But it hard to time the market. After all if u put 10k in 2000. In 2010. U still would have had the same 10k (due to stock market crash 40% in 2001 and of course the crash in late 2008).

That's only true for dollars invested exactly at the peak. If you were continually investing all along, you made a lot of money from 2000 to 2010 because you would've had so much invested at much lower points rather than just at the peak.

So yes, if you put all your money in at the top of a bubble it will be a long time before you get ahead. But if you just keep investing day after day, month after month, and year after year you are nearly guaranteed to come out ahead.

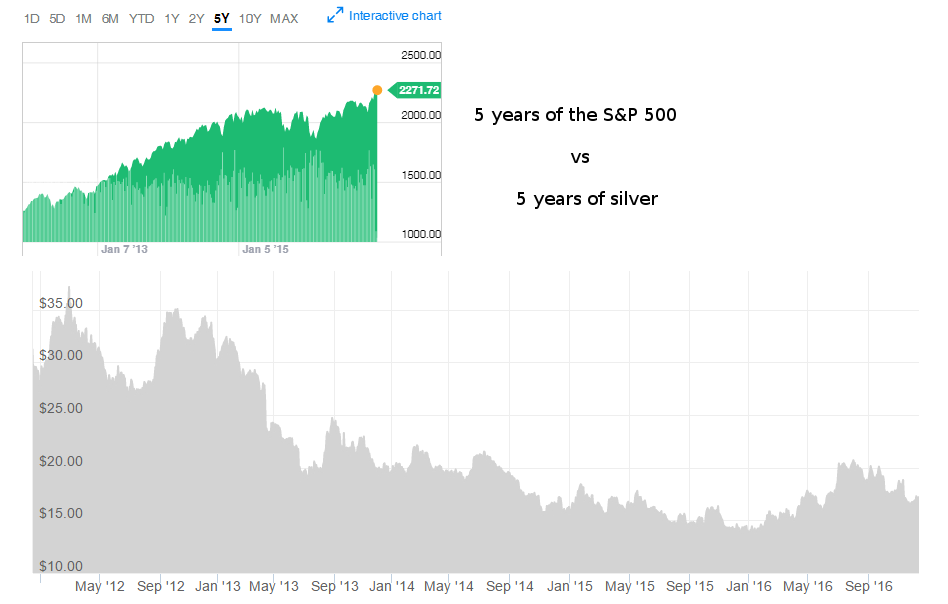

The moral of the story? Everyone should stop trying to predict where the market is going in the next 12 months and just stick with the plan. People have been strongly calling for a bear market since 2011. 5 years later and it's gone up this whole time. If you sat out this entire time (or worse took a net short position), you may have done permanent harm to your portfolio.