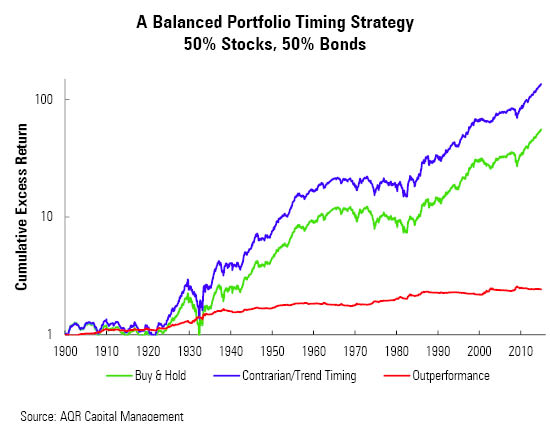

Well I can tell you my portfolio would be a lot smaller today if I had invested all my money exactly as the experts said to do. Instead, I prefer to go to my full equity exposure once a true bear market sets in. This strategy has been the one to use since 2000 and would trounce the notion that the same asset allocation should be used in all market conditions. These days the computers dictate a lot of the exit from the markets so as valuations get stretched the best approach is to scale back equity exposure and wait for a better entry point. This has worked like a charm since 2000 and is my long term strategy. I'll probably vary my equity exposure by 10-15 percent based on market conditions and valuations.

It's fine to keep buying equities every month but it would also be fine to use some technical Analysis along with fair value analysis to determine equity exposure. Stocks are not cheap right now and some are very expensive. Historically, that has led to underperformance.

The investing gurus are using data prior to the entry of super computers, ETFs and regular investors being able to sell with the click of a mouse. I submit to you this has changed the way the market acts and the speed in which things now move. That's why you can see flash crashes and vast price movements in minutes. I agree it's hard to time the market but it's not hard to keep cash on the sidelines for bear markets especially when the current bull market is long overdue for a correction. I'm not advocating single stock selection but rather common sense investing based on valuation and basic technical analysis.

Hey Blade, can you point me in the right direction on where to start learning about the technicals or some charts that show what's breaking down. Thanks

.....

.....