I dont know about housing crash/corection with the fed printing money like there is no tomorrow.Zillow? Interesting. I keep hearing about a housing crash/correction coming soon

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Investment Thread (stocks, bonds, real estate, retirement, just not gold)

- Thread starter BMBiology

- Start date

- Joined

- Nov 22, 2009

- Messages

- 7,965

- Reaction score

- 8,122

Didn’t you get in early on NIO and make a really good return? Or am I thinking of someone else?

BMB told us about NIO, he got in at single digits. I bought between 11-30 and panic sold around 42-44 last December. Also bought PLTR between 10-21 and panic sold around 27 I think on the same day. They both jumped a bit after that and everyone laughed at me but looking back, I did pretty good. I didn't have a huge amount compared to others here.

My trading account has been flat this year so I just want to buy and hold good stocks now.

Last edited:

- Joined

- Jul 20, 2015

- Messages

- 527

- Reaction score

- 386

I miss BMB…BMB told us about NIO, he got in at single digits. I bought between 11-30 and panic sold around 42-44 last December. Also bought PLTR between 10-21 and panic sold around 27 I think on the same day. They both jumped a bit after that and everyone laughed at me but looking back, I did pretty good. I didn't have a huge amount compared to others here.

My trading account has been flat this year so I just want to buy and hold good stocks now.

owlegrad

Uncontrollable Sarcasm Machine

Staff member

Administrator

Volunteer Staff

Lifetime Donor

15+ Year Member

- Joined

- Mar 19, 2009

- Messages

- 25,316

- Reaction score

- 11,935

Sounds like you have given up the FOMO? That’s good. You will get better returns over decades by not chasing the next meme stock. Good for you!BMB told us about NIO, he got in at single digits. I bought between 11-30 and panic sold around 42-44 last December. Also bought PLTR between 10-21 and panic sold around 27 I think on the same day. They both jumped a bit after that and everyone laughed at me but looking back, I did pretty good. I didn't have a huge amount compared to others here.

My trading account has been flat this year so I just want to buy and hold good stocks now.

I find buying companies I really believe in to be a much better experience than just buying whatever hype stock is out there and hoping it goes higher. I have the vast majority of my investments in VTI and SPY and those accounts are killing my brokerage account where I pick stocks.

I do still pick stocks here and there for fun and to have something to discuss with other stock pickers but it’s tough to beat a good index.

owlegrad

Uncontrollable Sarcasm Machine

Staff member

Administrator

Volunteer Staff

Lifetime Donor

15+ Year Member

- Joined

- Mar 19, 2009

- Messages

- 25,316

- Reaction score

- 11,935

Everyone claims they miss him now but where was the love when he was here? It’s easy to miss someone when you don’t have to put up with them.I miss BMB…

All he did was insult people and tell them they wouldn’t be able to own a home with student debt.

- Joined

- Jun 23, 2003

- Messages

- 15,455

- Reaction score

- 6,726

Eventually the maudes will realize that they were wrong in banning bmb.

Today is not that day, I suppose.

Today is not that day, I suppose.

- Joined

- Nov 22, 2009

- Messages

- 7,965

- Reaction score

- 8,122

Sounds like you have given up the FOMO? That’s good. You will get better returns over decades by not chasing the next meme stock. Good for you!

I find buying companies I really believe in to be a much better experience than just buying whatever hype stock is out there and hoping it goes higher. I have the vast majority of my investments in VTI and SPY and those accounts are killing my brokerage account where I pick stocks.

I do still pick stocks here and there for fun and to have something to discuss with other stock pickers but it’s tough to beat a good index.

Yeah after a year of FOMO buying I've decided it's not worth it. I keep telling myself that I should just index cause I can't beat VTI. Then I get addicted to watching stocks again. It's a vicious cycle.

owlegrad

Uncontrollable Sarcasm Machine

Staff member

Administrator

Volunteer Staff

Lifetime Donor

15+ Year Member

- Joined

- Mar 19, 2009

- Messages

- 25,316

- Reaction score

- 11,935

Buffet says he has a 1-800 number he calls every time he thinks about investing in airlines. When he calls he says he is a recovering addict and they talk him down from making the same mistake. Maybe you need that for stock picking?Yeah after a year of FOMO buying I've decided it's not worth it. I keep telling myself that I should just index cause I can't beat VTI. Then I get addicted to watching stocks again. It's a vicious cycle.

I kid. Sort of. I would be wealthier if I would follow my own advice and just poor it all into VTI. Richer but perhaps more bored.

- Joined

- Jul 26, 2008

- Messages

- 674

- Reaction score

- 483

At the end of 2020, I changed 2/3s of my Roth IRA into tech growth stocks. INSTANT REGRETYeah after a year of FOMO buying I've decided it's not worth it. I keep telling myself that I should just index cause I can't beat VTI. Then I get addicted to watching stocks again. It's a vicious cycle.

Buying VTI is the way to go, holding a bunch of tech stocks is like buying into a diversified meme index fund

owlegrad

Uncontrollable Sarcasm Machine

Staff member

Administrator

Volunteer Staff

Lifetime Donor

15+ Year Member

- Joined

- Mar 19, 2009

- Messages

- 25,316

- Reaction score

- 11,935

Ouch. Sorry my friend. An expensive lesson but a good one.At the end of 2020, I changed 2/3s of my Roth IRA into tech growth stocks. INSTANT REGRET

Buying VTI is the way to go, holding a bunch of tech stocks is like buying into a diversified meme index fund

- Joined

- Jul 20, 2015

- Messages

- 527

- Reaction score

- 386

I loved him while he was here, and thoroughly enjoyed his insults. Sure it’s against the rules/standards of the forum, but still extremely entertaining.Everyone claims they miss him now but where was the love when he was here? It’s easy to miss someone when you don’t have to put up with them.

All he did was insult people and tell them they wouldn’t be able to own a home with student debt.

- Joined

- May 17, 2013

- Messages

- 1,945

- Reaction score

- 1,194

Sounds like you have given up the FOMO? That’s good. You will get better returns over decades by not chasing the next meme stock. Good for you!

I find buying companies I really believe in to be a much better experience than just buying whatever hype stock is out there and hoping it goes higher. I have the vast majority of my investments in VTI and SPY and those accounts are killing my brokerage account where I pick stocks.

I do still pick stocks here and there for fun and to have something to discuss with other stock pickers but it’s tough to beat a good index.

Agree. I discovered Wallstreet bets forum on Reddit and definitely got burned a few times there lol 😂. Remember the GME squeeze back in January?

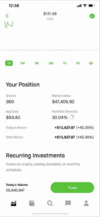

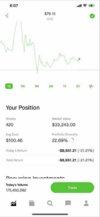

I Dropped 34k(360 shares) at open and in 10 mins made 15k(40%). Then added an extra 60 shares and at the end of the day the stock plummeted and was down $9k overall. The next day the stock ran up again and I sold at breakeven(stupidly) since I couldn’t handle the stress.

Then the stock quadrupled 3 days later lmao.. so I was like f this I am gonna go back in and bought at absolute top of $383( I was pissed because robinhood limited their members to can only buy maximum of 5 shares at that time due to the volatility lol and that turned out to saving my butt).

And yeah I was also playin around with options and shares in blackberry, riot, pltr, sndl, plug, etc and lost around 24k(most of them are from previous profits luckily). After that I said I’m done lol

I also panicked sold Tesla back in March 2021 but luckily was able to get back in in may at similar price. Been slowly DCAing month after month and will keep doing that.

My point is invest in stocks that you believe in and that have good balance sheet and strong fundamentals. When the stock dips you will not be worried and instead buy more.

Attachments

owlegrad

Uncontrollable Sarcasm Machine

Staff member

Administrator

Volunteer Staff

Lifetime Donor

15+ Year Member

- Joined

- Mar 19, 2009

- Messages

- 25,316

- Reaction score

- 11,935

Hadn’t heard of it but interesting concept.Anyone like SARK, the anti ARKK ETF? I opened a position just now.

owlegrad

Uncontrollable Sarcasm Machine

Staff member

Administrator

Volunteer Staff

Lifetime Donor

15+ Year Member

- Joined

- Mar 19, 2009

- Messages

- 25,316

- Reaction score

- 11,935

I said something similar at the time. I know Robinhood got a LOT of flack for limiting trading but I always supposed they saved a lot of people from losing a lot of money. I can’t say if that was their goal but I wouldn’t be surprised if it was.( I was pissed because robinhood limited their members to can only buy maximum of 5 shares at that time due to the volatility lol and that turned out to saving my butt).

- Joined

- Nov 22, 2009

- Messages

- 7,965

- Reaction score

- 8,122

I said something similar at the time. I know Robinhood got a LOT of flack for limiting trading but I always supposed they saved a lot of people from losing a lot of money. I can’t say if that was their goal but I wouldn’t be surprised if it was.

I remember reading one of the hedge funds that was losing to the GME squeeze was Robinhood's biggest client.

A ton of people lost money cause RH blocked buys and only allowed selling as the price tanked.

- Joined

- Nov 22, 2009

- Messages

- 7,965

- Reaction score

- 8,122

Everyone claims they miss him now but where was the love when he was here? It’s easy to miss someone when you don’t have to put up with them.

All he did was insult people and tell them they wouldn’t be able to own a home with student debt.

He did start this thread after all, the greatest thread in SDN pharmacy forum history. These instabans are kinda harsh. People should be given a second/third chance before being permanently banned

On another note, does anyone have large cap growth index in 401k or do you guys stick with a plain total stock market/S&P/large cap index?

- Joined

- Jul 20, 2015

- Messages

- 527

- Reaction score

- 386

My Vanguard 401k is 100% in VIIIX (tracks the S&P 500)He did start this thread after all, the greatest thread in SDN pharmacy forum history. These instabans are kinda harsh. People should be given a second/third chance before being permanently banned

On another note, does anyone have large cap growth index in 401k or do you guys stick with a plain total stock market/S&P/large cap index?

owlegrad

Uncontrollable Sarcasm Machine

Staff member

Administrator

Volunteer Staff

Lifetime Donor

15+ Year Member

- Joined

- Mar 19, 2009

- Messages

- 25,316

- Reaction score

- 11,935

It wasn’t an instaban. He was given WAY more than 3 warnings.He did start this thread after all, the greatest thread in SDN pharmacy forum history. These instabans are kinda harsh. People should be given a second/third chance before being permanently banned

On another note, does anyone have large cap growth index in 401k or do you guys stick with a plain total stock market/S&P/large cap index?

- Joined

- Jul 20, 2015

- Messages

- 527

- Reaction score

- 386

I agree that Tesla is leading the pack and will continue to do so, since EVs are their thing…AAPL is the way to go now. They will probably be the only player competing with Tesla in the electric car market in 5-10 yrs.

But how close is apple to producing EVs? Last I heard they’re still in R&D? I know a lot can happen in 5-10 years, but you really see them leapfrogging all of the traditional auto makers, who are already producing actual EVs?

- Joined

- Nov 22, 2009

- Messages

- 7,965

- Reaction score

- 8,122

AAPL is the way to go now. They will probably be the only player competing with Tesla in the electric car market in 5-10 yrs.

I agree that Apple is the way to go, or Microsoft. Those two have been 1a and 1b for 20 years.

Tesla is clearly the leader of EVs, but how many people can afford a Tesla? Nearly everyone in the world with disposable income has their own iPhone or uses Windows. Not everyone needs or wants a $40k+ vehicle. One of my richest friends still drives a 2005 Mustang that he bought for $5k used over a decade ago. So to someone like him, he would never be a Tesla customer. But he gets a new iPhone or laptop every few years.

Isn't gen Z moving away from owning vehicles? I heard less people are getting their driver's license. Many people in places like NYC don't even know how to drive. They prefer to use Uber.

- Joined

- Jul 20, 2015

- Messages

- 527

- Reaction score

- 386

Tesla is clearly the leader of EVs, but how many people can afford Tesla?

Good question… and when apple finally introduces the “iCar” how affordable do you think they’ll be?

Or do you think apple’s EV might actually be an affordable alternative to Tesla and others?

I’m really not hating on apple, just playing devils advocate. I’m an iPhone user, and I wouldn’t trust an apple car (yet).

Tesla did not have the model 3 (cheapest model) 12+ yrs ago. I think there will be even cheaper models (< 35k) in a few yrs.I agree that Apple is the way to go, or Microsoft. Those two have been 1a and 1b for 20 years.

Tesla is clearly the leader of EVs, but how many people can afford a Tesla? Nearly everyone in the world with disposable income has their own iPhone or uses Windows. Not everyone needs or wants a $40k+ vehicle. One of my richest friends still drives a 2005 Mustang that he bought for $5k used over a decade ago. So to someone like him, he would never be a Tesla customer. But he gets a new iPhone or laptop every few years.

Isn't gen Z moving away from owning vehicles? I heard less people are getting their driver's license. Many people in places like NYC don't even know how to drive. They prefer to use Uber.

Your richest friend is wise,. Most Americans aren't, and want to keep up with the Jones.

I would not be be shocked if AAPL share reaches $1000 by 2026-27.

- Joined

- May 17, 2013

- Messages

- 1,945

- Reaction score

- 1,194

Tesla was founded in 2003 yet they have only been profitable recently. The challenge is being able to MANUFACTURE and SCALE. I think the company almost went bankrupt twice. I agree that AAPL and MSFT are amazing companies... but nowhere close to TSLA when it comes to manufacturing cars.I agree that Apple is the way to go, or Microsoft. Those two have been 1a and 1b for 20 years.

Tesla is clearly the leader of EVs, but how many people can afford a Tesla? Nearly everyone in the world with disposable income has their own iPhone or uses Windows. Not everyone needs or wants a $40k+ vehicle. One of my richest friends still drives a 2005 Mustang that he bought for $5k used over a decade ago. So to someone like him, he would never be a Tesla customer. But he gets a new iPhone or laptop every few years.

Isn't gen Z moving away from owning vehicles? I heard less people are getting their driver's license. Many people in places like NYC don't even know how to drive. They prefer to use Uber.

In 5-10 years I'd expect TSLA's numbers of car production continue to rise and price to drop. They want to make their cars affordable to the masses.

- Joined

- Nov 22, 2009

- Messages

- 7,965

- Reaction score

- 8,122

Good question… and when apple finally introduces the “iCar” how affordable do you think they’ll be?

Or do you think apple’s EV might actually be an affordable alternative to Tesla and others?

I’m really not hating on apple, just playing devils advocate. I’m an iPhone user, and I wouldn’t trust an apple car (yet).

I don't know why Apple wants to make an EV to be honest. They're doing fine without one.

Tesla was founded in 2003 yet they have only been profitable recently. The challenge is being able to MANUFACTURE and SCALE. I think the company almost went bankrupt twice. I agree that AAPL and MSFT are amazing companies... but nowhere close to TSLA when it comes to manufacturing cars.

In 5-10 years I'd expect TSLA's numbers of car production continue to rise and price to drop. They want to make their cars affordable to the masses.

My point is EV is a niche market. You have old ladies using iPhones but they won't be buying a Tesla. Boomers don't want to change, my neighbor just bought a 67 Shelby GT replica. I'm the only one on my block who uses an electric lawnmower. They see that it's quiet, has no emissions, and no maintenance. Yet none of them have upgraded, they still use their loud, stinky, high maintenance gas lawnmowers. They also scoff at solar panels.

So you have millennials and gen Z left, who mostly can't afford an EV. I just don't see the need for the masses to buy a new luxury car. Toyota sold 10mil vehicles last year, will Tesla sell that many in 5-10 years? You can get a new Corolla for under 20k or a used one for under 5k and it will last many years. Heck I'm still driving a 12 year old Accord, I never felt the need to upgrade.

Last edited:

These millennials will be 40+ with money in the next 10+ yrs. AAPL will be the stock (along my S&P500 index) that got me completely retired in 10 yrs.I don't know why Apple wants to make an EV to be honest. They're doing fine without one.

My point is EV is a niche market. You have old ladies using iPhones but they won't be buying a Tesla. Boomers don't want to change, my neighbor just bought a 67 Shelby GT replica. I'm the only one on my block who uses an electric lawnmower. They see that it's quiet, has no emissions, and no maintenance. Yet none of them have upgraded, they still use their loud, stinky, high maintenance gas lawnmowers. They also scoff at solar panels.

So you have millennials and gen Z left, who mostly can't afford an EV. I just don't see the need for the masses to buy a new luxury car. Toyota sold 10mil vehicles last year, will Tesla sell that many in 5-10 years? You can get a new Corolla for under 20k or a used one for under 5k and it will last many years. Heck I'm still driving a 12 year old Accord, I never felt the need to upgrade.

- Joined

- May 17, 2013

- Messages

- 1,945

- Reaction score

- 1,194

I don't know why Apple wants to make an EV to be honest. They're doing fine without one.

My point is EV is a niche market. You have old ladies using iPhones but they won't be buying a Tesla. Boomers don't want to change, my neighbor just bought a 67 Shelby GT replica. I'm the only one on my block who uses an electric lawnmower. They see that it's quiet, has no emissions, and no maintenance. Yet none of them have upgraded, they still use their loud, stinky, high maintenance gas lawnmowers. They also scoff at solar panels.

So you have millennials and gen Z left, who mostly can't afford an EV. I just don't see the need for the masses to buy a new luxury car. Toyota sold 10mil vehicles last year, will Tesla sell that many in 5-10 years? You can get a new Corolla for under 20k or a used one for under 5k and it will last many years. Heck I'm still driving a 12 year old Accord, I never felt the need to upgrade.

Toyota to invest $13.6bn in batteries for EVs and hybrids by 2030

Japan automaker likely to invest in China and US as it nurtures eco-friendliness

Nissan to invest nearly $18 billion to speed electric car rollout

Japanese automaker to introduce 23 new models, including 15 EVs

VW boosts investment in electric and autonomous car technology to $86 billon

Volkswagen has raised its planned investment on digital and electric vehicle technologies to 73 billion euros ($86 billion) over the next five years as it seeks to hold onto its crown as the world's largest carmaker in a new green era.

Honda aims for 100% electric vehicles by 2040, says new CEO

Honda Motor Co (7267.T) is aiming to increase its ratio of electric vehicles (EVs) and fuel cell vehicles (FCVs) to 100% of all sales by 2040, chief executive Toshihiro Mibe said on Friday.

We'll see how it goes in 10 years

- Joined

- Nov 22, 2009

- Messages

- 7,965

- Reaction score

- 8,122

Toyota to invest $13.6bn in batteries for EVs and hybrids by 2030

Japan automaker likely to invest in China and US as it nurtures eco-friendlinessasia.nikkei.com

Nissan to invest nearly $18 billion to speed electric car rollout

Japanese automaker to introduce 23 new models, including 15 EVsasia.nikkei.com

VW boosts investment in electric and autonomous car technology to $86 billon

Volkswagen has raised its planned investment on digital and electric vehicle technologies to 73 billion euros ($86 billion) over the next five years as it seeks to hold onto its crown as the world's largest carmaker in a new green era.www.reuters.com

Honda aims for 100% electric vehicles by 2040, says new CEO

Honda Motor Co (7267.T) is aiming to increase its ratio of electric vehicles (EVs) and fuel cell vehicles (FCVs) to 100% of all sales by 2040, chief executive Toshihiro Mibe said on Friday.www.reuters.com

We'll see how it goes in 10 yearsAlso.. gas prices ain't getting cheaper nowadays..

All of those legacy car makers will give Tesla competition which makes me more hesitant to go big at current valuation.

owlegrad

Uncontrollable Sarcasm Machine

Staff member

Administrator

Volunteer Staff

Lifetime Donor

15+ Year Member

- Joined

- Mar 19, 2009

- Messages

- 25,316

- Reaction score

- 11,935

I think I am a pretty big Tesla bear, especially since the valuation is nonsensical, but I actually think that is a bit unfair. They poured all their cash into growing their business, which has been a successful strategy for them. They almost certainly could have booked profit much earlier if they were content with being a small niche manufacturer.Tesla was founded in 2003 yet they have only been profitable recently.

owlegrad

Uncontrollable Sarcasm Machine

Staff member

Administrator

Volunteer Staff

Lifetime Donor

15+ Year Member

- Joined

- Mar 19, 2009

- Messages

- 25,316

- Reaction score

- 11,935

I must be in a contrarian mode tonight because I wonder when gas prices got cheaper in the past and if the price for electricity is getting lower currently.We'll see how it goes in 10 yearsAlso.. gas prices ain't getting cheaper nowadays..

- Joined

- Nov 22, 2009

- Messages

- 7,965

- Reaction score

- 8,122

I must be in a contrarian mode tonight because I wonder when gas prices got cheaper in the past and if the price for electricity is getting lower currently.

My electric bill goes up every year, but sometimes gas costs less each year. I remember it was $2/gal like a year ago, and even $1/gal when Obama was in office.

owlegrad

Uncontrollable Sarcasm Machine

Staff member

Administrator

Volunteer Staff

Lifetime Donor

15+ Year Member

- Joined

- Mar 19, 2009

- Messages

- 25,316

- Reaction score

- 11,935

Uhh doesn’t gas prices being lower last year and lower when Obama was in office indicate that they go up year over year? I don’t recall them ever going down except as they fluctuate day to day or month to month.My electric bill goes up every year, but sometimes gas costs less each year. I remember it was $2/gal like a year ago, and even $1/gal when Obama was in office.

Also I do not think gas was $2/gallon last year. Perhaps you meant below $3 or in the 2s, which may be accurate. Likely the same for Obama-era gas (which of course would mean an 8 year period), I doubt gas was ever $1/gallon then but maybe 1.xx/gallon.

I remember when gas was less than $1/gallon, although I don’t recall if I ever bought it for that cheap.

“The best explanation for the good ole days is a bad memory”

- Joined

- Nov 22, 2009

- Messages

- 7,965

- Reaction score

- 8,122

Uhh doesn’t gas prices being lower last year and lower when Obama was in office indicate that they go up year over year? I don’t recall them ever going down except as they fluctuate day to day or month to month.

Also I do not think gas was $2/gallon last year. Perhaps you meant below $3 or in the 2s, which may be accurate. Likely the same for Obama-era gas (which of course would mean an 8 year period), I doubt gas was ever $1/gallon then but maybe 1.xx/gallon.

I remember when gas was less than $1/gallon, although I don’t recall if I ever bought it for that cheap.

“The best explanation for the good ole days is a bad memory”

I actually have photos from my phone LoL. It was 1.49 in my area last year.

You are right, it was never $1 since the Clinton days. However gas was 1.99 in my area in 2015. So it did go from 3.XX in the early 2010s to 1.99 in 2015 to 1.49 in 2020 in some places.

Attachments

owlegrad

Uncontrollable Sarcasm Machine

Staff member

Administrator

Volunteer Staff

Lifetime Donor

15+ Year Member

- Joined

- Mar 19, 2009

- Messages

- 25,316

- Reaction score

- 11,935

Wow $1.49 is great! I stand corrected.I actually have photos from my phone LoL. It was 1.49 in my area last year.

You are right, it was never $1 since the Clinton days. However gas was 1.99 in my area in 2015. So it did go from 3.XX in the early 2010s to 1.99 in 2015 to 1.49 in 2020 in some places.

As for the rest, are those prices from the same time of year? Or comparing the high of one year to the low of a different year?

I mean it’s no secret that it trends up over time. I don’t think anyone expects the price to go down and stay down over time.

- Joined

- Nov 22, 2009

- Messages

- 7,965

- Reaction score

- 8,122

Wow $1.49 is great! I stand corrected.

As for the rest, are those prices from the same time of year? Or comparing the high of one year to the low of a different year?

I mean it’s no secret that it trends up over time. I don’t think anyone expects the price to go down and stay down over time.

Not sure I just don't remember gas being above $4 except for maybe a short spike after hurricane Katrina, and below $2 was always a big deal so i think around $3 was average the rest of the time.

My electric bill gradually goes up every year though.

TSLA will have some competition and I think a company like AAPL with a big balance sheet will be in a great position to compete with them.TSLA under 1k again. Are you guys buying?

- Joined

- Nov 22, 2009

- Messages

- 7,965

- Reaction score

- 8,122

TSLA will have some competition and I think a company like AAPL with a big balance sheet will be in a great position to compete with them.

Do you like MSFT? I see a lot of people own both AAPL and MSFT.

I could see a steadily increase in MSFT. I dont see a big upswing like I see in AAPL. I have 10% of my stock portfolio in Zillow. Maybe it should be in MSFT.Do you like MSFT? I see a lot of people own both AAPL and MSFT.

- Joined

- Nov 22, 2009

- Messages

- 7,965

- Reaction score

- 8,122

I could see a steadily increase in MSFT. I dont see a big upswing like I see in AAPL. I have 10% of my stock portfolio in Zillow. Maybe it should be in MSFT.

Zillow seems so random to me in a two fund portfolio.

It is. I just want to believe it will go back to being $200/share again.Zillow seems so random to me in a two fund portfolio.

My portfolio is pretty much physical real estate, S&P index, AAPL, and 10% of Zillow as a play money.

- Joined

- Nov 22, 2009

- Messages

- 7,965

- Reaction score

- 8,122

It is. I just want to believe it will go back to being $200/share again.

My portfolio is pretty much physical real estate, S&P index, AAPL, and 10% of Zillow as a play money.

I'd replace Zillow with MSFT for sure since you already have real estate. Or BTC/ETH but wait for them to reverse.

StockPharmD2020

Full Member

- Joined

- Nov 29, 2020

- Messages

- 454

- Reaction score

- 179

Lol yea right.TSLA will have some competition and I think a company like AAPL with a big balance sheet will be in a great position to compete with them.

- Joined

- May 17, 2013

- Messages

- 1,945

- Reaction score

- 1,194

Good chance to buy in today in TSLA... or NVDA... or most NASDAQ stocks really...

- Joined

- May 17, 2013

- Messages

- 1,945

- Reaction score

- 1,194

Wish I had cash to buy more  This discount is crazy!

This discount is crazy!

Probably gonna start using margin on my next buy

Probably gonna start using margin on my next buy

- Joined

- Nov 27, 2007

- Messages

- 655

- Reaction score

- 142

What are you wanting to buy?Wish I had cash to buy moreThis discount is crazy!

Probably gonna start using margin on my next buy

- Joined

- May 17, 2013

- Messages

- 1,945

- Reaction score

- 1,194

TSLAWhat are you wanting to buy?

Similar threads

- Replies

- 17

- Views

- 2K