- Joined

- Dec 15, 2005

- Messages

- 17,216

- Reaction score

- 26,988

FOMO is always a terrible reason to invest. But I do hope you are able to profit from the cyclic pump-n-dump schemes going on.Get on or get left.

FOMO is always a terrible reason to invest. But I do hope you are able to profit from the cyclic pump-n-dump schemes going on.Get on or get left.

Looks like peer to peer lending for crypto speculation. Just let that sink in for a moment.What is NEXO lending and why would they pay me 12 percent interest ?

Slowly buying BTC ETH XLM over past four years. Cashed out 1M to USDC stablecoin. Now on NEXO lending platform gaining 10% interest. NEXO insured for 100M. Its definitely more tangible then gold and easy af to move with a few swipes of the screen.

Obviously in a huge bull run with eventual “correction”/crash still doesnt change that BTC has been the best performing asset of the last ten years.

I realize most here won’t go do the knowledge to understand what’s happening on global scale to the way we interact with currency and money (they are not the same), the digital revolution that’s occurring and a new asset class of digital assets that’s at the early stages. Maybe your money guy said it’s scam or pump and dump that’s going to zero. You should really fire them imo.

To the young medical student, residents and attending that are just starting out, learn about what money is, this new asset class how the world is changing and ask yourself, do you wanna be an early adopter or a laggard? When BTC hits 100K, the average person won’t be able to afford a full BTC.

BTC is digital gold and a way to store your hard work (energy) for tomorrow (time). BTC is scarce (21 million), divisible (1 BTC is broken into 100,00,000 pieces called satoshi), portable (global money that can be moved easily with an internet connection), permissionless and uncensorable (no bank can deplatform you and stop you from transacting on a peer to peer basis). This invention is akin to the invention of printing press did for communication.

I understand the older cats here may not want to put there money in a new emerging asset, but BTC (a some other Crypto) will be leading the way to final settlement of digital bearer assets (look up the SWIFT scam system and how many hops and fees your money has to go to when you send money abroad via western Union or even a check!). Final settlement for pennies on the dollar 24/7 and people think it’s going to zero or is a scam? 12 years of price discovery and BTC is still looked at as a scam. [emoji2363]

Love to!Can you explain in more detail to a more senior colleague what you are referencing?

Yes, I own some crypto but I still don’t understand the asset.

The interest rate is based on what percentage of your holdings is in NEXO. So you have to own NEXO as part of your portfolio for the good interest rates. And the risk is that NEXO or any other crypto fluctuates so much in value you have to keep an eye on it. You get the interest added to your account daily, get bonuses in NEXO from the company either quarterly or biannually I forget which and can always plant USDC in your account which is pegged to the USDollar. Could it be some Ponzi scheme Im not seeing? Sure it could but it is insured for 100M and is backed by Credissimo which has been doing loans for 15 years in Europe I believe.What is NEXO lending and why would they pay me 12 percent interest ?

For sure.I can see why more people from the boomer generation just buy Gold or Bitcoin. It’s easy to understand and fully backed by Coinbase without the need for a digital Wallet.

I’ve been buying gold since 2009. I’m up maybe 20 percent which is very poor vs the market.

I’ve been buying bitcoin for just a few years and I’m way way up. Clearly, bitcoin has been the better buy.

My main question/issue is what is the simplest way to own/store it without giving away to much in exchange fees, etc. if we are still a bit uncomfortable/unable to store it on a hard key (USB drive or what not).

I am torn between things like Coinbase versus things on stock market (GBTC etc.).

Any guidance/advice/basic breakdown would be awesome.

Somebody should tell Bill Gates he's investing in the wrong stuff:

Bill Gates is America's Largest Farmland Owner

In this Land Report exclusive, Bill Gates is identified as America's largest farmlandowner with more than 242,000 acres in 17 states.landreport.com

There are private REITs that invest in farmland, if I remember correctly. Most attending physicians satisfy the sophisticated investor rules.There is nothing wrong with that investment. See a common theme: move out of printable fiat assets into hard assets that are in limited supplies want by the people.

But, here lies the problem. What is easier to invest and make money while having minimal maintenance cost? BTC for the average Joes or farmland in Nebraska?

If you don't understand the technology, it's your call and money. It's also fine.There are private REITs that invest in farmland, if I remember correctly. Most attending physicians satisfy the sophisticated investor rules.

Crypto reminds me incredibly of the tulip mania (and many other Ponzi schemes).

Definitely. Because it's so hard to understand that a set number of coins is generated, and a bunch of suckers behave as if it were gold. Oh, wait, gold is also semi-worthless beyond the 7% or so industrial use (but at least it has some practical uses).If you don't understand the technology, it's your call and money. It's also fine.

But, at the end of the day, I just want people to be aware of the stealth theft inflicted by our leadership, take command of their finances, and protect themselves.

Definitely. Because it's so hard to understand that a set number of coins is generated, and a bunch of suckers behave as if it were gold. Oh, wait, gold is also semi-worthless beyond the 7% or so industrial use (but at least it has some practical uses).

This is a typical Ponzi scheme. The key is to get out before it crashes.

See on my end I have no idea what an REIT is or how to get in on one. Cryptos been right in front of me so Ive been able to access it.There are private REITs that invest in farmland, if I remember correctly. Most attending physicians satisfy the sophisticated investor rules.

Crypto reminds me incredibly of the tulip mania (and Ponzi schemes). Hopefully (for those invested), the mass delusion won't end overnight.

There are private REITs that invest in farmland, if I remember correctly. Most attending physicians satisfy the sophisticated investor rules.

Crypto reminds me incredibly of the tulip mania (and Ponzi schemes). Hopefully (for those invested), the mass delusion won't end overnight

Blockchain vs food chain.....I know which pony I'm betting on. 😎There are private REITs that invest in farmland, if I remember correctly. Most attending physicians satisfy the sophisticated investor rules.

Crypto reminds me incredibly of the tulip mania (and Ponzi schemes). Hopefully (for those invested), the mass delusion won't end overnight.

Gold has not been worthless for thousanda of years. Gold is a time tested currency. Even our founders knew Gold was the true world currency. Gold is t an investment. It’s more of an insurance policy against fiat currency. Gold generally holds up well in terms of purchasing power.Definitely. Because it's so hard to understand that a set number of coins is generated, and a bunch of suckers behave as if it were gold. Oh, wait, gold is also semi-worthless beyond the 7% or so industrial use (but at least it has some practical uses).

This is a typical Ponzi scheme. The key is to get out before it crashes. I hope you realize that the profit you make comes only from other suckers.

start a farmland crypto making it easier to move money and regular folks to access investing in it. hire coders put together a white paper and launch an ico. streamline the cash flow bro.Blockchain vs food chain.....I know which pony I'm betting on. 😎

www.farmland.finance

www.farmland.finance

Americans also believed in gods for thousands of years, then kind of stopped in the last decade. Good luck, Goldie!Gold has not been worthless for thousanda of years. Gold is a time tested currency. Even our founders knew Gold was the true world currency. Gold is t an investment. It’s more of an insurance policy against fiat currency. Gold generally holds up well in terms of purchasing power.

I think cryptocurrency and blockchain are revolutionary. While I own crypto I have reservations about purchasing large amounts of computer generated coins. So far, I’ve missed out on the chance to make a large sum of profit by holding my excess currency in cash vs crypto.

When you change your time horizon from months to years, you'll have a better understanding of maintaining purchasing power for tomorrow. Good luck to you.

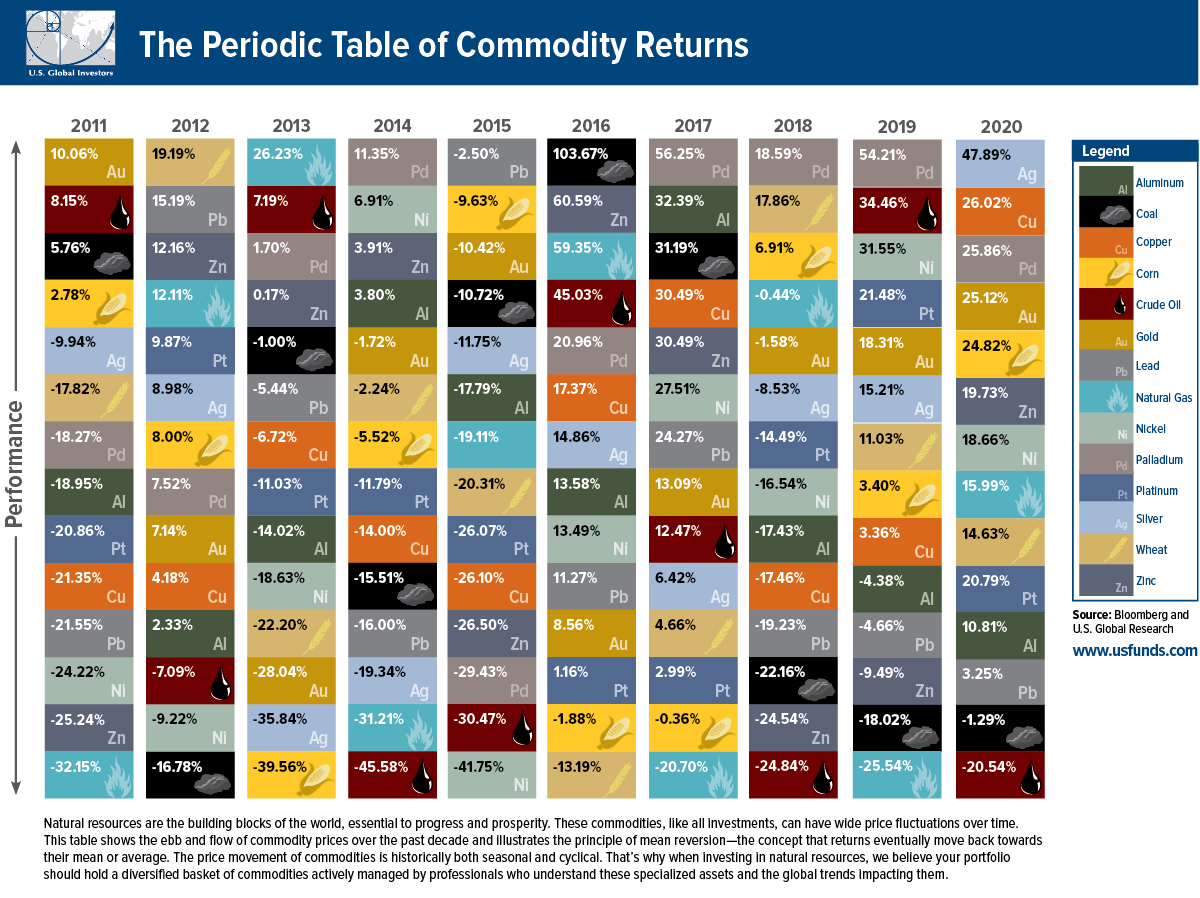

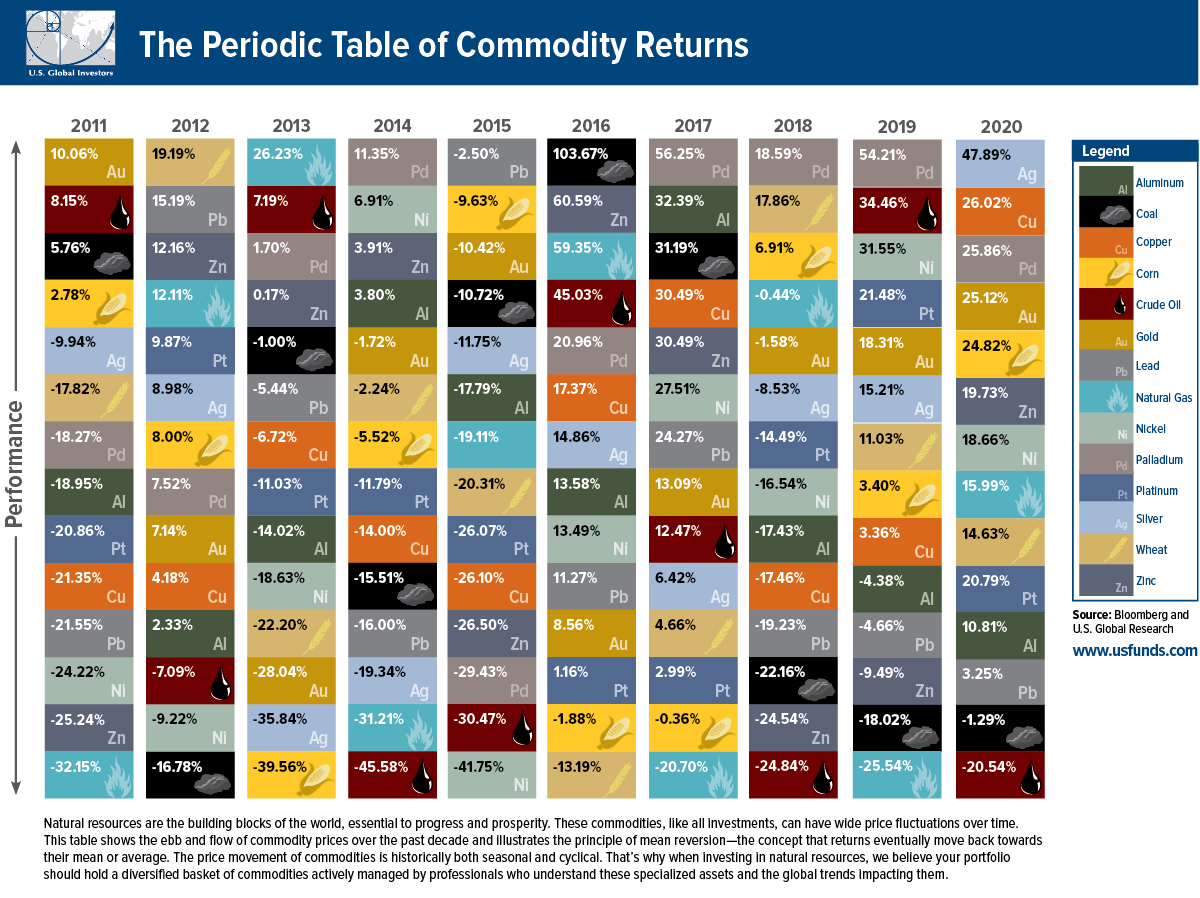

View attachment 327621

Note: Commodities tend to be a bad hedge against inflation. I posted this just for the various precious metal returns (Au, Pt, Pd, Ag).

hes also shorting tesla or at least said he was a month or two agoMike Burry of Big Short fame is also betting on farmland (and water rights). FWIW his call on COVID last year was very wrong.

For conservative investors this is the time to look at gold or other commodities. IMHO, commodities and metals are cheap relative to the fiat currency used to buy them. If you don’t like gold then look at other metals as a hedge against the devaluation of the US Dollar.

This post is about maintaining the purchasing power of the US dollar circa 2023 and 2024. Will the world ignore the largest debtor nation in the history of the planet forever? Can we just keep printing money without affecting what it buys?

By the time the average Joe figures out the US Dollar is no longer a good asset to hold what will the price of hard assets cost to acquire in that same fiat currency?

Sure, farmland like Bill Gates is buying up is a great idea. But, that doesn’t work for me. I need to buy Realty investments via etfs or mutual funds. I can also diversify into hard assets which will maintain their value.

I like good, solid companies which are fairly valued and produce stuff we need to buy. These dividend paying blue chip companies are also a good way to protect your purchasing power.

Ever try to make a large purchase of cocaine, meth, or heroin with a Visa card or bank wire? Me neither.How often do people need to transfer large sums of money instantly? How is a bank wire not adequate for this process?

Ever try to make a large purchase of cocaine, meth, or heroin with a Visa card or bank wire? Me neither.

Ever try to make a large purchase of cocaine, meth, or heroin with a Visa card or bank wire? .

I can only imagine that people who have had a giant ride up think it's going to keep going up, so they naturally don't want to cash out. FOMO is real.Has anyone or does anyone know anyone who has successfully made millions or even just hundreds of thousands of dollars by cashing out their bitcoin investments? Like for real, all this great talk about how valued it is and what a great investement, but what happens to the person who wants to cash out and retirement on the ten million valuation of their bitcoins? So far, I have met ZERO people like that.

Has anyone or does anyone know anyone who has successfully made millions or even just hundreds of thousands of dollars by cashing out their bitcoin investments? Like for real, all this great talk about how valued it is and what a great investement, but what happens to the person who wants to cash out and retirement on the ten million valuation of their bitcoins? So far, I have met ZERO people like that.

Nice.Yes. Neighbor’s son cashed out, bought a house in Lake Tahoe, and retired. My neighbor is retired Kaiser administrator in his 70s, his son is probably in his 40s.

Has anyone or does anyone know anyone who has successfully made millions or even just hundreds of thousands of dollars by cashing out their bitcoin investments? Like for real, all this great talk about how valued it is and what a great investement, but what happens to the person who wants to cash out and retirement on the ten million valuation of their bitcoins? So far, I have met ZERO people like that.

As long as you know that, historically, commodities have been a poor hedge against inflation.I own a materials ETF as part of my portfolio.

XLB is a massive, liquid ETF that invests in basic materials companies from the S&P 500. Its limited selection universe means it is heavily concentrated, with just a few holdings making up a huge chunk of the portfolio. Not surprisingly, XLB favors large-caps relative to our broader benchmark. Still, it offers reasonable exposure to the space. XLB is one of the most popular funds in the US materials segment, with a huge asset base and unmatched trading volume. It’s an excellent choice for occasional traders and institutions alike.

This may be the type of investment you can consider as well.

This attitude held by many of the classic investors that still dominate the market is what allows me to keep buying bitcoin at low cost and as those people cycle out of the market and we move into a completely digital future with people who don't resist the change I'll cash in and then cash out. Easiest long term play there is.Any currency is a convenient replacement of barter.

We barter "real" goods and services, things that actually we need, we just use money to represent their value. Accordingly, a currency should have real value behind, even if just by convention. It should be easily replaceable with real stuff.

The reason we've been using paper (fiat) currencies has been the power of the central banks and governments behind them (before that we used coins with real industrial value). The value of such a currency depends directly on its backer. A fiat currency is a contract, and it's as good as the people and the economic power behind that contract.

So I ask myself, what the heck is BTC? Who guarantees its value? And people tell me that it's the market, it's everybody. As long as we accept it as a convention, it's even better than a (multi)national currency, because it's not "controlled" by a central bank. That's BS. Everybody's property is nobody's property. What makes it so fragile is exactly that we have no central bank and economy propping it up. Its value is determined mostly by human psychology, and no country really cares if it loses value.

Now the crypto dreamers are counting on major investors and financial institutions starting to play the BTC game, for FOMO. So what? It's still a Ponzi scheme (there is no economic value being added, as in the case of a stock, or even a fiat currency with a real economy behind it). Given that 85% of all BTC has already been mined, the value of BTC is determined mostly by the demand for it (given that the supply is limited). And the demand depends on the number and psychology of speculators and real-world applications.

Except that I don't see crypto having many real-world applications, not in a world obsessed with tracking money (e.g. for anti-terrorism purposes), exactly because it's anonymous. The other advantage would be convenience. But all my online dollar accounts are as convenient, if not more, and they have the power of a big and serious economy behind them. I can pay with my VISA/Mastercard cards almost anywhere in the world, without even bothering to exchange money into the local currency. Of course, the State can always take away my money, which is much harder with crypto. Crypto are the illegal offshore accounts for regular people (in the legal version, one is obliged to disclose all of one's financial holdings, including crypto, to the State anyway). Again, who will need to hide his money and transactions from the State, except mostly for criminals (or dissidents)?

So the only "value" of BTC I see is speculative, like in a lottery. When all is said and done, some people will win, a lot of people will lose. One can make serious profits in a Ponzi scheme, as long as one is early enough. Just don't forget that it's a Ponzi scheme, i.e. your investment in it may become worthless tomorrow. In investing, bad things happen fast, good things happen slowly. There's no such thing as a free lunch. Crypto will keep existing as long as the crypto cult exists; when something bad happens, which will prove crypto worthless, it will disappear in a puff, like all the Ponzi schemes before.

Have fun, just don't call it investing, and don't make it part of your retirement plans.

The four most expensive words in English: This time is different.This attitude held by many of the classic investors that still dominate the market is what allows me to keep buying bitcoin at low cost and as those people cycle out of the market and we move into a completely digital future with people who don't resist the change I'll cash in and then cash out. Easiest long term play there is.

This attitude held by many of the classic investors that still dominate the market is what allows me to keep buying bitcoin at low cost and as those people cycle out of the market and we move into a completely digital future with people who don't resist the change I'll cash in and then cash out. Easiest long term play there is.