Regarding 3rd party votes hurting America -

A 3rd party vote outside a swing state doesn't hurt either Biden or Trump.

A 3rd party vote is a protest. Protests have value.

A 3rd party vote for president doesn't mean one can't cast other meaningful votes on the same ballot for federal, state, and local candidates.

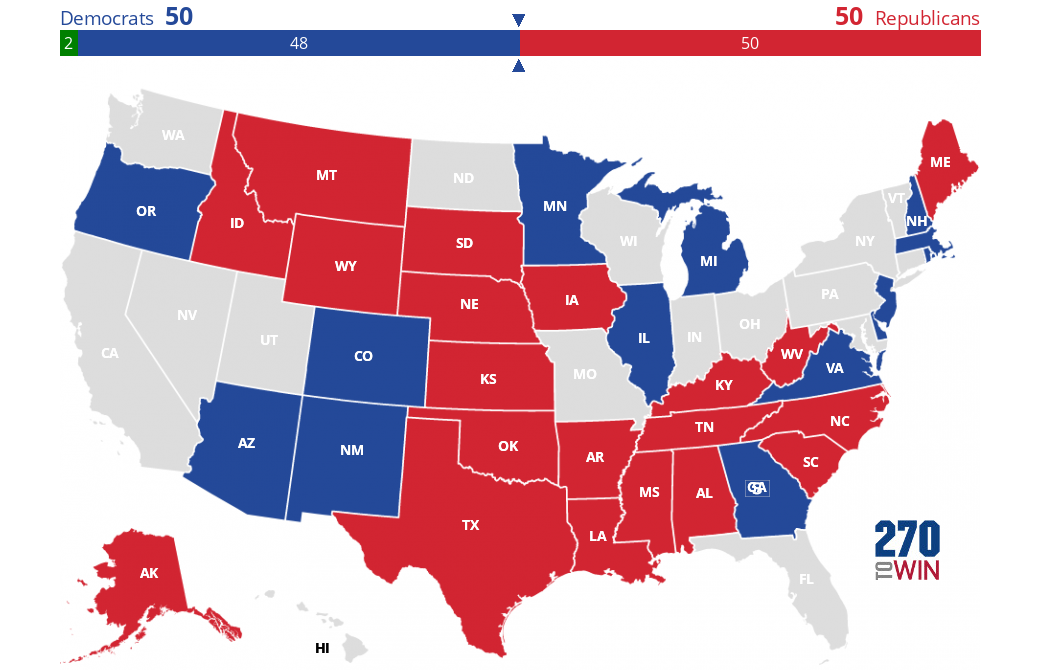

I won't vote for either Trump/Pence or Biden/Harris for all of these reasons. If I was a voter in PA or even FL then I might reconsider. At this point my grandest hope for the election is that opposite parties control the Senate and presidency.

As I said in my post, 3rd party/swing voters being or not being the deciders of

just the election result is beside the point. Like it or not, symbols matter- and there is great symbolic value in a candidate losing in a bonafide popular vote (and EC) landslide. If trump loses 48-46-6, then trump and the rest of history can just chalk that up to bad luck vis a vis corona. trump losing 60-40 is definitive evidence of repudiation, and I think that repudiation is important in establishing what our shared American values are going forward.

I agree that protests have value, but where we disagree is about which protest has priority at this time in our history. If it's 2012 and you decide to vote third party because Obama is a status quo neoliberal and Romney is a status quo Bill Buckley conservative then whatever. Big deal. Who cares. The status quo typically does not pose existential threats to our institutions. But if you vote third party this year, what does it say? It says that you think trump is just the same old, same old status quo Republican politician as always and that your single issue concerns are more important. But in my opinion, anyone who thinks trump is part of the same old group of status quo politicians who push their agenda hard but do so within the bounds of established norms, rules, and laws should have his head examined.

Ultimately, what is your third party vote about? Primarily 2A, civil rights, and small government, right? Enforcement and strengthening of 2A doesn't just exist in a vacuum. It exists within a framework where we respect the Constitution, respect checks and balances, respect Congress's power of the subpoena, respect the independence of the judiciary, respect the independence of the Attorney General, DOJ, and FBI, respect the tradition of having Senate-confirmed executive positions instead of "actings" so your subordinates have accountability, respect conflicts of interest and financial separation, respect the Hatch Act, and respect the FEC chair when he says "It is illegal for any person to solicit, accept, or receive anything of value from a foreign national in connection with a U.S. election."

At every step of the way trump undermines this framework while also subverting the rule of law, so for me, it begs the question when I hear people are going to vote trump or vote third party: Why on earth should I care about the issue you care about, when either explicitly or implicitly, you don't seem to care about the undermining of the framework that makes your issue enforceable?

www.270towin.com

www.270towin.com