- Joined

- Jun 23, 2007

- Messages

- 3,816

- Reaction score

- 1,250

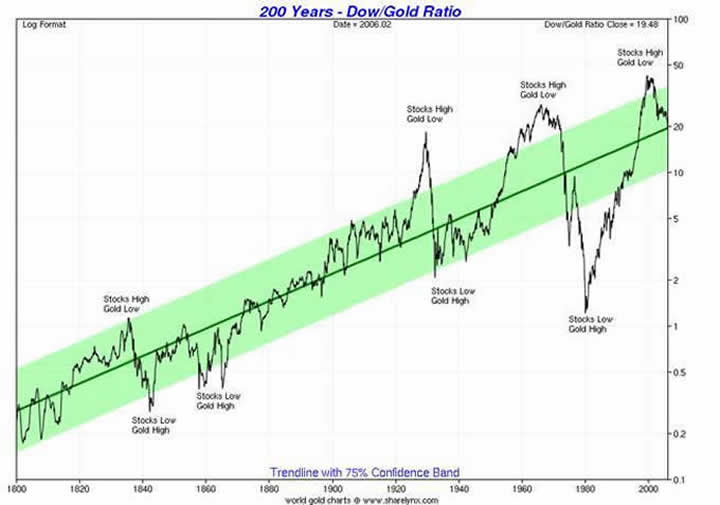

I'm scared. I honestly am. I wrote about the economy going down the crapper when Bear Sterns collapsed, but I'm still not prepared. I cannot find that thread but it is somewhere. The citizens are broke. The States are broke. The Federal Government is broke. We will borrow more money from poor foreign countries until we cannot borrow anymore. Then it will suddenly be Thunderdome(Mad Max). I'm sure people will kill each other for food. People might eat each other for all I know.

Latest news say that the States are asking for 1 trillion dollars to provide normal services such as education, welfare, and infrastructure. Makes me think twice whenever a non responsive bed ridden pt comes to the OR... Why waste millions of dollars in one person so they can have a crappy quality of life when you cannot provide essential services to the rest of the population? We are due for a rude awakening. We will have to re-examine our moral beliefs during this down turn. Is life really priceless? We clearly cannot provide everything for everyone. Should people starve while millions are spent in prisoners, for example? Should we kill the prisoners because people are starving? Same goes for the chronically ill, the traumas, prematures... Spending millions in a few so they can be eaten by a hungry mob does not seem to be the answer.

On a personal level, how are you preparing for what's coming?

I'm reading a lot. I have focused all my savings to pay down debt. I don't have any assets to protect, though.

Latest news say that the States are asking for 1 trillion dollars to provide normal services such as education, welfare, and infrastructure. Makes me think twice whenever a non responsive bed ridden pt comes to the OR... Why waste millions of dollars in one person so they can have a crappy quality of life when you cannot provide essential services to the rest of the population? We are due for a rude awakening. We will have to re-examine our moral beliefs during this down turn. Is life really priceless? We clearly cannot provide everything for everyone. Should people starve while millions are spent in prisoners, for example? Should we kill the prisoners because people are starving? Same goes for the chronically ill, the traumas, prematures... Spending millions in a few so they can be eaten by a hungry mob does not seem to be the answer.

On a personal level, how are you preparing for what's coming?

I'm reading a lot. I have focused all my savings to pay down debt. I don't have any assets to protect, though.