wow, some predents are so incredibly naive. Unless you have significant help from family or you win the lottery while you're in school, I think it's pretty safe to say that it'd be damn near imposisble to pay off 300K in 5 years, even as a specialist.

Like a few others have said, after you subtract taxes, living expenses, car expenses, house mortgage, etc. from your gross pay as a dentist fresh out of school, how much per month do you think you'll be able to put towards repaying your 6 figure loan? Definitely not enough to pay it off in 5 years.

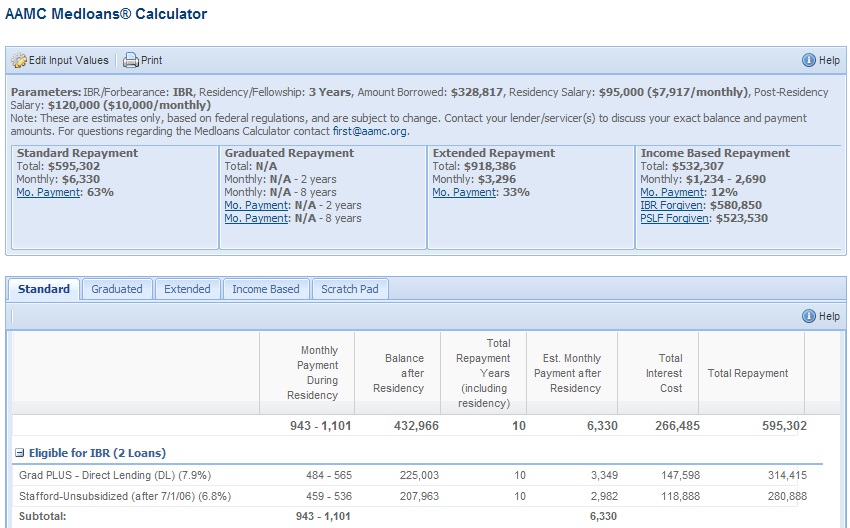

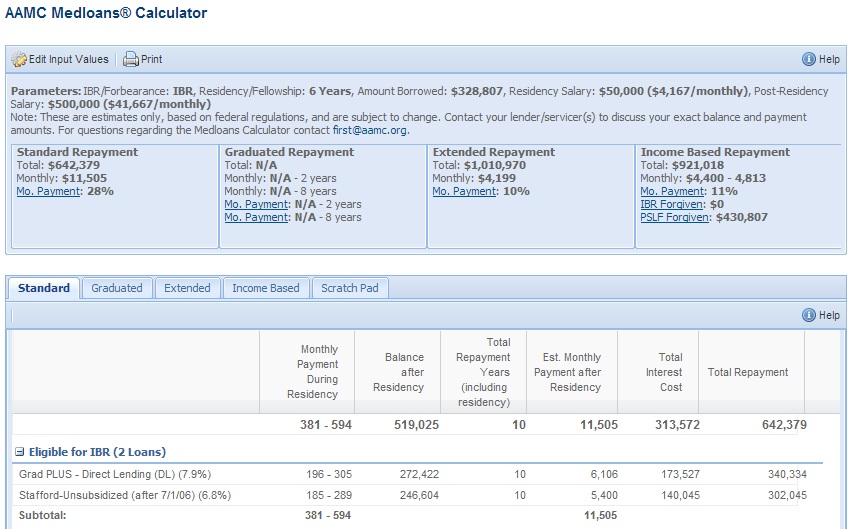

So realistically, you're looking at a 30 year loan. And don't forget that interest starts accruing WHILE you're in school, so it's not just the 300k that you'll owe back. At an interest rate of 6% (that's an optimistic figure), I'll let you do the math on how much interest you'll accrue on a $300,000 principal over ~35 years.

<-- take a look in the mirror after you calculate this number... I'll bet the expression on your face looks something like this.