- Joined

- Apr 22, 2007

- Messages

- 22,351

- Reaction score

- 9,010

Dynamic Spending Rules To Account For The Dispersion Of Return Sequences?

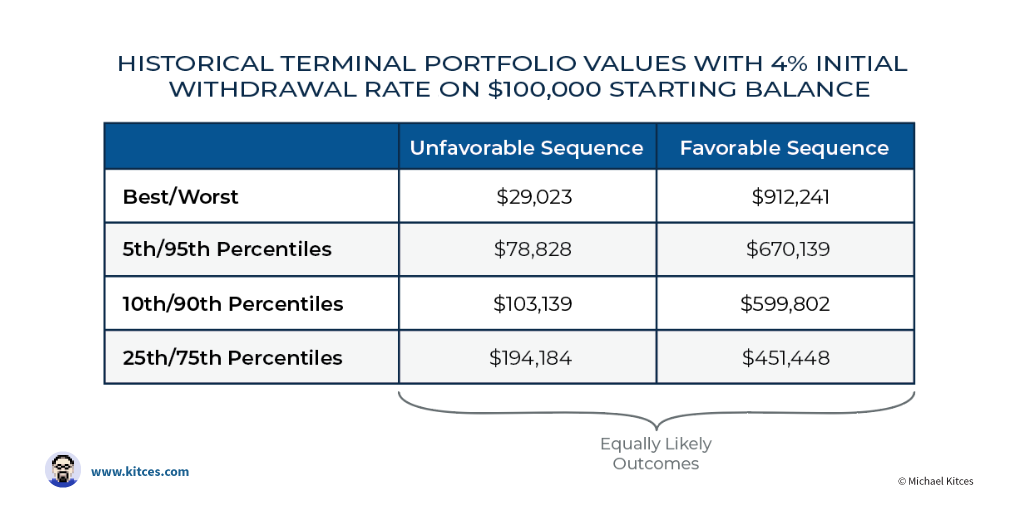

While sequence of returns risk can cut both ways – to the downside, and the upside – the irony is that due to the compounding nature of wealth, the reality is that when the sequence is good, it can actually produce exponentially more wealth to the upside than the bad scenarios produce to the downside! Thus why, for a $1M portfolio, there’s an equally likely probability to finish with the same $1M in principal remaining, or $6M left over instead! And even at a 5% initial withdrawal rate, the 25% chance of depleting the portfolio that advisors might caution clients about is the same as the 25% chance of finishing with nearly triple the original principal instead (on top of that 5% initial withdrawal rate with a lifetime of inflation adjustments)!

Extraordinary Upside Potential Of Sequence Of Return Risk

A bad sequence of returns can deplete a portfolio in retirement, but in fact, it's far more common for favorable sequences to create an excess of wealth.