- Joined

- Apr 22, 2007

- Messages

- 22,315

- Reaction score

- 8,964

I realize most are "buy and hold" Index or ETF investors on SDN but I'm curious to see if anyone will be adding to equities at these levels or 5% lower from here.

I have no idea whether the US stock market has reached its peak but I am a buyer at 1910-1920 S & P 500; But, I have been waiting for this market correction.

I realize most are "buy and hold" Index or ETF investors on SDN but I'm curious to see if anyone will be adding to equities at these levels or 5% lower from here.

Bought emerging markets yesterday because I hit a rebalancing band.

Balls! I couldn't pull the trigger because each weak that sector keeps going down. I'll need to see a leveling off first of EM before I add to my positions.

Since I will be buying lots of equities in the future, I would love nothing more than a big down swing from here so I can buy them on the cheap. Alas if they don't go down, I will still be buying.

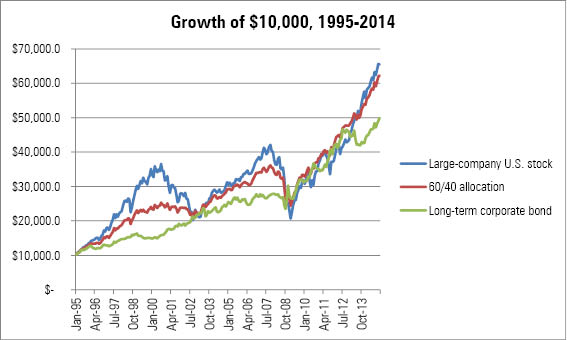

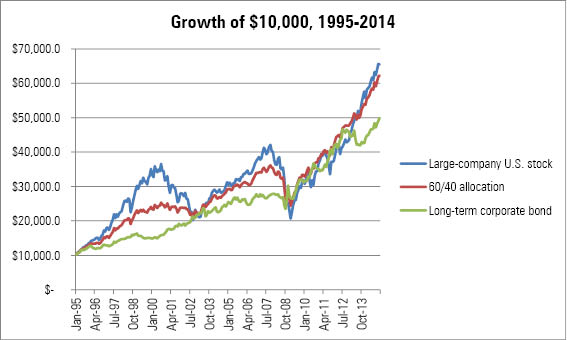

We agree on this fact. Please look at the graph below from Morningstar on the return since 1995. Now, I'm not expecting that same return but I hope to get half that amount over the next two decades (i'll be retired before then though):

If u would have put 10k in 2000. U still would have had 10k in 2010. Which represents a zero percent gain. Actually u lost money due to inflation.

Kinda of misleading graph to include the internet boom 1995-2000, housing boom run which correlated with stock market boom 2002-2007 and of course the run we have had 2009-2015. So the graph represents 3 booms and 2 nosedives (2000-2001 and 2008-209).

If u would have put 10k in 2000. U still would have had 10k in 2010. Which represents a zero percent gain. Actually u lost money due to inflation.

Can can plug in any time frame we want to make it look more compelling.

Since I will be buying lots of equities in the future, I would love nothing more than a big down swing from here so I can buy them on the cheap. Alas if they don't go down, I will still be buying.

No because you ignore dividends, you actually would have made a small gain in that time frame. And if you dollar cost averaged investments over the duration of that time frame you made a lot. You can pick out whatever time frame you want, but if it's long enough you always make money.

In the long run we are all dead. Deciding on how much to reduce equity exposure as we approach the end of our earning capacity is a very thorny issue. Sequence of returns for retirees is hugely important and beyond one's control.

The person who retired in 1980 with a 50/50 or 60/40 portfolio had a very different sustainable withdrawal rate experience than the person who retired in 2000.

I agree that a 3% SWR is prudent for planning going forward and is very safe. But most people are counting on a much higher rate. Sequence of returns around retirement will be critical if you are counting on a higher rate.

http://www.nytimes.com/interactive/2011/01/02/business/20110102-metrics-graphic.html?_r=0

That's a fascinating graphic.

Real annual returns over 7% are in green. There's not a lot of green on that chart. But everyone I know tells me the stock market returns 11% on average in the long term.

I agree that a 3% SWR is prudent for planning going forward and is very safe. But most people are counting on a much higher rate. Sequence of returns around retirement will be critical if you are counting on a higher rate.

http://www.nytimes.com/interactive/2011/01/02/business/20110102-metrics-graphic.html?_r=0

China down 8%. Dow futures down another 400 points. Don't catch a falling knife.

Buying on the way up seems more sensible than on the way down.

I would be a very rich man if I knew the answer to that question! I guess I would wait to see if the market stabilized at some point before jumping in.

That might hurt you, given the news from developing markets this morning. Trouble with emerging markets is their recovery times tend to be measured in years, not months, and this looks like the start of a stagnation trend care of the Chinese. They don't have as many effective toys as the feds to make things bounce back, but they're trying a few things right now, let's see if their new pension and investment option schemes work to stabilize their market...Bought emerging markets yesterday because I hit a rebalancing band.

The s and p 500 is at the same place today as it was on Sept. 30, 2014. This is when the criminal Fed stopped pumping the heroine QE into the arms of the wall street traders. The fed balance sheet has been flat the for the last year and so has the stock market. Instead we are distracted by Caitlyn, the raping mexicans, Jared from Subway, and trying to figure out wherever the blood is coming from.

Wake up people!

The economic recovery is nothing but FRAUD! Debt is not wealth. It's propped up by BS subprime auto loans of 0% for 7 years now I see on tv, young people enslaved by 6 figure student loan debt at 8% that can never be repaid, pretending that people who don't look for jobs are not unemployed, i.e. they don't count, underreporting the correct amoutn of inflation so social security doesn't become insolvent as quickly, artifically inflated stock market, real estate and bond markets with negative real interest rates.

Thus, the Fed is controlled by Wall Street. These entities are criminals. People need to wake up, realize what's going on. Wherever the blood is coming from is from the oligarchs that control this country!

That might hurt you, given the news from developing markets this morning. Trouble with emerging markets is their recovery times tend to be measured in years, not months, and this looks like the start of a stagnation trend care of the Chinese. They don't have as many effective toys as the feds to make things bounce back, but they're trying a few things right now, let's see if their new pension and investment option schemes work to stabilize their market...

True- detachment and acceptance are what separate serious investors from gamblers." it is from time to time the duty of a serious investor to accept the depreciation of his holdings with equanimity and without reproaching himself. "

John Maynard Keynes

True- detachment and acceptance are what separate serious investors from gamblers.

You can be a very rich man by simply dollar cost averaging and always buying for the long term.

Depends on your time horizon. I've currently got just under 9% of my investments in developing markets- used to carry a lot more, because I was investing in my 20s and the risk:reward was fine for a young investor, but as I've gotten older I've just let that part of my portfolio sit steady without rebalancing. Ideally 10% or less of your portfolio should be in high risk markets, IMO. It's more of an optional investment category than a critical one, a place to throw a few extra dollars in if you want to diversify and add potential growth but can handle the risk of loss if the developing markets go South.Yes. But, TRUE investors disagree on how much (if any) exposure you need to Emerging Markets for a diversified portfolio. I'm limiting mine to 4% of my total equities position. Emerging market is the most volatile sector one can invest in and it is perfectly rational to avoid buying into that sector whatsoever.

Instead, Developed foreign market equities are on sale right now (large and small)- that is the space to be buying over EM.

Holy crap, is that from today?