- Joined

- May 7, 2005

- Messages

- 22,783

- Reaction score

- 346

It's enough to buy that 100K car and a bag of cocaine every week. You can devote all your salary to the car/drugs because of the Medicaid Free Food Benefit program.

I would like to know what she thinks the "average medicaid recipient's salary" is. She probably thinks it's about 50K because to her, that's gotta be poverty level.

In all seriousness, it's just her making stuff up again. That's why I didn't comment on it. She's already been caught making stuff up/lying/exaggerating so many times in this thread and she just happily goes on doing the same despite people calling her on it repeatedly. I just don't understand how someone can be OK with being so ignorant about the world around them.

SHC, I will bite. What is the typical medicaid's family salary? How much is "way more" than 25k?

AFDC/TANF is what people traditionally considered "welfare checks." These programs, along with Social Security Disability, SSI, Unemployment and Social Security provide monthly "checks" or electronic transfers of funds that are intended to be a person's primary income or a supplement. No program hands out CASH but some do provide money that people can spend as they choose. That's how people generally pay rent, utilities, put gas in their cars, etc.

I've detailed this in other threads but I've attended two different pharmacy schools and neither allowed COA that was that generous. At my first school, I was able to obtain about $10,000 over tuition in federal loans (and I had an extra line item in my budget for child care) and it's about the same at my current school (although I don't borrow for expenses anymore).

The only way I could imagine needing $35,000 per year for living expenses was if the school was in a high cost metropolitan area. Even then, it seems high to me. I doubt that allowing living expenses that are almost 3X the amount of tuition is the norm. It's not in this area of the country, anyway.

I haven't lied about anything in this thread. Sure, I guess their BMWs, Corvettes, Land Rovers, etc. might cost less than 100K, but they are still abusing medcaid. Average BMW cost what? 40K to 70K at least...how could they afford that?

I might not know all the "correct" names for the many government programs out there, but you mention there was one (TANF?) that offer a source of income (free money) for those that need it, but that is "suppose" to be their primary income to pay for rent, uilities, etc. Well there you go, that's $$$ the government is giving out to these people that most likely could live without it if they budgeted their income better.

The average family income varies by cities, so I can't say exactly what the average is since it varies so much by cities. The city I live in now has an average household income of 68K a year (I looked it up on wiki). The city beside where I live Alpharetta, GA has a average household income of over 100K a year. That is the AVERAGE household salary. 25K is way below that so I would consider it low...I am sure there are medicaid families recieving aid with incomes above 25K a year. I wouldn't be surprise if there are people out there with incomes of 30K or 40K a year, but still file for medicaid and under report their salary. My whole point is it is POSSIBLE to live with very little money and NOT need the government, if you know how to budget you do not need the government to survive.

We had a test on this last year. You took this test. This was a question on the test. The answer was like 13,600 being the threshold for eligibility. That's half the number you quoted. 7200 for an individual with an additional 4000 for every dependent living in house. I'm sure those numbers have changed a little bit in the past year, but it didn't double.

We had a test on this last year. You took this test. This was a question on the test. The answer was like 13,600 being the threshold for eligibility. That's half the number you quoted. 7200 for an individual with an additional 4000 for every dependent living in house. I'm sure those numbers have changed a little bit in the past year, but it didn't double.

ZOMG!! SHC got something wrong? Surely it's you..you must be wrong.

Like I said, she's being willfully ignorant. And showing how spoiled/clueless she is. $25K, even today, is not the lowest of the low; it's not even minimum wage. You could probably support your family, albeit with not much more than what you'd absolutely need. And twenty years ago, you'd be even better off. It does depend where in the country you are. I could do much better in SC than I could in Seattle on that income.

And quoting the average income for one of the highest-paid counties does not make that anywhere near the average for the country.

We really shouldn't egg her on, but then we wouldn't be on page 9 of this discussion. And I'd have to be doing something productive, like laundry or studying for my PK test on Wednesday...

Drat, I always forget to take it out of the dryer! Thanks for reminding me. (100% serious - I need to go fold laundry.)

I am doing laundry right now and working on a presentation for Journal Club. This thread is MUCH more entertaining, especially now that CynicalIntern has joined us.

Glad I could be of service!

But now that I've joined in, I want to comment on something 5 pages back where she's saying empathy doesn't really matter, because she'd rather have the pharmacist who doesn't make any mistakes but doesn't give a damn about the patient versus the one who's super nice but makes a ton of mistakes all the time. That's the equivalent of saying I'd rather have a unicorn that a pixie that circles around my head - neither of the cases really exists. The former is a statistical impossibility, the latter would have been fired a long time ago if their error rate was as bad as this theoretical strawman. I would imagine that the range of errors between CVS's best pharmacist and their worst pharmacist in terms of errors is probably somewhere between 0.5 and 2 % error rates, and that's probably an extreme statistical outlier - And quite frankly, if you were to tell me (and most likely anyone who cared about their healthcare) that for every 50 prescriptions they got, 1 might be screwed up, but their pharmacist would care about them and work their ass off to try to help them...They'd keep going back to that pharmacist, versus the 1 in 100 pharmacist who pissed them off the first time they tried to fill a script and the pharmacist looked down their nose at them.

We had a test on this last year. You took this test. This was a question on the test. The answer was like 13,600 being the threshold for eligibility. That's half the number you quoted. 7200 for an individual with an additional 4000 for every dependent living in house. I'm sure those numbers have changed a little bit in the past year, but it didn't double.

7200+4000+4000+4000=19,600 for a family of one parent and three children. 25K is close enough. I can't remember anything from that class b/c I hardly studied at all for it.

7200+4000+4000+4000=19,600 for a family of one parent and three children. 25K is close enough. I can't remember anything from that class b/c I hardly studied at all for it.

Actually over 5,000 in income is a big difference when you are making such a small amount. We aren't talking 105,000 vs 100,000. So no, it's not "close enough."

Actually over 5,000 in income is a big difference when you are making such a small amount. We aren't talking 105,000 vs 100,000. So no, it's not "close enough."

LOL, add that to the list, couple of posts before it was about people with medicaid driving in $100,000 Mercedes and Land Rovers.

Couple weeks ago it was about NYC garbage men making 90K a year, when in reality they could max out at 60K...

It's a shame when a student knows more about next year's fashion line than they do about the programs they'll be participating in as healthcare practitioners.7200+4000+4000+4000=19,600 for a family of one parent and three children. 25K is close enough. I can't remember anything from that class b/c I hardly studied at all for it.

I've detailed this in other threads but I've attended two different pharmacy schools and neither allowed COA that was that generous. At my first school, I was able to obtain about $10,000 over tuition in federal loans (and I had an extra line item in my budget for child care) and it's about the same at my current school (although I don't borrow for expenses anymore).

The only way I could imagine needing $35,000 per year for living expenses was if the school was in a high cost metropolitan area. Even then, it seems high to me. I doubt that allowing living expenses that are almost 3X the amount of tuition is the norm. It's not in this area of the country, anyway.

Our COA is around 56K/yr, so I've been taking ~24K the last couple. But that's with $1550/mo in rent plus (now) $530/mo in health insurance for the wife and 3 kids. I'll be graduating with $216K in debt. And that's after starting with $60K in the bank from the sale of our condo. The good part is that we've been living relatively well in SoCal on $36K/yr (including my intern pay), so that by the time I'm out of residency we should be able to pay loans down fairly quickly.

C'mon nowThis country is broke, we are borrowing 43% of the budget and spending it on the welfare programs.

As a student who works, I've had taxes taken out of my check every year, and then every year, I got pretty much a complete refund. Everyone jokes that their tax refund is like a fun bonus.While everybody is preaching the virtue of being kind to the poor, nobody seems to be willing to address the the nation's tough budget crisis. This country is broke, we are borrowing 43% of the budget and spending it on the welfare programs.

As a student who works, I've had taxes taken out of my check every year, and then every year, I got pretty much a complete refund. Everyone jokes that their tax refund is like a fun bonus.

Rather than discuss cutting benefits to many people who genuinely need them, why not stop refunding tax funds to people who don't really need them? Honestly, how many of us have used that refund to buy frivolous crap? $1,000 per person (getting a complete refund) going back into the pot might make a big difference, and it's money you already consider "lost" to taxes during the year anyway.

C'mon nowStop with inflammatory, FALSE statements.

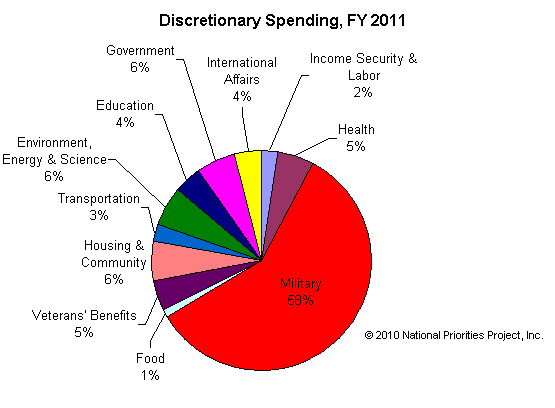

42% of federal income tax is spent on the military.

While everybody is preaching the virtue of being kind to the poor, nobody seems to be willing to address the the nation's tough budget crisis. This country is broke, we are borrowing 43% of the budget and spending it on the welfare programs.

We can increase the taxes of the well off some more, it isn't going to make up for the enormous gap. The welfare programs have to take a cut too. All the talks of empathy isn't going to make the numbers add up at the end of the day, but I foresee it's going to be all talking and do nothing until national bankruptcy hit us like a ton of bricks.

This is why I say this country has grown soft. Whether it's politicians, health care providers, or the poor, nobody is willing to be do what it takes any more.

As a student who works, I've had taxes taken out of my check every year, and then every year, I got pretty much a complete refund. Everyone jokes that their tax refund is like a fun bonus.

This is true. I never saw more government waste than when I served in the Navy. When your budget is based on a "use it or lose it" principle, then divisions feel required to spend all their money, regardless of whether they need to or not. October 1st was the start of the new fiscal year for us, and right around the end of September, you'd see all kinds of new furniture, televisions, etc, rolling in. Gotta make sure that money gets spent, or they won't give you as much in the coming year.The military can be cut a ton.

Well, the problem is that its just a drop in the bucket. You CAN'T cut medicare, disability coverage, SS, or coverage for children. It's just flat out wrong on so many levels.

You can't stop paying interest on debt unless you want our credit rating to die.

The military can be cut a ton.

The problem is more with taxes than spending. We pay too little - especially major corporations.

My checks were pretty thin. Assuming I paid about 1200/yr in taxes, that's $100/mo I could otherwise invest. Any recommendations on what I could invest that in?That just means you were over withholding on your taxes. The more financially savvy folks have $0 refund at tax time.

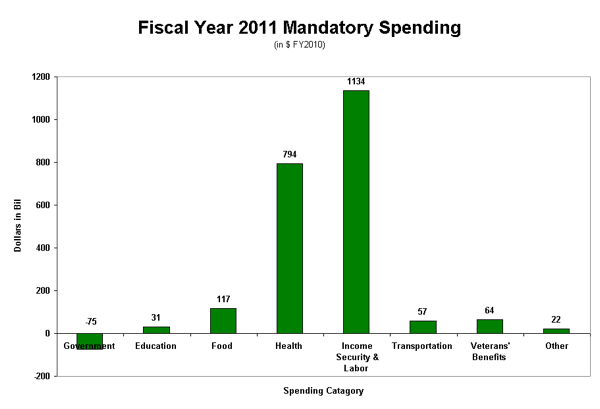

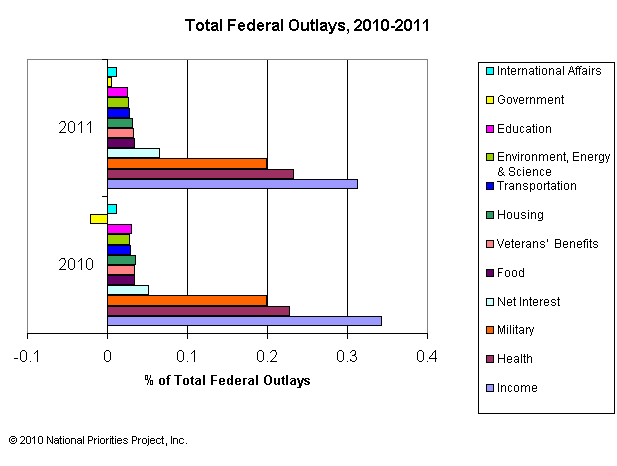

You need to look things up. Here are the 2010 number:

medicare/medicaid: 23%

Social security: 20%

Military: 20%

So even if you cut the military to $0, the budget will still be $1 trillion in the hole.

My checks were pretty thin. Assuming I paid about 1200/yr in taxes, that's $100/mo I could otherwise invest. Any recommendations on what I could invest that in?

No, we don't cut it all out. But as you and I pointed out earlier, people CAN live on less than what is currently allowed. I am not proposing denying everyone, but the eligibility requirements needs to be tougher.

Agreed

Agreed also, but as I pointed out. Even if military was cut to nothing, we will still be very far off.

Taxes needs to be raise. But higher taxes will result in increased off-shoring. I support we resort to a sales/value added tax system with a income based credit. This will capture those who don't currently pay taxes (the illegals and criminals).

You could have a single-payer system that everyone has access to, then charge healthcare consumption fees on high calorie foods, alcohol, dangerous behavior (smoking, white water rafting, drinking, being obese).

And, really, I don't think cutting this hypothetical "fat" from medicaid is that viable. All children should have medical coverage. It's not their fault whose vagina they came out of. I would join the riots in the streets if they tried to take medicaid coverage from children in any way, shape, or form. Disability...that's a tough cookie. It obviously needs some good auditing on some people, but to those legitimately disabled...we can't just let them rot. And the elderly...can't pick on them, either. Too old to fend for themselves. And those groups consume the most healthcare dollars, by far. Everyone else...like I said...drop in the bucket...

Not an unreasonable idea, but logistically impractical. How are you going to to keep track how much smoking, white water raft, drinking a person has done? By self report? Although the obesity part should be quite possible.

LOL, add that to the list, couple of posts before it was about people with medicaid driving in $100,000 Mercedes and Land Rovers.

Couple weeks ago it was about NYC garbage men making 90K a year, when in reality they could max out at 60K...

It's a shame when a student knows more about next year's fashion line than they do about the programs they'll be participating in as healthcare practitioners.

But hey, we can't be held accountable for it, right? I mean, we hardly studied for it. As long as the poor people don't stink up the place.

This doesn't do much to support your claim that 25K is much LOWER than the average Medicaid recipient's salary. It would seem that 25K is higher.

Not an unreasonable idea, but logistically impractical. How are you going to to keep track how much smoking, white water raft, drinking a person has done? By self report? Although the obesity part should be quite possible.

I'm gonna eclipse the $300k mark, gonna feel pretty good.I'll be graduating with $216K in debt.

Sure, I'll acknowledge it. The solution is the cut the military in half and tax the **** out of the rich. Income above $1 million taxed at 60% and a 2% tax per year on all bank accounts with more than $100k in assets. Oh and also capital gains at 50% after the first few thousand in income. The rich have reaped all the benefits of the last 30 years of neoliberal Reaganism, it's time they paid for it.While everybody is preaching the virtue of being kind to the poor, nobody seems to be willing to address the the nation's tough budget crisis.

As you can see, welfare (social security, medicare, medicaid) is the biggest chunk of the budget.

If you work at a pharmacy you would see plenty of medicaid patients driving very nice cars. Just ask anyone that works at a pharmacy.

That example was used by my women's studies teacher to argue how underpaid teachers are. It wasn't something I said myself.

I've never seen a medicaid patient driving a car worth more than maybe $15k, at most. Just because its a BMW or Mercedes doesn't mean its worth a ton of money. You can get a nice looking early 2000s BMW for well under $10k. If you aren't a car person, you would probably think its an expensive car when it isn't really.

Same way they tax them now. At the point of sale.

There would be more taxes on activities like white water rafting, bungie jumping, etc. that many people do.

If you work at a pharmacy you would see plenty of medicaid patients driving very nice cars. Just ask anyone that works at a pharmacy.

I'm gonna eclipse the $300k mark, gonna feel pretty good.

Sure, I'll acknowledge it. The solution is the cut the military in half and tax the **** out of the rich. Income above $1 million taxed at 60% and a 2% tax per year on all bank accounts with more than $100k in assets. Oh and also capital gains at 50% after the first few thousand in income. The rich have reaped all the benefits of the last 30 years of neoliberal Reaganism, it's time they paid for it.