value is a different story altogether. for those with means, the top schools provide a significant advantage. if you have to take out a 200k loan to go to sarah lawrence then i dont have much sympathy.Please explain the value in terms of the coinciding debt.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Yahoo Finance: FIRE Movement Pioneer Returns to Work

- Thread starter drusso

- Start date

- Joined

- May 30, 2005

- Messages

- 23,121

- Reaction score

- 14,677

Michigan is unique. Go out in public. Try not to find an M hat or shirt. The alumni are everywhere and super friendly. Was on spring break in Jupiter and 2 people stopped to talk to me about the M at a shrimp store. Also, Ross school of business is a top tier MBA.

- Joined

- Sep 12, 2010

- Messages

- 6,101

- Reaction score

- 3,104

I want to spend it on my future. Kids don't fit in FIREWhat's the point of working this hard and making all this money if we aren't spending it on our childrens' futures?

- Joined

- Jan 9, 2010

- Messages

- 13,314

- Reaction score

- 7,588

Objectively speaking, I don't think the product that is being sold is worth the cost. I think it just comes down to people being attracted to name brands and prestige. And the prestige comes from research publications and grants and other factors that have little to do with education.do you folks think NYU or Columbia is worth the cost?

Daughter wants to go if she can get in a few years from now

But if I had a kid that was super excited and got into one of those schools, I would melt in a heartbeat.

- Joined

- Aug 8, 2011

- Messages

- 4,161

- Reaction score

- 2,472

a 911 Turbo S isnt going to disappoint you.Drive a Porsche but nickel and dime your kid’s future

Sometimes we spend money on things because they’re nice

Good thing about being a lazy millennial is being too lazy to have kids to waste money on.Man - all this doom and gloom makes me glad I'm a lazy millennial who won't work hard enough to worry about such things for my kids.

- Joined

- May 26, 2010

- Messages

- 5,075

- Reaction score

- 2,936

I think it'd be a lot of fun to live in NYC as a college student, especially if she has spending money.do you folks think NYU or Columbia is worth the cost?

Daughter wants to go if she can get in a few years from now

- Joined

- Jun 16, 2021

- Messages

- 3,515

- Reaction score

- 3,907

A LOT of spending money.I think it'd be a lot of fun to live in NYC as a college student, especially if she has spending money.

D

deleted131481

I agree completely with this statement. We have a couple great in-state schools and only a few Ivy and and other select schools as above provide an advantage in terms of connections, alumni, name brand, etc.I think it is worth it to pay $$$ for a ivy league school, or one of the few private universities that is considered in the same breath as the Ivy league

such as MIT, Caltech, Stanford, Juilliard, Duke. Those 15 names will open many doors for rest of their lives.

I just don't think it is worth it to pay full freight for a regular private university or out of state tuition at a "national" state public university.

Now if one of those two school types can give you a good financial package so that the private university/national state university is 1.5 x the cost of the top local state university, I can somewhat understand.

However, I don't understand paying 5x the cost of the top state university for someone to attend a private university or out of state tuition at a public university

It also depends on what they're studying. Perhaps only Caltech and MIT in that list provide a significant advantage in engineering or CS over a top state school. Undergrad premed probably does not matter much one way or the other. If someone wants to do finance or something entrepreneurial it may be worthwhile to go to an Ivy, but even then it's not clear cut.

- Joined

- Sep 14, 2009

- Messages

- 5,665

- Reaction score

- 7,807

I picked what I thought was the lesser college at the time, because they offered me half tuition and a special program. Now people are bribing their kids into it. Things change. Also chose the medical school that offered me money. Huge cost savings for me and my parents, and I don’t think I ended up in a worse position than someone educated through the Ivies.

- Joined

- May 30, 2005

- Messages

- 23,121

- Reaction score

- 14,677

Sons friend: 35 ACT, 1550 SAT.

Aerospace Engineering.

Choose between MIT $80k or Georgia Tech (free)

Aerospace Engineering.

Choose between MIT $80k or Georgia Tech (free)

- Joined

- Jun 10, 2011

- Messages

- 408

- Reaction score

- 226

I went to 5 colleges in 5 years (long story). Went to my state med school, $25k/year. Residency and fellowship at a very good program. Don't need a prestigious, expensive school to be successful. Barring significant scholarships, will be strongly encouraging my kids to go to state schools.

Last edited:

- Joined

- May 30, 2010

- Messages

- 2,182

- Reaction score

- 2,074

MIT in a heartbeat, IMOSons friend: 35 ACT, 1550 SAT.

Aerospace Engineering.

Choose between MIT $80k or Georgia Tech (free)

- Joined

- May 30, 2010

- Messages

- 2,182

- Reaction score

- 2,074

They definitely can fit in FIRE. We are one and done in terms of kids but plan on fully(or mostly) covering undergrad and grad school as well as retiring around age 55 with an 8 digit net worth. Obviously we could retire earlier than that with a smaller nest egg but that's up to your own goals.I want to spend it on my future. Kids don't fit in FIRE

- Joined

- Sep 14, 2009

- Messages

- 5,665

- Reaction score

- 7,807

Rankings say they’re #1 and #4. I had no idea Georgia Tech was so good for aerospace engineering, it wouldn’t be a bad idea to stay there.Sons friend: 35 ACT, 1550 SAT.

Aerospace Engineering.

Choose between MIT $80k or Georgia Tech (free)

Although there is the advantage of your kid meeting and dating the kind of people who get into MIT

- Joined

- Nov 11, 2012

- Messages

- 2,216

- Reaction score

- 1,500

Another top ranked engineering school that most don't hear about is Cooper Union in NYC. They used to be free but now every student gets a 50% merit scholarship if admitted. Net tuition $22,275/yr. They plan to give full scholarships again in 2028/29.

honestly, its a crappy situation, but a kid should really only attend the uber expensive private liberal arts schools if they are rich. or if they get a scholarship or grant. it doesnt make sense for a middle class family or the student themselves to shoulder the burden of exorbitant tuition. that being said, those students still do have a leg up in the professional sphere.

- Joined

- May 30, 2010

- Messages

- 2,182

- Reaction score

- 2,074

Where would you put children of Pain Doctors in terms of socioeconomic class?honestly, its a crappy situation, but a kid should really only attend the uber expensive private liberal arts schools if they are rich. or if they get a scholarship or grant. it doesnt make sense for a middle class family or the student themselves to shoulder the burden of exorbitant tuition. that being said, those students still do have a leg up in the professional sphere.

- Joined

- Oct 23, 2005

- Messages

- 8,113

- Reaction score

- 5,880

Upper middle class. Not rich, not poor.Where would you put children of Pain Doctors in terms of socioeconomic class?

So scholarships and grants still matter for those parents, particularly for parents with multiple kids.

Clearly upper middle class parents with 1 kid have more money to spend on overly expensive colleges than those with 3 kids.

- Joined

- Feb 2, 2008

- Messages

- 2,532

- Reaction score

- 1,015

Looks like this went the way of discussing college expenses:

Physicians, generally, will not qualify for need based aid

A lot of the #elite schools do not offer much, if any, Merit aid (they don't have to)

We are in the same boat as Steve that there will be a specific sport component to our decision making

Already tailoring the list of prospective schools that have merit + sport + high academics, but that is a tough category to fill, and no guarantee of recruitment in that vein

We also do private high and middle school already (boarding $$$), but were able to negotiate. two mortgages per month currently but cash flowing it and clipping coupons (literally)

Physicians, generally, will not qualify for need based aid

A lot of the #elite schools do not offer much, if any, Merit aid (they don't have to)

We are in the same boat as Steve that there will be a specific sport component to our decision making

Already tailoring the list of prospective schools that have merit + sport + high academics, but that is a tough category to fill, and no guarantee of recruitment in that vein

We also do private high and middle school already (boarding $$$), but were able to negotiate. two mortgages per month currently but cash flowing it and clipping coupons (literally)

- Joined

- May 26, 2010

- Messages

- 5,075

- Reaction score

- 2,936

Rich and wealthy. Let's keep things in perspective. Median income for Americans is less than $70k, and that's per household.Where would you put children of Pain Doctors in terms of socioeconomic class?

Compare that to the RVU thing you guys keep talking about. Pretty much everyone in here is in the top 1%. If not, then definitely in the top 2-5%. Not too shabby.

- Joined

- Jan 9, 2010

- Messages

- 13,314

- Reaction score

- 7,588

If the kid is taking out loans - GT. Assuming he wants to go to MIT, if the parents have plenty of money to spend, earning 300+/year in their 30s-40s, then MIT.Sons friend: 35 ACT, 1550 SAT.

Aerospace Engineering.

Choose between MIT $80k or Georgia Tech (free)

It's like buying a Porsche vs a Toyota. One is a better value, the other has more prestige. In 15 years, they will both be sold and no one cares about that car you once owned.

Where would you put children of Pain Doctors in terms of socioeconomic class?

depends.

depends on if you are married to a doctor or not.

i am not.

but in general, we should be able to afford to send our kids anywhere we want.

529 plans not doing so hot the last couple years. looking for a rebound in the next few years.

- Joined

- Oct 7, 2011

- Messages

- 16,402

- Reaction score

- 7,026

Georgia tech is a great school for STEM.

if he wants to do STEM, prob the way to go.

MIT is a different beast because there are other avenues outside of STEM a grad may get in to. if he isnt sure about his future career, then consider MIT.

and personally, Beantown is an amazing city.

Michigan has one of the largest alumni associations in the US. We are everywhere.

#1 place to live for quality of life (US News), #8 overall.

#2 best place to live overall in 2022 (liveability.com)

#3 Top public school

#6 undergrad engineering

#4 undergrad business

if he wants to do STEM, prob the way to go.

MIT is a different beast because there are other avenues outside of STEM a grad may get in to. if he isnt sure about his future career, then consider MIT.

and personally, Beantown is an amazing city.

Michigan has one of the largest alumni associations in the US. We are everywhere.

#1 place to live for quality of life (US News), #8 overall.

#2 best place to live overall in 2022 (liveability.com)

#3 Top public school

#6 undergrad engineering

#4 undergrad business

- Joined

- May 30, 2005

- Messages

- 23,121

- Reaction score

- 14,677

I’m sure my son will do the work to get to where he needs to in life. I think his friend is going to MIT because he really wants to be at the jet propulsion lab. I wish SDN had an aerospace engineering forum to ask the question is MIT worth it over Georgia Tech. Clearly, both are great schools with a lot of prestige. MIT may have inside connections to the most desirable aerospace jobs.

- Joined

- Mar 23, 2020

- Messages

- 128

- Reaction score

- 166

The choice is clear, only MIT has a Wearables Club

- Joined

- May 5, 2005

- Messages

- 1,523

- Reaction score

- 748

The ability to pull all that off and monetize it is very rare. Even if one had it, there is still an element of luck/timing/chance that also plays a part in business success. If it were that easy, everyone would be doing it.That’s what I plan on nudging my kid toward. Entrepreneurship and having a strong background in engineering/computer science/sales. If you can create something and then the ability to sell it, the world is your oyster.

- Joined

- May 5, 2005

- Messages

- 1,523

- Reaction score

- 748

What’s the weather ranking?Georgia tech is a great school for STEM.

if he wants to do STEM, prob the way to go.

MIT is a different beast because there are other avenues outside of STEM a grad may get in to. if he isnt sure about his future career, then consider MIT.

and personally, Beantown is an amazing city.

Michigan has one of the largest alumni associations in the US. We are everywhere.

#1 place to live for quality of life (US News), #8 overall.

#2 best place to live overall in 2022 (liveability.com)

#3 Top public school

#6 undergrad engineering

#4 undergrad business

- Joined

- Jul 6, 2008

- Messages

- 4,499

- Reaction score

- 7,370

Before I had kids, I had the mindset of - I will pay for a public college and they are on their own after this. Similar to Buffet's mentality.

Now that I have kids and great connections, I have done a 180.

Now that I am FIRE and have a nice nestegg, most of my possessions will go to my kids so why not let them have some now when they can enjoy it.

What is the point of dying at 90, giving everything to my kids who are now 60? My grandkids would get the most benefits and I have no idea what kind of relationship I will have with them.

Now that I have kids and great connections, I have done a 180.

Now that I am FIRE and have a nice nestegg, most of my possessions will go to my kids so why not let them have some now when they can enjoy it.

What is the point of dying at 90, giving everything to my kids who are now 60? My grandkids would get the most benefits and I have no idea what kind of relationship I will have with them.

- Joined

- Jun 26, 2008

- Messages

- 1,701

- Reaction score

- 2,792

"If you want to make God laugh, tell him your plans..."

A FIRE movement pioneer who retired early with $3 million at age 34 says he must return to work to afford his kids’ college education

Sam Dogen, 45, spearheaded the FIRE blogosphere when he retired early a decade ago. Now, he is trying to return to work.finance.yahoo.com

I thought it came out that his post was a late April fool's type joke.

The guys a doofus though. Just posts financial shock porn to drum up interest. I think he made some fake budgets on how someone can be very financially limited with mid six figure salaries.

He's a little full of himself. He claims he could monetize his newsletter to the tune of $200,000 a year but doesn't out of the goodness of his heart. I'm just slightly skeptical to that

I'm shocked people still read email newsletters and wondering what kind of financial advice can he even give that hasn't been reported numerous times on the Internet.

1. Save

2. Invest

3. Maximize income

- Joined

- Jul 6, 2008

- Messages

- 4,499

- Reaction score

- 7,370

You don't even have to make 90%, 300k/yr, pay 80K taxes. Live off 120K/yr, invest 100k/yr.If can make 90% mgma stay with the big group. U will end up with 8 figures in your blank account eventually.

Start when your 30, when you are 60 you will have 10M if the stock market does historical appreciation. The caveat is 10M in 30 yrs is worth about 3.5M today.

- Joined

- Dec 12, 2006

- Messages

- 3,069

- Reaction score

- 3,625

My partner went to UofM for medical school, then Harvard/Beth Israel/etc for anesthesia and pain training.

I went to Michigan State and did anesthesia and pain training in the DO system at community hospitals.

We get paid the same. I do kypho/DRG/etc and she is scared to do a caudal.

Save your money folks.

*Only exception is if the social network is more important for your job than your training. Business connections at Harvard MBA will help much more than business connections at Pheonix online MBA.

I went to Michigan State and did anesthesia and pain training in the DO system at community hospitals.

We get paid the same. I do kypho/DRG/etc and she is scared to do a caudal.

Save your money folks.

*Only exception is if the social network is more important for your job than your training. Business connections at Harvard MBA will help much more than business connections at Pheonix online MBA.

- Joined

- Jan 9, 2010

- Messages

- 13,314

- Reaction score

- 7,588

Wait, she's scared to do a caudal but gets paid the same as you, doing all the high-risk procedures? Seems like she's doing pretty well in that case...My partner went to UofM for medical school, then Harvard/Beth Israel/etc for anesthesia and pain training.

I went to Michigan State and did anesthesia and pain training in the DO system at community hospitals.

We get paid the same. I do kypho/DRG/etc and she is scared to do a caudal.

Save your money folks.

*Only exception is if the social network is more important for your job than your training. Business connections at Harvard MBA will help much more than business connections at Pheonix online MBA.

My partner went to UofM for medical school, then Harvard/Beth Israel/etc for anesthesia and pain training.

I went to Michigan State and did anesthesia and pain training in the DO system at community hospitals.

We get paid the same. I do kypho/DRG/etc and she is scared to do a caudal.

Save your money folks.

*Only exception is if the social network is more important for your job than your training. Business connections at Harvard MBA will help much more than business connections at Pheonix online MBA.

whoa.

how much did you have to pay for your fellowship? where you learned to do all of those things?

thought so.

apples to oranges

- Joined

- Aug 16, 2007

- Messages

- 6,520

- Reaction score

- 3,680

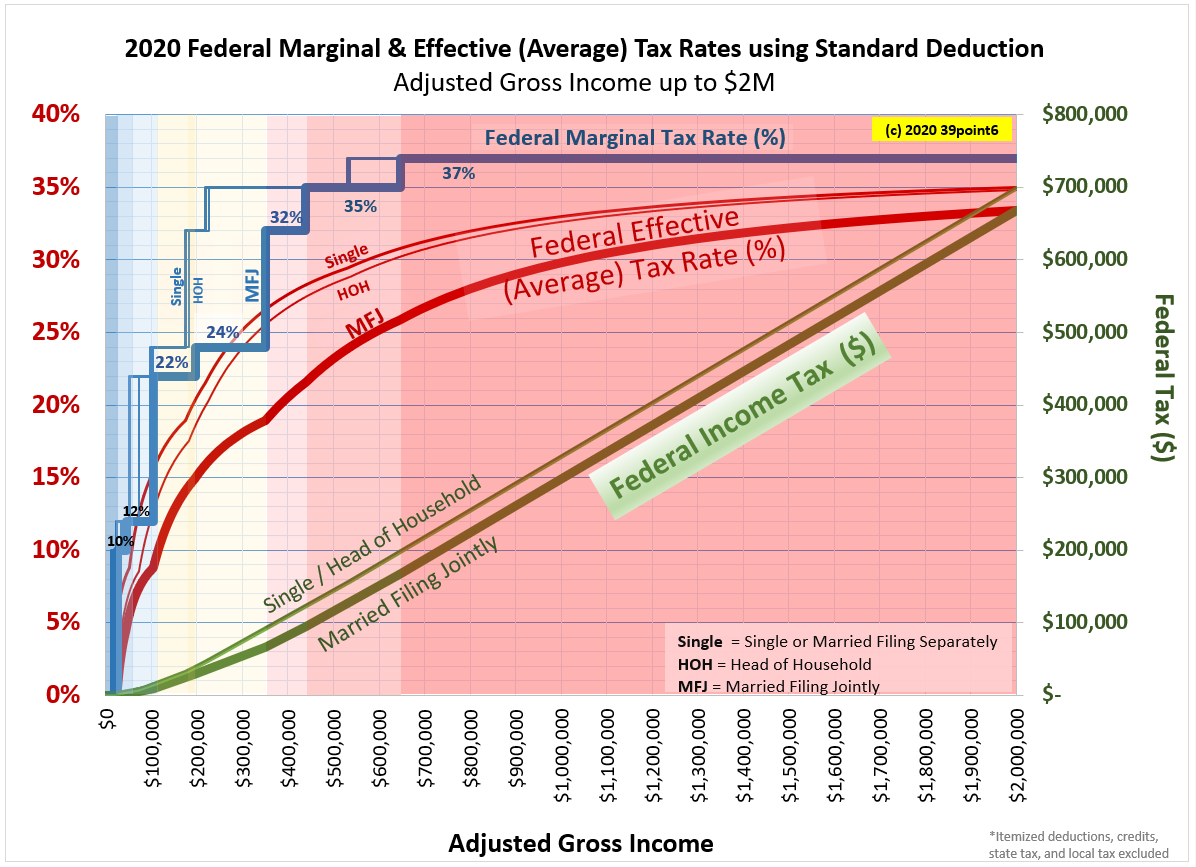

hold up something ain't right. How are you only paying a total of 80k in taxes on 300k? Your total tax burden including federal , state, social security, 3.8% medicare/medicaid tax, etc can't be 26%. Mine's around 40% and that's after taking deductions for sizable donations to charity. Also curious what amount you think is FIRE money, if you don't mind sharingYou don't even have to make 90%, 300k/yr, pay 80K taxes. Live off 120K/yr, invest 100k/yr.

Start when your 30, when you are 60 you will have 10M if the stock market does historical appreciation. The caveat is 10M in 30 yrs is worth about 3.5M today.

- Joined

- Dec 12, 2006

- Messages

- 3,069

- Reaction score

- 3,625

We're talking the dollar value of prestige. Applies to your school choice as well as your residency/fellowship training. No one cares who you trained with, as long as you're a good doctor.whoa.

how much did you have to pay for your fellowship? where you learned to do all of those things?

thought so.

apples to oranges

ya if i can get paid the same to do less work then that's the real win to be honest.My partner went to UofM for medical school, then Harvard/Beth Israel/etc for anesthesia and pain training.

I went to Michigan State and did anesthesia and pain training in the DO system at community hospitals.

We get paid the same. I do kypho/DRG/etc and she is scared to do a caudal.

Save your money folks.

*Only exception is if the social network is more important for your job than your training. Business connections at Harvard MBA will help much more than business connections at Pheonix online MBA.

i assume she's prescribing more though in which case i'd rather focus on the procedural load as you are.

- Joined

- May 30, 2005

- Messages

- 23,121

- Reaction score

- 14,677

Clubdeac=Lois Lerner.hold up something ain't right. How are you only paying a total of 80k in taxes on 300k? Your total tax burden including federal , state, social security, 3.8% medicare/medicaid tax, etc can't be 26%. Mine's around 40% and that's after taking deductions for sizable donations to charity. Also curious what amount you think is FIRE money, if you don't mind sharing

D

deleted131481

hold up something ain't right. How are you only paying a total of 80k in taxes on 300k? Your total tax burden including federal , state, social security, 3.8% medicare/medicaid tax, etc can't be 26%. Mine's around 40% and that's after taking deductions for sizable donations to charity. Also curious what amount you think is FIRE money, if you don't mind sharing

Federal Income Tax Calculator (2024-2025)

Calculate your federal, state and local taxes for the current filing year with our free income tax calculator. Enter your income and location to estimate your tax burden.

Effective tax rate on 300k single is 29.5%. If you are using tax advantaged accounts, married, have kids, no state income tax, etc can likely be 20-25% effective.

- Joined

- Aug 2, 2006

- Messages

- 1,293

- Reaction score

- 473

hold up something ain't right. How are you only paying a total of 80k in taxes on 300k? Your total tax burden including federal , state, social security, 3.8% medicare/medicaid tax, etc can't be 26%. Mine's around 40% and that's after taking deductions for sizable donations to charity. Also curious what amount you think is FIRE money, if you don't mind sharing

No, that sounds about right. The marginal tax rate is much higher, but I was always surprised by how low the overall tax rate was.

- Joined

- Oct 7, 2011

- Messages

- 16,402

- Reaction score

- 7,026

from my perspective, being UM alumni is worth millions - so that i dont have to admit that i went to Moo U 😏We're talking the dollar value of prestige. Applies to your school choice as well as your residency/fellowship training. No one cares who you trained with, as long as you're a good doctor.

but admittedly, going to MSU is infinitely better than being associated with THE school down south.

- Joined

- May 8, 2004

- Messages

- 4,163

- Reaction score

- 1,862

hold up something ain't right. How are you only paying a total of 80k in taxes on 300k? Your total tax burden including federal , state, social security, 3.8% medicare/medicaid tax, etc can't be 26%. Mine's around 40% and that's after taking deductions for sizable donations to charity. Also curious what amount you think is FIRE money, if you don't mind sharing

2020 Marginal & Effective Tax Rate Graphs

Here are the updated tax rate graphs for 2020. This year, in addition to married filing jointly (MFJ), I have included graphs for single / head of household (HOH). I have also made graphs combining…

39point6.com

this site is really helpful to get a sense of effective tax rates

- Joined

- Aug 16, 2007

- Messages

- 6,520

- Reaction score

- 3,680

I understand marginal and effective tax rates. I think my effective federal tax rate was somewhere around 30%. The problem is when you include ssdi, Medicare and Medicaid and whatever other little surcharges the government adds, my total income tax burden was around 37-38% this year. So not quite 40% but plenty high, much higher than 26%

As an aside my only deduction is charity. I am a W2 employee without kids or a home so essentially no other write offs, no one pays higher taxes than me

As an aside my only deduction is charity. I am a W2 employee without kids or a home so essentially no other write offs, no one pays higher taxes than me

Last edited:

- Joined

- Aug 2, 2006

- Messages

- 1,293

- Reaction score

- 473

Don't worry, kids cost a lot more than the tax write off returns.I understand marginal and effective tax rates. I think my effective federal tax rate was somewhere around 30%. The problem is when you include ssdi, Medicare and Medicaid and whatever other little surcharges the government adds, my total income tax burden was around 37-38% this year. So not quite 40% but plenty high, much higher than 26%

As an aside my only deduction is charity. I am a W2 employee without kids or a home so essentially no other write offs, no one pays higher taxes than me

Greatest move you made was no kids or house..kudos, both will age you at least 6-10 years if not moreI understand marginal and effective tax rates. I think my effective federal tax rate was somewhere around 30%. The problem is when you include ssdi, Medicare and Medicaid and whatever other little surcharges the government adds, my total income tax burden was around 37-38% this year. So not quite 40% but plenty high, much higher than 26%

As an aside my only deduction is charity. I am a W2 employee without kids or a home so essentially no other write offs, no one pays higher taxes than me

Similar threads

- Replies

- 75

- Views

- 5K

- Replies

- 10

- Views

- 1K