- Joined

- Jul 16, 2003

- Messages

- 6,025

- Reaction score

- 3,785

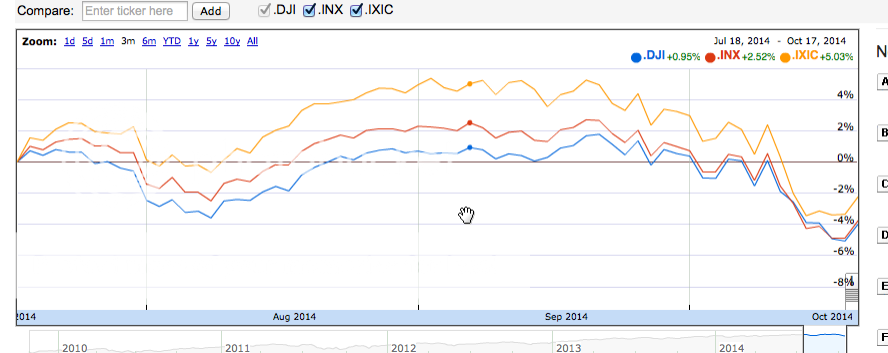

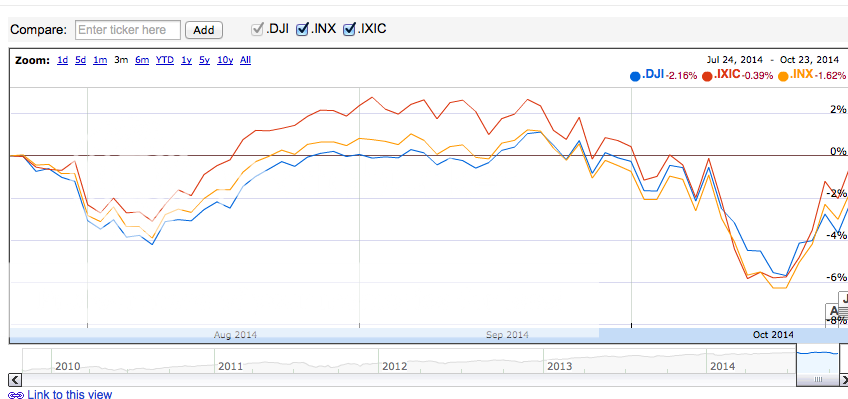

Or buying opportunity?

I'm buying. Added strong positions with RIG, XOM, NXPI, Dividend Funds, NASDAQ and Total Stock market. Started yesterday and will continue to do so over the next 5-10 days.

How are you guys playing this last sell-off. In my opinion, the correction was overdue and we are still in a bull market.

Europe/Ebola is holding us back.

I'm buying. Added strong positions with RIG, XOM, NXPI, Dividend Funds, NASDAQ and Total Stock market. Started yesterday and will continue to do so over the next 5-10 days.

How are you guys playing this last sell-off. In my opinion, the correction was overdue and we are still in a bull market.

Europe/Ebola is holding us back.