- Joined

- Jul 27, 2012

- Messages

- 199

- Reaction score

- 281

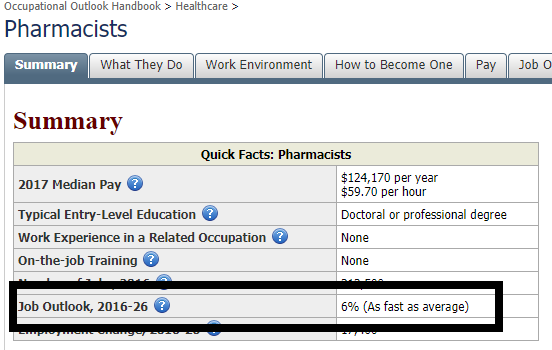

I hear so many people with 100k plus loans, really curious to see the reasoning behind peoples decision to take out that much loans. How much loan is too much?

I graduated from Rutgers 2 years ago as an in state student and had 45K in loans. Did Not think too much of it at first until after started working and realizing the difference between "making" and actually taking home.

I met fellow grads from this other for profit school of pharmacy in my state with 150k plus in loans and I just feel so bad for them having student loans eat up all their take home pay for the next 10 years

I graduated from Rutgers 2 years ago as an in state student and had 45K in loans. Did Not think too much of it at first until after started working and realizing the difference between "making" and actually taking home.

I met fellow grads from this other for profit school of pharmacy in my state with 150k plus in loans and I just feel so bad for them having student loans eat up all their take home pay for the next 10 years