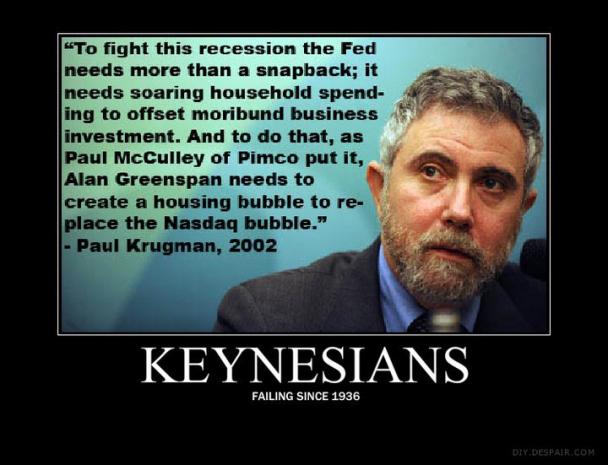

Mises was a genius. He has no agenda and simply understands the laws of mathematics can not be manipulated by politicians.

From another source I found explaining what I was trying to explain previously:

"The translation of currency practices into equivalent trade policies is straightforward in the

long run when all prices are fully flexible. As is well known, currency market intervention has no real effects in

that environment due to the long-run neutrality of money prices in a country that devalues its currency will adjust so that the real effects of the devaluation and implied price changes cancel out, leaving import and export volumes unchanged."

Nevertheless, a devaluation in this environment is equivalent to the imposition of a tariff on all imports and a subsidy to all exports.Just as with the devaluation, the tariff-cum-subsidy policy leads to price adjustments that cancel each other out and leave import and export volumes unchanged (an implication of Lerner symmetry)."

Most of us in anesthesia are numbers oriented and get the concept of real versus nominal value and can understand the above. On the other hand, there's that guy in the White House who I'm a bit doubtful can add 2 +2:

"President Obama stated in October 2008, for example, that Chinas current trade surplus is

directly related to its manipulation of its currencys value. He concurrently promised to beef up US enforcement efforts against unfair trade practices.

Similar comments were made on various occasions by former EU Trade Commissioner Peter Mandelson."

I promise to get off of Obama's case as soon as he says something... anything... that isn't a

mathematical fallacy. He continually says politically based rhetoric that is simply incorrect, and hasn't shown any degree of numerical intelligence to understand that.