkk strike to as low as 35. Theoretically i could have just held that price. Arkf was at $10 strike. Again something i could have held, the underlying prices never got within 15-20 percent of my strikes as i kept managing the positions. When i started the positions i was comfortable with just holding and watching the position recover. I was never pressured by being too leveraged and always maintained a healthy maintenance margin. But because of those two positions, i went from positive 4% to negative 15-20 percent, and then i was where the SPY was on a YTD basis. I was beating spy by almost 20 percent prior to that. And it bothered me losing my 20 percent advantage over spy so i essentially walked out with a plan to go back to my strategy that always worked - 45 to 60 day puts on things like ewz, rut, qqq. Im back to deviating again as i opened a 5 month long position, but this one I’m probably not going to fold regardless of what happens.

I also eventually sold the positions because i went through the income statements of all the major holdings of arkk and arkf. Most of these companies were on shaky grounds financially, massive losses, barely any income, massive debt, ridiculous price to earnings ratios. I didn’t have an exact formula for taking the loss, i just looked at the opportunity cost and decided to move and make my portfolio safer. While i probably would have done better today had i just held those positions, but it did make me nervous at some point and i began preparing for nasdaq dropping to pre-covid high levels as a bounce for support, which meant a further 15-20 percent decline in qqq, which probably would have been devastating for ARKK/arkf. It never happened, so holding would have turned out great, but i didn’t have a crystal ball. I probably would have been 10 percent positive YTD instead of 3 percent negative ytd right now if i had held.

So yeah…i don’t really have a formula. Though every trade i make, i have the ability to hold perpetually if needed - i just lost faith in the companies that were within arkk and arkf after seeing the balance sheets and income statements. A loss should not hold you down, it’s a sunk cost. Put your capital towards winning trades instead rather than hope a loser becomes a winner.

Also strangles scare me. I don’t do them, I’ve done a couple, but they don’t sit right with me from a risk perspective. People also swear by iron condors, i did one once and quickly realized how having an iron condor takes away the flexibility of a naked put position. Just the idea of naked calls scares me. With a naked put, as long as you can bring in enough capital to prevent a capital call, you can hold perpetually, which is then the same as holding a stock position except better - you keep getting paid a premium to wait for the position to recover. With a naked call, if you keep extending time, and the underlying keeps going up and up, you are only creating a bigger hole.

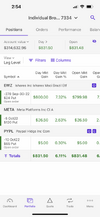

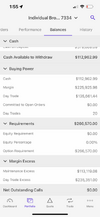

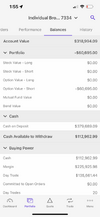

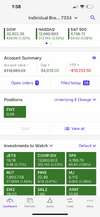

I’m attaching two screenshots - one shows what a rollover hold would look like (keeping the same strike and extending time), the other shows a very defensive move of dropping the strike using premium from an option further out.

So you dont wait till expiration because then you have risk of being allotted the shares. You just change the terms of your holdings essentially and swap out one contract for the other.

In the Rollover hold trade in the attached example - I’m getting paid another 19k for extending my position by 3 months. If my margin maintenance was very healthy with no concern for margin calls, and i didn’t mind waiting for the stock to recover, this is a great way to be paid to wait.

In the rollover drop strike trade, a very defensive trade that I’ve done very very frequently, I’ve attached two examples - i can take a 5k hit and extend the option by 3 months and mostly pay for the drop in price with the new premium (except 5k). So essentially be the sleazy insurance man who changes the terms of the deal. Or if i always want to do a positive trade, i can extend it by 6 months and take 28k more premium, extend the contract by 6 months, drop the strike to 20 from 22. These trades drop your margin maintenance requirements, open up liquidity, and they make it even more unlikely that the strike price will execute. It’s a great trade to de-risk.

So yeah a loss can be managed. The biggest assumption you are making is that the underlying does not go to 0, if it doesn’t, you can keep getting premium until it recovers. If the underlying goes bankrupt and goes to 0, then you’re actually screwed - but etfs tend not to go to 0 usually.