- Joined

- Apr 22, 2007

- Messages

- 22,315

- Reaction score

- 8,964

This thread is about investment ideas and the market for 2021. Any discussion about politics is only Due to fiscal and market implications.

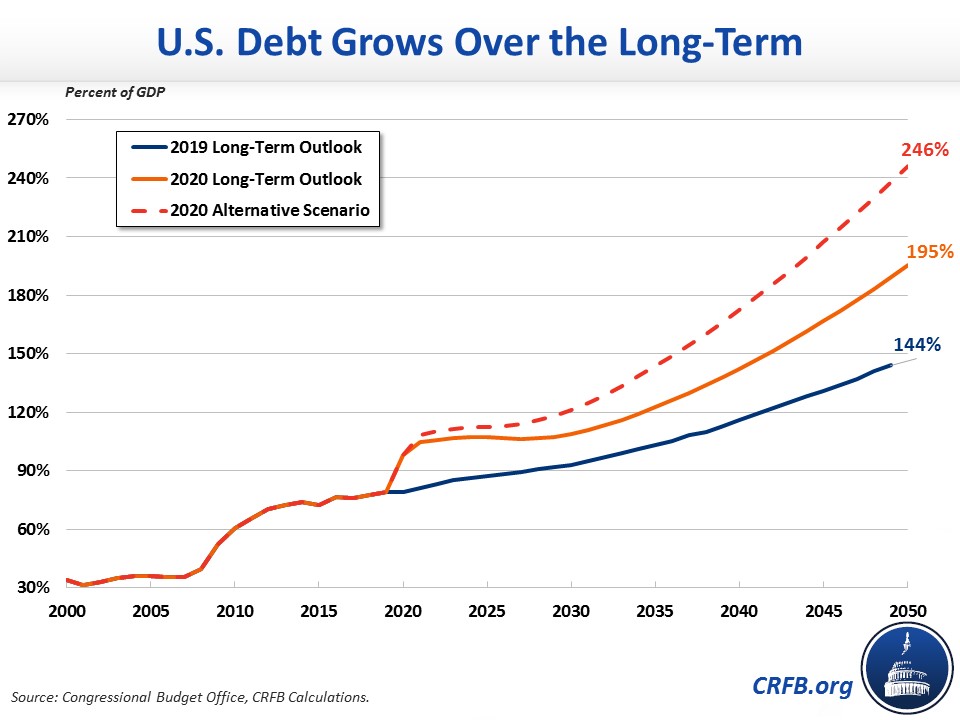

For example, the 1.9 trillion dollar stimulus plan is a bad idea because it will cause inflation and increase our national debt. This may devalue our currency and drive up the cost of goods. Gold is a hedge against this devaluation as is owning great multinational companies.

The stock market looks a bit overheated at this point with a pullback likely soon. Despite the wasteful govt spending Bill ( 1 trillion too much) I’m still bullish on stocks particularly foreign and emerging equities.

With US stocks at very high valuations I’m looking at oil and gas etfs as I think Biden wants gasoline at $4.00 per gallon very soon to push consumers away from fossil fuels.

For example, the 1.9 trillion dollar stimulus plan is a bad idea because it will cause inflation and increase our national debt. This may devalue our currency and drive up the cost of goods. Gold is a hedge against this devaluation as is owning great multinational companies.

The stock market looks a bit overheated at this point with a pullback likely soon. Despite the wasteful govt spending Bill ( 1 trillion too much) I’m still bullish on stocks particularly foreign and emerging equities.

With US stocks at very high valuations I’m looking at oil and gas etfs as I think Biden wants gasoline at $4.00 per gallon very soon to push consumers away from fossil fuels.