- Joined

- Mar 4, 2018

- Messages

- 35

- Reaction score

- 18

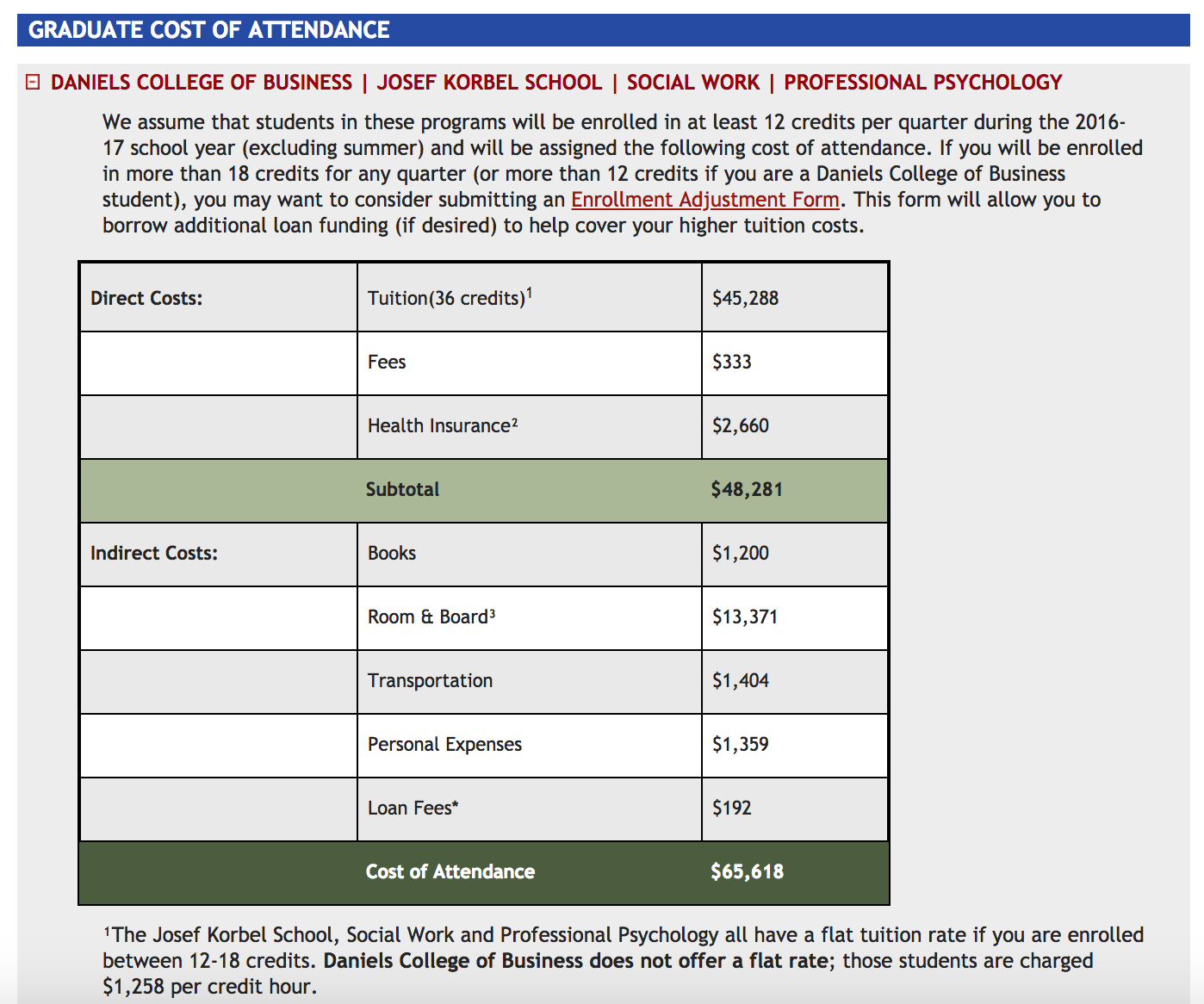

Although I am waiting to hear back from University of Denver's PsyD program, I'm worried about the tuition. It's $62,000 a year. Is it even worth it? I was accepted to Florida Tech and their tuition is $29,000 a year. Can I justify DU's price??? Anyone attending a costly PsyD program, and if so, how are you dealing with a huge amount of debt?