The Biden administration is considering using executive action to forgive

Americans’ federal student debt, the White House’s chief spokeswoman said Thursday, responding to pressure from Democratic lawmakers and progressive groups.

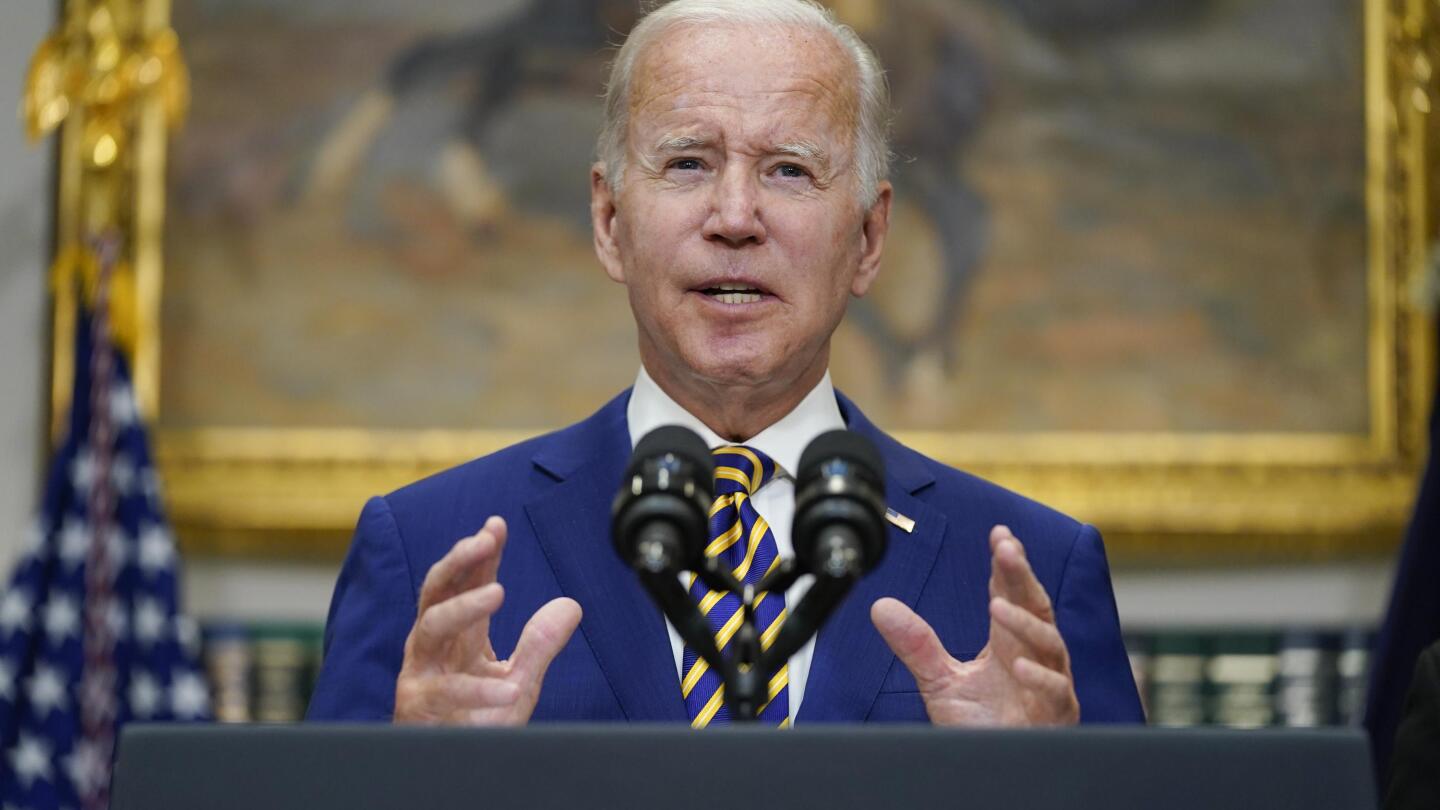

President Biden has previously questioned his ability to use executive action to forgive some or all of Americans’ federal student debt. He has instead urged Congress to pass legislation

to write off $10,000 in student debt for every borrower.

The White House shifted Thursday, saying it was open to forgiving debt without a move by Congress. “Our team is reviewing whether there are any steps he can take through executive action and he would welcome the opportunity to sign a bill sent to him by Congress,” Jen Psaki, the White House press secretary, wrote on Twitter.

Mr. Schumer urged Mr. Biden to use his executive powers to eliminate $50,000 in student loan debt for all borrowers.

“This debt holds people back from buying cars, from going on vacation, from starting families, from getting the job they want to get. It’s a huge anchor on our entire economy. And there’s very little that the president could do with a flick of a pen that would boost our economy more than canceling $50,000 of student debt,” Mr. Schumer said.