Deutsche Bank has become the latest big name on Wall Street to issue a bullish stock-market forecast for 2024, with analysts predicting the

S&P 500 will soar to a fresh all-time high next year.

Strategists at the bank said Monday that they expect the benchmark share index to trade at 5,100 points at the end of 2024, which would be 12% higher than its current level and way clear of the previous record of 4,768 points,

set in January 2022.

Bank of America, Goldman Sachs, RBC Capital Markets, and BMO Capital are among other well-known Wall Street firms that have predicted an upbeat 2024 for US equities.

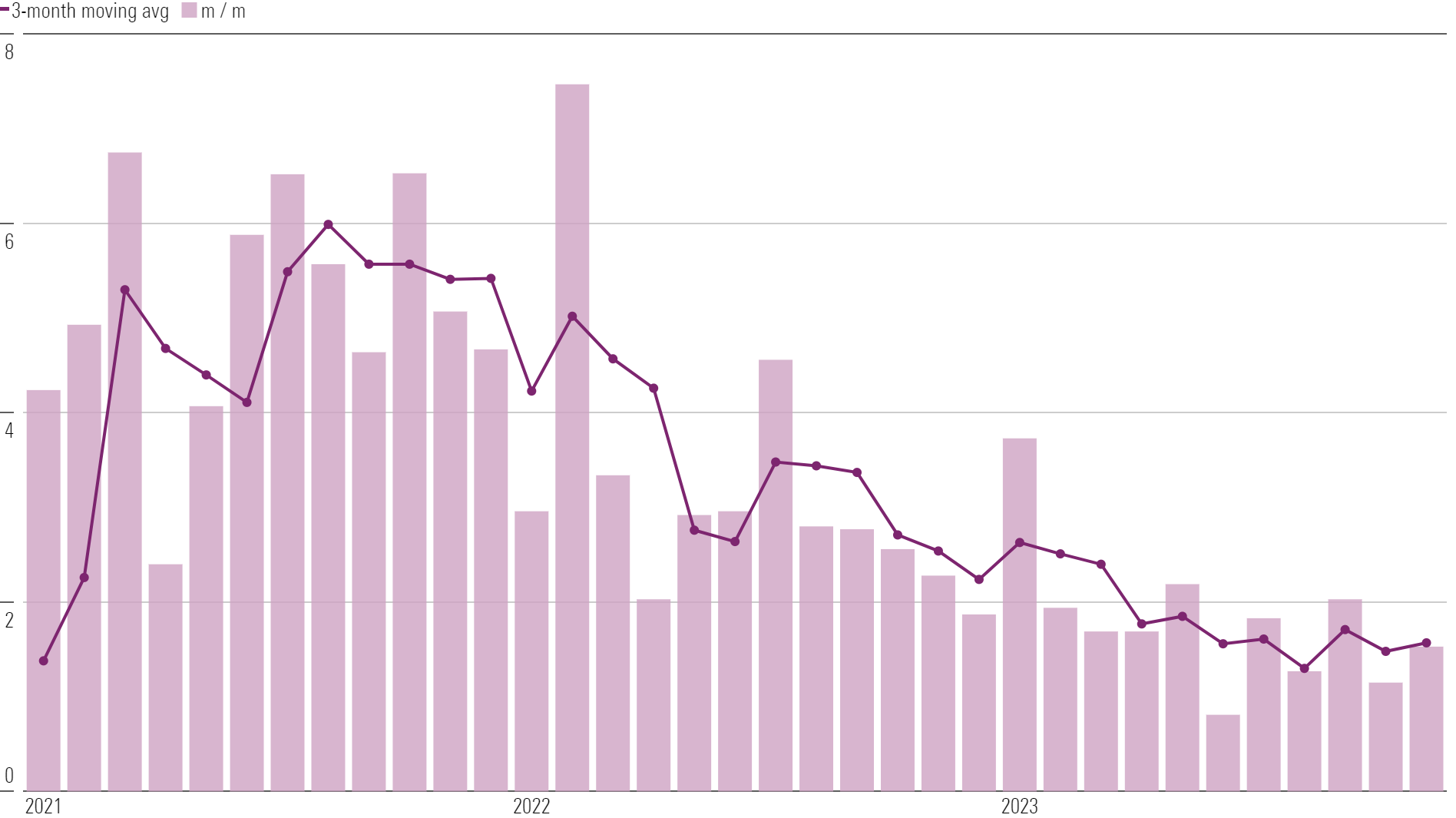

Deutsche Bank's bullish outlook is based off a view that the US is nearing a

"soft landing" economic scenario, with

inflation cooling while quarterly

GDP growth remains strong.