I guess I'm quoting myself from 5 months ago to give an update to anyone who cares. Maybe this might inspire others to learn to take control of their portfolio themselves.

I literally shared my positions and my trades and that I was anticipating ending the year positive. Answered a bunch of skeptical folks and had my portfolio positions available for anyone to see and I believe I was anticipating/aiming for ending the year 50-60k positive.

Well...5 months later. How did I do?

August of 2022, when this thread was originally created, my account was negative 3.5 percent (10k negative) vs SPY that was negative 13%. I was beating SPY by 10% and I was pretty stoked about that.

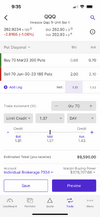

Dec 29th, 2022 - SPY is 19.73% negative YTD. The market has continued to slip. I'm up YTD $72393 now (essentially a positive 82k swing in 4-5 months - doing the trades I shared publicly here with everyone). I'm up 17.5% YTD, see below for proof. Which means I'm ending the year beating SPY by 37%.

View attachment 364012

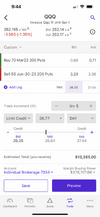

My current portfolio - I'm again attaching a screenshot from my current portfolio - the EWZ position is the big one, the other positions are just temporary, small, and just there to add an extra 1-2 percent total return and are minimal risk positions. They really don't matter, and these smaller positions will be closed once 30-40% profit is achieved. The EWZ position will likely be held for 366+ days for long term capital gains since the tax difference between long term capital gain vs short term capital gain alone will be 45k on that position (total $219k premium and profit if that position expires worthless). And this one position is 95% of the portfolio essentially.

View attachment 364013

Why I'm bullish on EWZ - Very high premiums, lowest price to earnings ratio in history, cash cow brazilian stocks making A LOT of money, literally 12-13% dividend right now; stock mostly taken a beating due to political instability. EWZ price to earnings is far below of EEM (emerging market peers) and their dividend is so high because of being so damn under valued. Now take something that's already undervalued and sell puts on a strike price that is essentially the lowest price point in many many years, then you're getting into "excellent return while very reasonable risk" territory.

Plan for 2023 - Hold current EWZ position to 366+ days and close to expiration (January 2024 is expiration for current position). This should net my account 160k in just slightly over a year as long as EWZ stays above $22 (todays closing price 28.16). That's a 33% return for 2023. If EWZ drops below $22, then I keep rolling my options in time, keep collecting premium, and wait for EWZ to recover above 22, and when that happens my options expire worthless and I walk away with massive premiums.

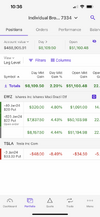

My biggest winners and losers - I'm attaching a screenshot of my biggest winners and losers for the year as well. Not every trade went accordingly so I think that transparency is important too. I'm learning to stick with my winners more and more and be more disciplined in that regard.

View attachment 364014View attachment 364015

Net worth trajectory - Looking back it's kind of amazing to see where I've come from. 3.5 years ago I was worth negative 80-100k when I graduated residency. In only 3.5 years I'm ending 2022 at 1.27M. 2 more years, I think we will be FI if we continue this trajectory, so age 36.

View attachment 364016

Lastly, I'm not a financial advisor or anything, just a guy passionate about personal finance who reads financial information for fun and entertainment, so this isn't financial advice, just an encouragement to read, learn and take control of your portfolio. I have nothing to gain or sell here, I just truly enjoy talking about this stuff (in real life and the internet). I have had dozens of folks send DMs regarding this stuff, so there are people who are interested in this stuff and have benefited from these conversations. So this post is for those people. If you don't like to read this, or are tired of these topics, or don't find value in this, that's fine, it's not for everyone. And seriously, don't ever hold large positions unless you really really really know what you are doing. I hope there was some value in this post to anyone that cares. Good luck everyone.