- Joined

- Oct 26, 2008

- Messages

- 7,495

- Reaction score

- 4,186

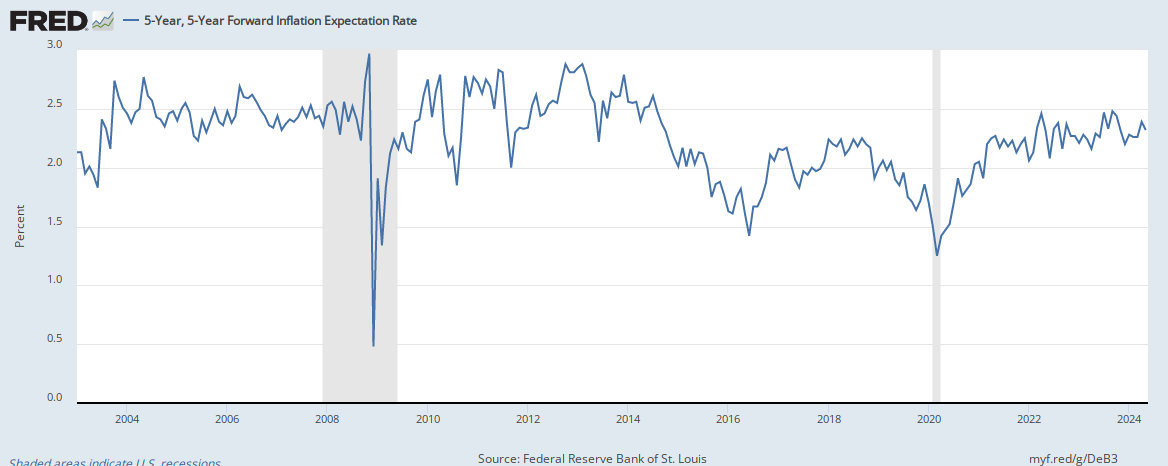

The Fed’s official position is that inflation will spike temporarily, then return to under 2% which is their long term target. I recently spent $90 for a tank of gas and $15 at McDonald’s just for myself so I don’t believe them. It feels like inflation is already here.

i dont know about gas since i cant afford a car but spending 15$ at mcdonalds for myself has been pretty easy for a while..